Exam 13: Current Liabilities, Provisions, and Contingencies

Exam 1: Financial Accounting and Accounting Standards86 Questions

Exam 2: Conceptual Framework Underlying Financial Accounting123 Questions

Exam 3: The Accounting Information System110 Questions

Exam 4: Income Statement and Related Information59 Questions

Exam 5: Statement of Financial Position and Statement of Cash Flows111 Questions

Exam 6: Accounting and the Time Value of Money118 Questions

Exam 7: Cash and Receivables135 Questions

Exam 8: Valuation of Inventories: a Cost-Basis Approach136 Questions

Exam 9: Inventories: Additional Valuation Issues120 Questions

Exam 10: Acquisition and Disposition of Property, Plant, and Equipment137 Questions

Exam 11: Depreciation, Impairments, and Depletion123 Questions

Exam 12: Intangible Assets126 Questions

Exam 13: Current Liabilities, Provisions, and Contingencies129 Questions

Exam 14: Non-Current Liabilities108 Questions

Exam 15: Equity108 Questions

Exam 17: Investments74 Questions

Exam 18: Revenue83 Questions

Exam 19: Accounting for Income Taxes92 Questions

Exam 20: Accounting for Pensions and Postretirement Benefits100 Questions

Exam 21: Accounting for Leases105 Questions

Exam 22: Accounting Changes and Error Analysis78 Questions

Exam 23: Statement of Cash Flows112 Questions

Exam 24: Presentation and Disclosure in Financial Reporting83 Questions

Select questions type

A short-term obligation can be excluded from current liabilities if the company intends to refinance it on a long-term basis.

(True/False)

4.9/5  (36)

(36)

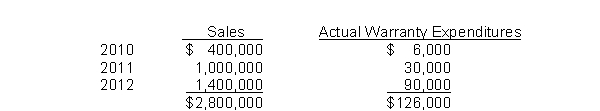

During 2010, Stabler Co.introduced a new line of machines that carry a three-year warranty against manufacturer's defects.Based on industry experience, warranty costs are estimated at 2% of sales in the year of sale, 4% in the year after sale, and 6% in the second year after sale.Sales and actual warranty expenditures for the first three-year period were as follows:  What amount should Stabler report as a liability at December 31, 2012?

What amount should Stabler report as a liability at December 31, 2012?

(Multiple Choice)

4.8/5  (44)

(44)

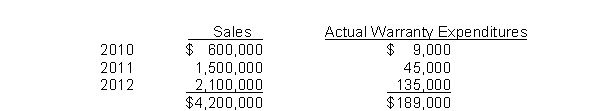

During 2010, Vanpelt Co.introduced a new line of machines that carry a three-year warranty against manufacturer's defects.Based on industry experience, warranty costs are estimated at 2% of sales in the year of sale, 4% in the year after sale, and 6% in the second year after sale.Sales and actual warranty expenditures for the first three-year period were as follows:  What amount should Vanpelt report as a liability at December 31, 2012?

What amount should Vanpelt report as a liability at December 31, 2012?

(Multiple Choice)

4.9/5  (40)

(40)

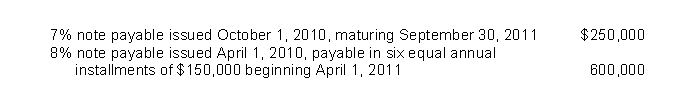

Included in Vernon Corp.'s liability account balances at December 31, 2010, were the following:  Vernon's December 31, 2010 financial statements were issued on March 31, 2011.On January 15, 2011, the entire $600,000 balance of the 8% note was refinanced by issuance of a long-term obligation payable in a lump sum.In addition, on March 10, 2011, Vernon consummated a noncancelable agreement with the lender to refinance the 7%, $250,000 note on a long-term basis, on readily determinable terms that have not yet been implemented.On the December 31, 2010 statement of financial position, the amount of the notes payable that Vernon should classify as short-term obligations is

Vernon's December 31, 2010 financial statements were issued on March 31, 2011.On January 15, 2011, the entire $600,000 balance of the 8% note was refinanced by issuance of a long-term obligation payable in a lump sum.In addition, on March 10, 2011, Vernon consummated a noncancelable agreement with the lender to refinance the 7%, $250,000 note on a long-term basis, on readily determinable terms that have not yet been implemented.On the December 31, 2010 statement of financial position, the amount of the notes payable that Vernon should classify as short-term obligations is

(Multiple Choice)

4.7/5  (44)

(44)

The expected profit from a sales type warranty that covers several years should all be recognized in the period the warranty is sold.

