Exam 13: Retirement Savings and Deferred Compensation

Exam 1: An Introduction to Tax110 Questions

Exam 2: Tax Compliance, the Irs, and Tax Authorities112 Questions

Exam 3: Tax Planning Strategies and Related Limitations107 Questions

Exam 4: Individual Income Tax Overview, Exemptions, and Filing Status126 Questions

Exam 5: Gross Income and Exclusions131 Questions

Exam 6: Individual Deductions107 Questions

Exam 7: Investments75 Questions

Exam 8: Individual Income Tax Computation and Tax Credits154 Questions

Exam 9: Business Income, Deductions, and Accounting Methods99 Questions

Exam 10: Property Acquisition and Cost Recovery94 Questions

Exam 11: Property Dispositions110 Questions

Exam 12: Compensation102 Questions

Exam 13: Retirement Savings and Deferred Compensation115 Questions

Exam 14: Tax Consequences of Home Ownership111 Questions

Exam 15: Entities Overview70 Questions

Exam 16: Corporate Operations140 Questions

Exam 17: Accounting for Income Taxes100 Questions

Exam 18: Corporate Taxation: Nonliquidating Distributions98 Questions

Exam 19: Corporate Formation, Reorganization, and Liquidation100 Questions

Exam 20: Forming and Operating Partnerships102 Questions

Exam 21: Dispositions of Partnership Interests and Partnership Distributions100 Questions

Exam 22: S Corporations134 Questions

Exam 23: State and Local Taxes117 Questions

Exam 24: The US Taxation of Multinational Transactions100 Questions

Exam 25: Transfer Taxes and Wealth Planning123 Questions

Select questions type

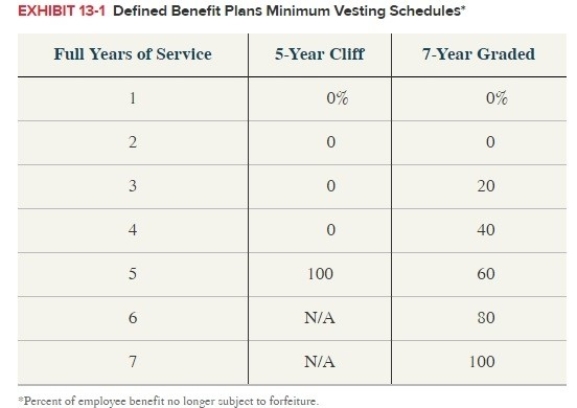

Joan recently started her career with PDEK Accounting, LLP which provides a defined benefit plan for all employees. Employees receive 1.5 percent of the average of their three highest annual salaries for each full year of service. Plan benefits vest under a 5-year cliff schedule. Joan worked 5½ yearsat PDEK before leaving for another opportunity. She received an annual salary of $49,000, $52,000,$58,000, $65,000, and $75,000 for years one through five respectively. Joan earned $40,000 of her$80,000 annual salary in year six. What is the vested benefit Joan is entitled to receive from PDEKfor her retirement? Exhibit 13-1

(Essay)

4.8/5  (37)

(37)

Which of the following statements regarding traditional IRAs is true?

(Multiple Choice)

4.9/5  (47)

(47)

Heidi retired from GE (her employer) at age 56. At the end of the year, when she was 56 years of age, Heidi received a distribution from her GE sponsored 401(k) account.Because Heidi was not at least 59½ years of age at the time of the distribution, she must pay tax on the full amount of the distribution and a 10 percent penalty on the full amount of the distribution.

(True/False)

4.8/5  (45)

(45)

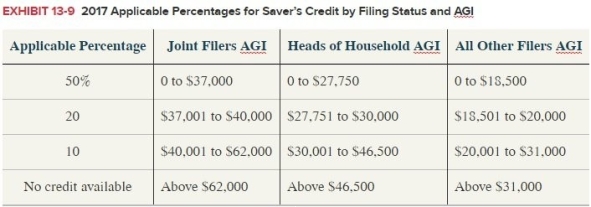

Amy is single. During 2017, she determined her adjusted gross income was $12,000.During the year, Amy also contributed $2,500 to a Roth IRA. What is the maximum saver's credit she may claim for the year?

