Exam 3: Adjusting the Accounts

Exam 1: Accounting in Action276 Questions

Exam 2: The Recording Process223 Questions

Exam 3: Adjusting the Accounts303 Questions

Exam 4: Completing the Accounting Cycle262 Questions

Exam 5: Accounting for Merchandising Operations244 Questions

Exam 6: Inventories257 Questions

Exam 7: Fraud, Internal Control, and Cash238 Questions

Exam 8: Accounting for Receivables269 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets339 Questions

Exam 10: Liabilities317 Questions

Exam 12: Investments227 Questions

Exam 13: Statement of Cash Flows213 Questions

Exam 14: Financial Statement Analysis231 Questions

Exam 15: Accounting and Financial Reporting for Contingent Liabilities and Leases281 Questions

Select questions type

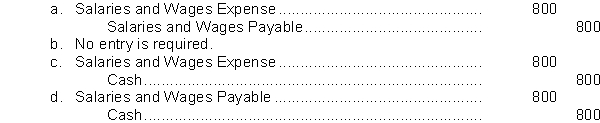

BJ, an employee of Walker Corp., will not receive her paycheck until April 2. Based on services performed from March 16 to March 31, her salary was $800. The adjusting entry for Walker Corp. on March 31 is

(Short Answer)

4.8/5  (39)

(39)

In general, the shorter the time period, the difficulty of making the proper adjustments to accounts

(Multiple Choice)

4.9/5  (35)

(35)

What is Ling's 2013 net income using cash basis accounting?

(Multiple Choice)

4.8/5  (34)

(34)

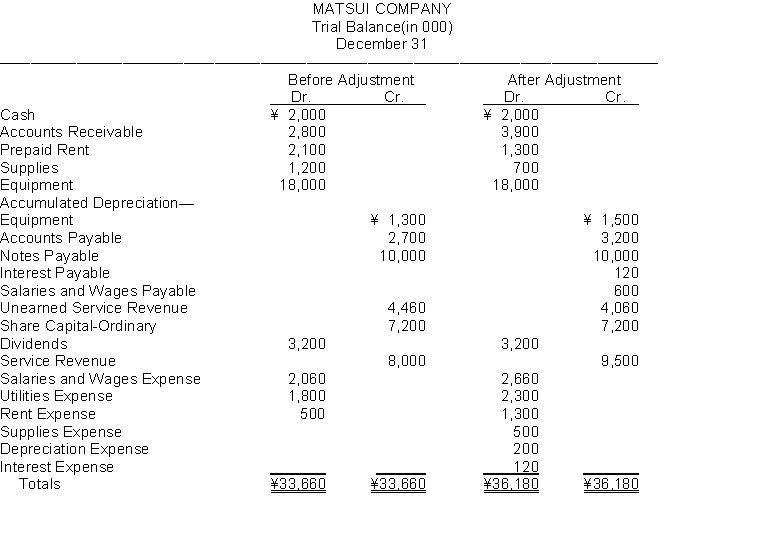

Presented below is the Trial Balance and Adjusted Trial Balance for Matsui Company on December 31.  Instructions

Prepare in journal form, with explanations, the adjusting entries that explain the changes in the balances from the trial balance to the adjusted trial balance.

Instructions

Prepare in journal form, with explanations, the adjusting entries that explain the changes in the balances from the trial balance to the adjusted trial balance.

(Essay)

4.8/5  (42)

(42)

State whether each situation is a prepaid expense (PE), unearned revenue (UR), accrued revenue (AR) or an accrued expense (AE).

1. Unrecorded interest on savings bonds is $245.

2. Property taxes that have been incurred but that have not yet been paid or recorded amount to $300.

3. Legal fees of $1,000 were collected in advance. By year end 60 percent were still unearned.

4. Prepaid insurance had a $500 balance prior to adjustment. By year end, 40 percent was still unexpired.

(Short Answer)

4.9/5  (39)

(39)

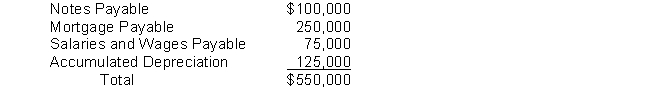

The non-current liability section of Gamma Company's statement of financial position includes the following accounts:  Gamma Company is an established company and does not experience any financial difficulties or have any cash flow problems. Discuss at least two items that are questionable as non-current liabilities.

Gamma Company is an established company and does not experience any financial difficulties or have any cash flow problems. Discuss at least two items that are questionable as non-current liabilities.

(Essay)

4.8/5  (46)

(46)

The balance in the supplies account on June 1 was $5,200, supplies purchased during June were $3,500, and the supplies on hand at June 30 were $2,000. The amount to be used for the appropriate adjusting entry is

(Multiple Choice)

4.8/5  (38)

(38)

Hardwood Supplies Inc. purchased a 12-month insurance policy on March 1, 2014 for ₤ 1,500. At March 31, 2014, the adjusting journal entry to record expiration of this asset will include a

(Multiple Choice)

4.8/5  (35)

(35)

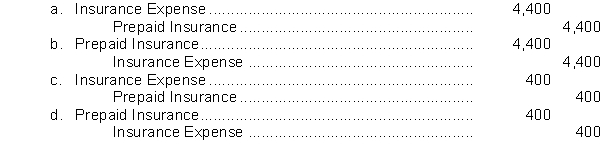

On January 2, 2014, National Credit and Cash purchased a general liability insurance policy for ₤4,800 for coverage for the calendar year. The entire ₤4,800 was charged to Insurance Expense on January 2, 2014. If the firm prepares monthly financial statements, the proper adjusting entry on January 31, 2014, will be:

(Short Answer)

4.8/5  (41)

(41)

Adjusting entries are needed to enable financial statements to conform to International Financial Reporting Standards (IFRS).

(True/False)

4.9/5  (32)

(32)

Which one of the following is not an enhancing quality of useful information?

(Multiple Choice)

4.9/5  (42)

(42)

The book value of a depreciable asset is always equal to its market value because depreciation is a valuation technique.

(True/False)

4.9/5  (35)

(35)

Expenses paid and recorded as assets before they are used are called

(Multiple Choice)

4.8/5  (44)

(44)

The difference between the cost of a depreciable asset and its related accumulated depreciation is referred to as the

(Multiple Choice)

4.9/5  (26)

(26)

Showing 21 - 40 of 303

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)