(True/False)

4.9/5  (32)

(32)

Provisions are only recorded if it is likely that the company will have to settle an obligation at some point in the future.

(True/False)

4.9/5  (42)

(42)

Ortiz Corporation, a manufacturer of household paints, is preparing annual financial statements at December 31, 2010.Because of a recently proven health hazard in one of its paints, the government has clearly indicated its intention of having Ortiz recall all cans of this paint sold in the last six months.The management of Ortiz estimates that this recall would cost $800,000.What accounting recognition, if any, should be accorded this situation?

(Multiple Choice)

4.8/5  (47)

(47)

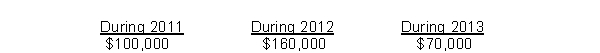

Felton Co.sells major household appliance service contracts for cash.The service contracts are for a one-year, two-year, or three-year period.Cash receipts from contracts are credited to unearned service contract revenues.This account had a balance of $480,000 at December 31, 2010 before year-end adjustment.Service contract costs are charged as incurred to the service contract expense account, which had a balance of $120,000 at December 31, 2010.Outstanding service contracts at December 31, 2010 expire as follows:  What amount should be reported as unearned service contract revenues in Felton's December 31, 2010 statement of financial position?

What amount should be reported as unearned service contract revenues in Felton's December 31, 2010 statement of financial position?

(Multiple Choice)

4.9/5  (47)

(47)

A company offers a cash rebate of $1 on each $4 package of light bulbs sold during 2010.Historically, 10% of customers mail in the rebate form.During 2010, 4,000,000 packages of light bulbs are sold, and 140,000 $1 rebates are mailed to customers.What is the rebate expense and liability, respectively, shown on the 2010 financial statements dated December 31?

(Multiple Choice)

4.8/5  (38)

(38)

Current liabilities are usually recorded and reported in financial statements at their full maturity value.

(True/False)

4.8/5  (40)

(40)

Winter Co.is being sued for illness caused to local residents as a result of negligence on the company's part in permitting the local residents to be exposed to highly toxic chemicals from its plant.Winter's lawyer states that it is probable that Winter will lose the suit and be found liable for a judgment costing Winter anywhere from $1,200,000 to $6,000,000.However, the lawyer states that the most probable cost is $3,600,000.As a result of the above facts, Winter should accrue

(Multiple Choice)

4.9/5  (43)

(43)

The cause for litigation must have occurred on or before the date of the financial statements to report a liability in the financial statements.

(True/False)

4.8/5  (40)

(40)

A company offers a cash rebate of $1 on each $4 package of batteries sold during 2010.Historically, 10% of customers mail in the rebate form.During 2010, 6,000,000 packages of batteries are sold, and 210,000 $1 rebates are mailed to customers.What is the rebate expense and liability, respectively, shown on the 2010 financial statements dated December 31?

(Multiple Choice)

4.7/5  (38)

(38)

Among the short-term obligations of Lance Company as of December 31, the statement of financial position date, are notes payable totaling $250,000 with the Madison National Bank.These are 90-day notes, renewable for another 90-day period.These notes should be classified on the statement of financial position of Lance Company as

(Multiple Choice)

4.7/5  (34)

(34)

A company has not declared a dividend on its cumulative preference shares for the past three years.What is the required accounting treatment or disclosure in this situation?

(Multiple Choice)

5.0/5  (36)

(36)

What is the relationship between current liabilities and a company's operating cycle?

(Multiple Choice)

4.8/5  (41)

(41)

Collier borrowed $175,000 on October 1 and is required to pay $180,000 on March 1.What amount is the note payable recorded at on October 1 and how much interest is recognized from October 1 to December 31?

(Multiple Choice)

4.8/5  (30)

(30)

A company can exclude a short-term obligation from current liabilities if it intends to refinance the obligation and has an unconditional right to defer settlement of the obligation for at least 12 months following the due date.

(True/False)

4.9/5  (29)

(29)

Showing 21 - 40 of 129

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)