(Multiple Choice)

5.0/5  (38)

(38)

Kathy is 48 years of age and self-employed. During the year she reported $500,000 of revenues and $100,000 of expenses relating to her self-employment activities. If Kathy has no other retirement accounts in her name, what is the maximum amount she can contribute to an individual 401(k)?

(Multiple Choice)

4.8/5  (42)

(42)

Taxpayers who participate in an employer-sponsored retirement plan are not allowed to contribute to individual retirement accounts (IRAs).

(True/False)

4.8/5  (32)

(32)

Amy is single. During 2017, she determined her adjusted gross income was $12,000.During the year, Amy also contributed $1,500 to a Roth IRA. What is the maximum saver's credit she may claim for the year?

(Multiple Choice)

4.9/5  (31)

(31)

When a taxpayer receives a nonqualified distribution from a Roth 401(k) account thetaxpayer contributions are deemed to be distributed first. If the amount of the distribution exceeds the taxpayer contributions, the remainder is from the account earnings.

(True/False)

4.9/5  (41)

(41)

Bryan, who is 45 years old, had some surprise medical expenses during the year. To pay for these expenses (which were claimed as itemized deductions on his tax return), he received a $20,000 distribution from his traditional IRA (he has only made deductible contributions to the IRA). Assuming his marginal ordinary income tax rate is 15%, what amount of taxes and/or early distribution penalties will Bryan be required to pay on this distribution?

(Multiple Choice)

4.8/5  (42)

(42)

Carmello and Leslie (ages 34 and 35, respectively) are married and want to contribute to a RothIRA. In 2017, their AGI totaled $42,000. Of the $42,000, Carmello earned $35,000 and Leslieearned $7,000. How much can each spouse contribute to a Roth IRA if they file jointly? How much can each spouse contribute to a Roth IRA if they file separately?

(Essay)

4.7/5  (31)

(31)

When employees contribute to a traditional 401(k) plan, they ________ allowed to deduct the contributions and they ________ taxed on distributions from the plan.

(Multiple Choice)

4.8/5  (39)

(39)

Tyson (48 years old) owns a traditional IRA with a current balance of $50,000. Thebalance consists of $30,000 of deductible contributions and $20,000 of account earnings. Tyson's marginal tax rate is 25%. Convinced that his marginal tax rate will increase inthe future, Tyson receives a distribution of the entire $50,000 balance of his traditionalIRA. He retains $12,500 to pay tax on the distribution and he contributes $37,500 to a Roth IRA. What amount of income tax and penalty must Tyson pay on this series of transactions?

(Multiple Choice)

4.8/5  (41)

(41)

Employee contributions to traditional 401(k) accounts are deductible by the employee, but employee contributions to Roth 401(k) accounts are not.

(True/False)

4.9/5  (40)

(40)

Tatia, age 38, has made deductible contributions to her traditional IRA over the past few years.When her account balance was $30,000, she received a distribution of the entire $30,000 balance of her traditional IRA. She retained $5,000 of the distribution to help her pay the taxes due from the distribution and she immediately contributed the remaining $25,000 to a Roth IRA. What amount of tax and early distribution penalty is she required to pay on the $30,000 distribution from the traditional IRA if her marginal tax rate is 25 percent?

(Short Answer)

4.9/5  (43)

(43)

A taxpayer can only receive a saver's credit if she contributes to a qualified retirement account.

(True/False)

4.7/5  (30)

(30)

Deborah (single, age 29) earned $25,000 in 2017. Deborah was able to contribute $1,800($150/month) to her employer sponsored 401(k). What is the total saver's credit that Deborah can claim for 2017? Exhibit 13-9

(Essay)

4.9/5  (39)

(39)

On December 1, 2017 Irene turned 71 years old. She is still working for her employer and she participates in her employer's 401(k) plan. Irene is not required to receive a minimum distribution for 2017 from her 401(k) account because she has not yet retired.

(True/False)

4.8/5  (53)

(53)

Which of the following describes a defined contribution plan?

(Multiple Choice)

4.7/5  (43)

(43)

Showing 81 - 100 of 115

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)