Exam 8: Variable Costing: a Decision-Making Perspective

Exam 1: Managerial Accounting100 Questions

Exam 2: Managerial Cost Concepts and Cost Behaviour Analysis98 Questions

Exam 3: Job Order Costing166 Questions

Exam 4: Process Costing65 Questions

Exam 5: Activity-Based-Costing81 Questions

Exam 6: Cost-Volume-Profit78 Questions

Exam 7: Incremental Analysis103 Questions

Exam 8: Variable Costing: a Decision-Making Perspective57 Questions

Exam 9: Pricing102 Questions

Exam 10: Budgetary Planning155 Questions

Exam 11: Budgetary Control and Responsibility Accounting110 Questions

Exam 12: Standard Costs and Balanced Scorecard101 Questions

Exam 13: Planning for Capital Investments100 Questions

Select questions type

Use the following information for items

Green Company sells its product for $11,000 per unit.Variable costs per unit are: manufacturing, $6,000; and selling and administrative, $125.Fixed costs are: $30,000 manufacturing overhead, and $40,000 selling and administrative.There was no beginning inventory at 1/1/10.Production was 20 units per year in 2010 - 2012.Sales were 20 units in 2010, 16 units in 2011, and 24 units in 2012.

-Income under absorption costing for 2011 is

Free

(Multiple Choice)

4.8/5  (47)

(47)

Correct Answer:

B

The computation of absorption costing gross profit always involves subtracting

Free

(Multiple Choice)

4.8/5  (36)

(36)

Correct Answer:

C

Use the following information for items

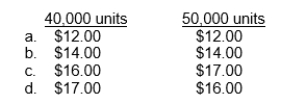

The Colin Division of Mochrie Company sells its product for $30 per unit.Variable costs per unit are: manufacturing, $12; and selling and administrative, $2.Fixed costs are: $200,000 manufacturing overhead, and $50,000 selling and administrative.There was no beginning inventory.Expected sales for next year are 40,000 units.Ryan Stiles, the manager of the Colin Division, is under pressure to improve the performance of the Division.As he plans for next year, he has to decide whether to produce 40,000 units or 50,000 units.

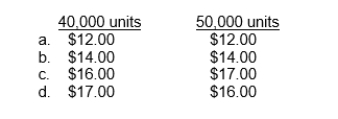

-What would the anufacturing cost per unit be under variable costing for each alternative?

(Short Answer)

4.8/5  (37)

(37)

When absorption costing is used, management may be tempted to overproduce in a given period in order to increase net income.

(True/False)

4.8/5  (35)

(35)

GAAP requires that absorption costing be used for the costing of inventory for external reporting purposes.

(True/False)

4.9/5  (31)

(31)

A customer wants to purchase a large quantity of your product at a price below your normal selling price.Which of the following would be most helpful in assessing the offer?

(Multiple Choice)

4.8/5  (44)

(44)

Use the following information for items

Obama Company sells its product for $25 per unit.During 2012, it produced 20,000 units and sold 15,000 units (there was no beginning inventory).Costs per unit are: direct materials $5, direct labour $4, and variable overhead $3.Fixed costs are: $300,000 manufacturing overhead, and $50,000 selling and administrative expenses.

-The per unit manufacturing cost under variable costing is

(Multiple Choice)

4.9/5  (46)

(46)

EKP's unit production cost under variable costing is $5, and $7 under absorption costing.Net income under variable costing was $10,000 and $12,000 under absorption costing last year.EKP sold 15,000 units.How many units did it produce?

(Multiple Choice)

4.9/5  (35)

(35)

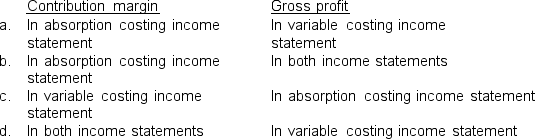

In income statements prepared under absorption costing and variable costing, where would you find the terms contribution margin and gross profit?

(Multiple Choice)

4.9/5  (31)

(31)

M&H's unit production cost under variable costing is $25, and $32 under absorption costing.Net income under variable costing was $250,000 and $187,000 under absorption costing last year.Production equalled 63,000 units.How many units did M&H sell?

(Multiple Choice)

4.7/5  (27)

(27)

Net income under GAAP highlights differences between variable and fixed costs.

(True/False)

4.8/5  (42)

(42)

Fixed manufacturing overhead is a period cost under absorption costing.

(True/False)

4.8/5  (42)

(42)

Use the following information for items

The Colin Division of Mochrie Company sells its product for $30 per unit.Variable costs per unit are: manufacturing, $12; and selling and administrative, $2.Fixed costs are: $200,000 manufacturing overhead, and $50,000 selling and administrative.There was no beginning inventory.Expected sales for next year are 40,000 units.Ryan Stiles, the manager of the Colin Division, is under pressure to improve the performance of the Division.As he plans for next year, he has to decide whether to produce 40,000 units or 50,000 units.

-What would the manufacturing cost per unit be under absorption costing for each alternative?

(Short Answer)

4.9/5  (45)

(45)

Showing 1 - 20 of 57

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)