Exam 12: Exchange Rate Determination

Exam 1: The International Economy and Globalization70 Questions

Exam 2: Foundations of Modern Trade Theory Comparative Advantage215 Questions

Exam 3: Sources of Comparative Advantage145 Questions

Exam 4: Tariffs157 Questions

Exam 5: Nontariff Trade Barriers181 Questions

Exam 6: Trade Regulations and Industrial Policies199 Questions

Exam 7: Trade Policies for the Developing Nations141 Questions

Exam 8: Regional Trading Arrangements164 Questions

Exam 9: International Factor Movements and Multinational Enterprises136 Questions

Exam 10: The Balance of Payments148 Questions

Exam 11: Foreign Exchange197 Questions

Exam 12: Exchange Rate Determination199 Questions

Exam 13: Mechanisms of International Adjustment116 Questions

Exam 14: Exchange Rate Adjustments and the Balance of Payments162 Questions

Exam 15: Exchange Rate Systems and Currency Crises71 Questions

Select questions type

Suppose that Barclays Bank of the United Kingdom expects the exchange rate to be $1.40 per pound at the end of the year.If today's exchange rate is $1.50 per pound, then Barclays will

(Multiple Choice)

4.8/5  (30)

(30)

A forward premium on the British pound serves as a rough benchmark of the expected rate of appreciation in the pound's spot rate.

(True/False)

4.8/5  (31)

(31)

A shift in the U.S.supply curve of dollars in the foreign exchange market could be caused by all of the following EXCEPT a change in

(Multiple Choice)

4.8/5  (36)

(36)

The supply of francs would shift to the right for all of the following reasons EXCEPT

(Multiple Choice)

4.8/5  (31)

(31)

The demand curve for euros in the foreign exchange market will increase (shift rightward) if

(Multiple Choice)

4.8/5  (37)

(37)

Given floating exchange rates, a simultaneous decrease in the Canadian demand for British products and increase in the British desire to invest in Canadian government securities would cause a(n)

(Multiple Choice)

4.7/5  (31)

(31)

If German tastes for Microsoft software become stronger, then

(Multiple Choice)

4.9/5  (34)

(34)

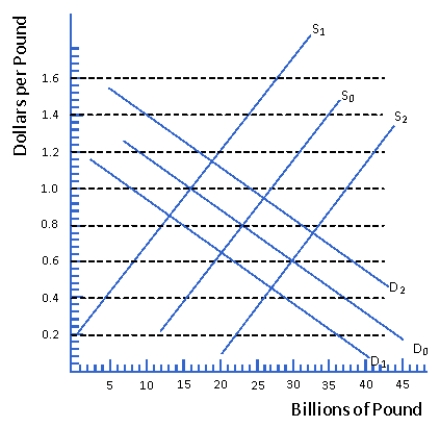

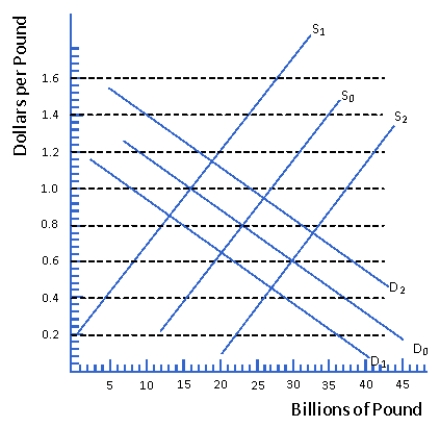

Figure 12.3 Market for British Pounds

-Consider Figure 12.3.The market is initially governed by demand curve D0 and supply curve S0.Suppose US productivity growth is faster than the UK, which supply and demand curves depict the new situation?

-Consider Figure 12.3.The market is initially governed by demand curve D0 and supply curve S0.Suppose US productivity growth is faster than the UK, which supply and demand curves depict the new situation?

(Multiple Choice)

4.9/5  (34)

(34)

The U.S.demand for pesos would shift to the right if there occurred a(n)

(Multiple Choice)

4.8/5  (38)

(38)

Suppose the exchange rate between the U.S.dollar and the Japanese yen is initially 90 yen per dollar.According to purchasing-power parity, if the price of traded goods rises by 5 percent in the United States and 15 percent in Japan, then the exchange rate will become

(Multiple Choice)

4.9/5  (36)

(36)

Figure 12.3 Market for British Pounds

-Consider Figure 12.3.The market is initially governed by demand curve D0 and supply curve S0.Suppose US consumers develop stronger preferences for UK made goods, which supply and demand curves depict the new situation?

-Consider Figure 12.3.The market is initially governed by demand curve D0 and supply curve S0.Suppose US consumers develop stronger preferences for UK made goods, which supply and demand curves depict the new situation?

(Multiple Choice)

4.8/5  (35)

(35)

According to the asset-markets approach, adjustments among financial assets are a key determinant of long-run movements in exchange rates.

(True/False)

4.7/5  (36)

(36)

Suppose that trade barriers and transportation costs are nonexistent.If the exchange rate is 0.9 Swiss francs per dollar, then according to the law of one price, a refrigerator that costs $1,000 in the United States will cost

(Multiple Choice)

4.9/5  (35)

(35)

If the U.S.inflation rate rises to the foreign inflation rate, then in the foreign exchange market

(Multiple Choice)

4.7/5  (41)

(41)

In the long run, exchange rates are mainly determined by economic fundamentals, such as the productivity levels of different countries.

(True/False)

4.8/5  (30)

(30)

Which of the following is likely to result in long-run appreciation of the U.S.dollar relative to the peso?

(Multiple Choice)

4.9/5  (35)

(35)

Given floating exchange rates, assume that the Swiss decrease their import purchases from Italy while the Italians increase their purchases of Swiss government securities.The first action by itself would lead to a(n) ____ of the franc against the lira while the second action by itself would lead to a(n) ____ of the franc against the lira.

(Multiple Choice)

4.8/5  (36)

(36)

The Canadian dollar would depreciate on the foreign exchange market if

(Multiple Choice)

4.9/5  (36)

(36)

If the rate of growth of labor productivity in the United States rises relative to the rate of growth of labor productivity in other countries, then the dollar's exchange value will depreciate.

(True/False)

4.8/5  (31)

(31)

Showing 41 - 60 of 199

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)