Exam 3: Adjusting the Accounts

Exam 1: Accounting in Action276 Questions

Exam 2: The Recording Process223 Questions

Exam 3: Adjusting the Accounts303 Questions

Exam 4: Completing the Accounting Cycle262 Questions

Exam 5: Accounting for Merchandising Operations244 Questions

Exam 6: Inventories257 Questions

Exam 7: Fraud, Internal Control, and Cash238 Questions

Exam 8: Accounting for Receivables269 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets339 Questions

Exam 10: Liabilities317 Questions

Exam 12: Investments227 Questions

Exam 13: Statement of Cash Flows213 Questions

Exam 14: Financial Statement Analysis231 Questions

Exam 15: Accounting and Financial Reporting for Contingent Liabilities and Leases281 Questions

Select questions type

The balance in the Prepaid Rent account before adjustment at the end of the year is ¥15,000, which represents three months' rent paid on December 1. The adjusting entry required on December 31 is to

(Multiple Choice)

4.9/5  (39)

(39)

The adjusting entry at the end of the period to record an expired cost may be different depending on whether the cost was initially recorded as an asset or an expense.

(True/False)

5.0/5  (43)

(43)

Niagara Corporation purchased a one-year insurance policy in January 2013 for $36,000. The insurance policy is in effect from March 2013 through February 2014. If the company neglects to make the proper year-end adjustment for the expired insurance

(Multiple Choice)

4.8/5  (42)

(42)

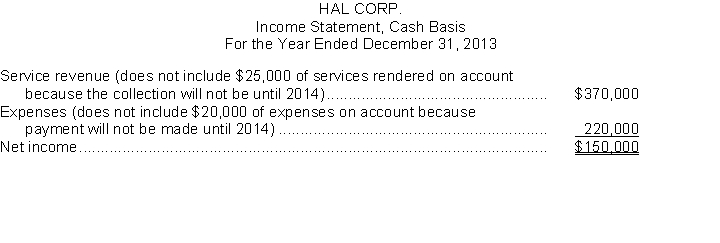

Hal Corp. prepared the following income statement using the cash basis of accounting:  Additional data:

1. Depreciation on a company automobile for the year amounted to $6,000. This amount is not included in the expenses above.

2. On January 1, 2013, paid for a two-year insurance policy on the automobile amounting to $2,400. This amount is included in the expenses above.

Instructions

(a) Recast the above income statement on the accrual basis in conformity with IFRS. Show computations and explain each change.

(b) Explain which basis (cash or accrual) provides a better measure of income.

Additional data:

1. Depreciation on a company automobile for the year amounted to $6,000. This amount is not included in the expenses above.

2. On January 1, 2013, paid for a two-year insurance policy on the automobile amounting to $2,400. This amount is included in the expenses above.

Instructions

(a) Recast the above income statement on the accrual basis in conformity with IFRS. Show computations and explain each change.

(b) Explain which basis (cash or accrual) provides a better measure of income.

(Essay)

4.8/5  (39)

(39)

A contra account found on the statement of financial position behaves contrary to accounting rules by being debited on the right and credited on the left.

(True/False)

4.9/5  (43)

(43)

The total amount of debits on the adjusted trial balance will equal the amount of assets on the statement of financial position.

(True/False)

4.9/5  (34)

(34)

If a resource has been consumed but a bill has not been received at the end of the accounting period, then

(Multiple Choice)

4.8/5  (37)

(37)

The adjusted trial balance of Rocky Acre Spread Inc. on December 31, 2014 includes the following accounts: Accumulated Depreciation, ₤6,000; Depreciation Expense, ₤2,000; Note Payable ₤7,500; Interest Expense ₤150; Utilities Expense, ₤300; Rent Expense, ₤500; Service Revenue, ₤16,600; Salaries and Wages Expense, ₤4,000; Supplies, ₤200; Supplies Expense, ₤1,200; Salaries and Wages Payable, ₤600. Prepare an income statement for the month of December.

(Essay)

4.9/5  (35)

(35)

Unearned revenue on the books of Chocolate Company, the landlord, can be a prepaid asset on the statement of financial position of its tenant, Cupcake, Inc.

(True/False)

4.8/5  (32)

(32)

For each of the following oversights, state whether total assets will be understated (U), overstated (O), or no affect (NA)

___1. Failure to record revenue earned but not yet received

___2. Failure to record expired prepaid rent.

___ 3. Failure to record accrued interest on the bank savings account

___ 4. Failure to record depreciation

___5. Failure to record accrued wages.

___6. Failure to recognize the earned portion of unearned revenues.

(Short Answer)

4.8/5  (32)

(32)

Failure to prepare an adjusting entry at the end of the period to record an accrued expense would cause

(Multiple Choice)

4.8/5  (44)

(44)

Failure to adjust a prepaid expense account for the amount expired will cause ______________ to be understated and ________________ to be overstated.

(Short Answer)

4.8/5  (39)

(39)

The economic entity assumption states that economic events can be identified with a particular unit of accountability.

(True/False)

4.9/5  (23)

(23)

One part of eight adjusting entries is given below.

Instructions

Indicate the account title for the other part of each entry.

1. Unearned Service Revenue is debited.

2. Prepaid Rent is credited.

3. Accounts Receivable is debited.

4. Depreciation Expense is debited.

5. Utilities Expense is debited.

6. Interest Payable is credited.

7. Service Revenue is credited (give two possible debit accounts).

8. Interest Receivable is debited.

(Essay)

4.8/5  (46)

(46)

From an accounting standpoint, the acquisition of productive facilities can be thought of as a long-term

(Multiple Choice)

4.8/5  (40)

(40)

Showing 281 - 300 of 303

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)