Exam 12: Exchange Rate Determination

Exam 1: The International Economy and Globalization70 Questions

Exam 2: Foundations of Modern Trade Theory Comparative Advantage215 Questions

Exam 3: Sources of Comparative Advantage145 Questions

Exam 4: Tariffs157 Questions

Exam 5: Nontariff Trade Barriers181 Questions

Exam 6: Trade Regulations and Industrial Policies199 Questions

Exam 7: Trade Policies for the Developing Nations141 Questions

Exam 8: Regional Trading Arrangements164 Questions

Exam 9: International Factor Movements and Multinational Enterprises136 Questions

Exam 10: The Balance of Payments148 Questions

Exam 11: Foreign Exchange197 Questions

Exam 12: Exchange Rate Determination199 Questions

Exam 13: Mechanisms of International Adjustment116 Questions

Exam 14: Exchange Rate Adjustments and the Balance of Payments162 Questions

Exam 15: Exchange Rate Systems and Currency Crises71 Questions

Select questions type

Lower tariffs on U.S.agricultural imports cause the dollar to ____ in the ____.

(Multiple Choice)

4.8/5  (39)

(39)

In a free market, exchange rates are determined by market fundamentals and market expectations.

(True/False)

4.8/5  (36)

(36)

Day-to-day influences on foreign exchange rates always cause rates to move in the same direction as changes in long-term market fundamentals.

(True/False)

4.9/5  (32)

(32)

If the current exchange value of the dollar is $1.25 per euro, then

(Multiple Choice)

4.7/5  (36)

(36)

An increase in the British demand for exports of American steel will ______ the demand for U.S.dollars and result in a (an) ______ of the dollar.

(Multiple Choice)

4.8/5  (41)

(41)

If the Federal Reserve decreases interest rates in the United States relative to interest rates in other countries, then in the foreign exchange market

(Multiple Choice)

4.9/5  (29)

(29)

If the United States reduces its tariffs on the import of natural gas, then

(Multiple Choice)

4.7/5  (39)

(39)

For the United States, suppose the annual interest rate on government securities equals 12 percent, while the annual inflation rate equals 8 percent.For Japan, suppose the annual interest rate equals 5 percent.These variables would cause investment funds to flow from

(Multiple Choice)

4.9/5  (35)

(35)

In a free market, the equilibrium exchange rate occurs at the point where the quantity demanded of a foreign currency equals the quantity of that currency supplied.

(True/False)

4.9/5  (32)

(32)

What is the purchasing power parity approach to exchange rate determination?

(Essay)

4.9/5  (30)

(30)

Suppose the exchange rate between the U.S.dollar and the Japanese yen is initially 90 yen per dollar.According to purchasing power parity, if the price of traded goods falls by 5 percent in the United States and rises by 5 percent in Japan, then the exchange rate will become

(Multiple Choice)

4.9/5  (37)

(37)

Exchange rates are determined by the unregulated forces of supply and demand for foreign currencies as long as central banks do not intervene in the foreign exchange markets.

(True/False)

4.8/5  (31)

(31)

In recent decades, the safe-haven effect has applied to the United States, with a long history of stable government, relatively stable economy, and large and efficient financial markets.

(True/False)

4.9/5  (48)

(48)

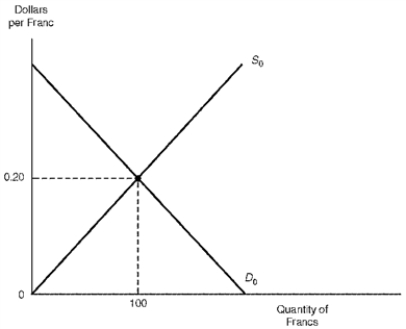

Figure 12.1 The Market for Francs  -Refer to Figure 12.1.Should the United States impose tariffs on imports from Switzerland, there would occur a(n)

-Refer to Figure 12.1.Should the United States impose tariffs on imports from Switzerland, there would occur a(n)

(Multiple Choice)

4.8/5  (44)

(44)

Concerning exchange rate forecasting, judgmental forecasts are common sense models that rely on a wide array of political and economic data.

(True/False)

4.8/5  (38)

(38)

Assume the initial dollar/pound exchange rate to be $2 per pound.If the U.S.inflation rate is 8 percent, and the U.K.inflation rate is 3 percent, then the exchange rate should move to $2.10 per pound according to the purchasing-power-parity theory.

(True/False)

4.7/5  (36)

(36)

In 1985 and 1986, U.S.interest rates fell relative to interest rates in Japan.Under floating exchange rates, this would lead to the dollar's exchange value depreciating against the yen.

(True/False)

4.9/5  (31)

(31)

Concerning exchange rate forecasting, ____ is a common-sense approach based on a wide array of political and economic data.

(Multiple Choice)

4.9/5  (39)

(39)

Assume a system of floating exchange rates.Due to a high savings rate, suppose the level of savings in Japan is in excess of domestic investment needs.If Japanese residents invest abroad, then the yen's exchange value will ____ , and the Japanese trade balance will move toward ____.

(Multiple Choice)

4.9/5  (33)

(33)

Showing 81 - 100 of 199

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)