Exam 3: Adjusting the Accounts

Exam 1: Accounting in Action276 Questions

Exam 2: The Recording Process223 Questions

Exam 3: Adjusting the Accounts303 Questions

Exam 4: Completing the Accounting Cycle262 Questions

Exam 5: Accounting for Merchandising Operations244 Questions

Exam 6: Inventories257 Questions

Exam 7: Fraud, Internal Control, and Cash238 Questions

Exam 8: Accounting for Receivables269 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets339 Questions

Exam 10: Liabilities317 Questions

Exam 12: Investments227 Questions

Exam 13: Statement of Cash Flows213 Questions

Exam 14: Financial Statement Analysis231 Questions

Exam 15: Accounting and Financial Reporting for Contingent Liabilities and Leases281 Questions

Select questions type

Adjusting entries are not necessary if the trial balance debit and credit columns balances are equal.

(True/False)

4.9/5  (38)

(38)

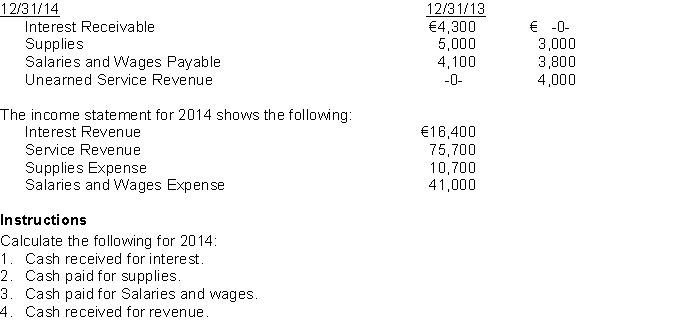

The statements of financial position of Claude Company include the following:

(Essay)

4.8/5  (36)

(36)

A company spends $10 million dollars for an office building. Over what period should the cost be written off?

(Multiple Choice)

4.8/5  (38)

(38)

A law firm received $2,000 cash for legal services to be rendered in the future. The full amount was credited to the liability account Unearned Service Revenue. If the legal services have been rendered at the end of the accounting period and no adjusting entry is made, this would cause

(Multiple Choice)

4.8/5  (44)

(44)

Ron's Hot Rod Shop follows the revenue recognition principle. Ron services a car on July 31. The customer picks up the vehicle on August 1 and mails the payment to Ron on August 5. Ron receives the check in the mail on August 6. When should Ron show that the revenue was earned?

(Multiple Choice)

5.0/5  (42)

(42)

An adjusting entry that increases an expense on the income statement and decreases an asset on the statement of financial position is the result of prepaid expenses that expire with the passage of time.

(True/False)

4.8/5  (41)

(41)

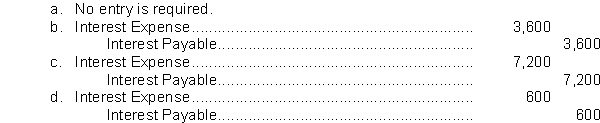

CHS Company purchased a truck from JLS Corp. by issuing a 6-month, 8% note payable for $45,000 on November 1. On December 31, the accrued expense adjusting entry is

(Short Answer)

4.8/5  (42)

(42)

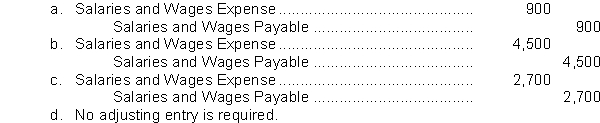

Cindi's Candies paid employee wages on and through Friday, January 26, and the next payroll will be paid in February. There are three more working days in January (29-31). Employees work 5 days a week and the company pays $900 a day in wages. What will be the adjusting entry to accrue wages expense at the end of January?

(Short Answer)

4.8/5  (38)

(38)

On July 1, Runner's Sports Store paid $12,000 to Acme Realty for 4 months rent beginning July 1. Prepaid Rent was debited for the full amount. If financial statements are prepared on July 31, the adjusting entry to be made by Runner's Sports Store is

(Multiple Choice)

4.9/5  (40)

(40)

Before month-end adjustments are made, the February 28 trial balance of Alice's Adventures contains revenue of $7,000 and expenses of $3,900. Adjustments are necessary for the following items:

Depreciation for February is $1,500.

Revenue earned but not yet billed is $2,300.

Accrued interest expense is $700.

Revenue collected in advance that is now earned is $3,500.

Portion of prepaid insurance expired during February is $600.

Instructions

Calculate the correct net income for Alice's Income Statement for February.

(Essay)

4.8/5  (37)

(37)

If prepaid expenses are initially recorded in expense accounts and have not all been used at the end of the accounting period, then failure to make an adjusting entry will cause

(Multiple Choice)

4.9/5  (27)

(27)

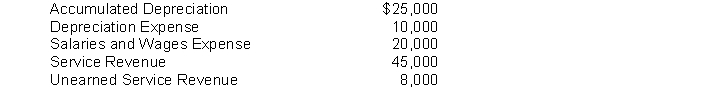

Compute the net income for 2014 based on the following amounts presented on the adjusted trial balance of D-Lay Company.

(Essay)

4.9/5  (45)

(45)

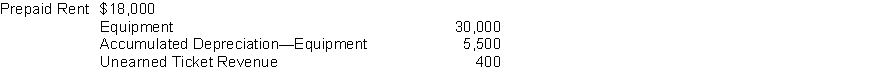

The Poway Animal Encounters operates a drive through tourist attraction. The company adjusts its accounts at the end of each month. The selected accounts appearing below reflect balances after adjusting entries were prepared on April 30. The adjusted trial balance shows the following:  Other data:

1. Three months' rent had been prepaid on April 1.

2. The equipment is being depreciated at $6,000 per year.

3. The unearned ticket revenue represents tickets sold for future visits. The tickets were sold at $4.00 each on April 1. During April, twenty of the tickets were used by customers.

Instructions

(a) Calculate the following:

1. Monthly rent expense.

2. The age of the equipment in months.

3. The number of tickets sold on April 1.

(b) Prepare the adjusting entries that were made by the Poway Animal Encounters on April 30.

Other data:

1. Three months' rent had been prepaid on April 1.

2. The equipment is being depreciated at $6,000 per year.

3. The unearned ticket revenue represents tickets sold for future visits. The tickets were sold at $4.00 each on April 1. During April, twenty of the tickets were used by customers.

Instructions

(a) Calculate the following:

1. Monthly rent expense.

2. The age of the equipment in months.

3. The number of tickets sold on April 1.

(b) Prepare the adjusting entries that were made by the Poway Animal Encounters on April 30.

(Essay)

4.9/5  (44)

(44)

Daly Investments purchased an 18-month insurance policy on May 31, 2014 for $6,300. The December 31, 2014 statement of financial position would report Prepaid Insurance of

(Multiple Choice)

5.0/5  (38)

(38)

Expenses sometimes make their contribution to revenue in a different period than when they are paid. When wages are incurred in one period and paid in the next period, this often leads to which account appearing on the statement of financial position at the end of the time period?

(Multiple Choice)

4.8/5  (27)

(27)

O.K.C. Company collected $14,000 in September of 2013 for 4 months of service which would take place from October of 2013 through January of 2014. The revenue reported from this transaction during 2013 would be

(Multiple Choice)

4.8/5  (42)

(42)

Showing 161 - 180 of 303

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)