Exam 13: Current Liabilities, Provisions, and Contingencies

Exam 1: Financial Accounting and Accounting Standards86 Questions

Exam 2: Conceptual Framework Underlying Financial Accounting123 Questions

Exam 3: The Accounting Information System110 Questions

Exam 4: Income Statement and Related Information59 Questions

Exam 5: Statement of Financial Position and Statement of Cash Flows111 Questions

Exam 6: Accounting and the Time Value of Money118 Questions

Exam 7: Cash and Receivables135 Questions

Exam 8: Valuation of Inventories: a Cost-Basis Approach136 Questions

Exam 9: Inventories: Additional Valuation Issues120 Questions

Exam 10: Acquisition and Disposition of Property, Plant, and Equipment137 Questions

Exam 11: Depreciation, Impairments, and Depletion123 Questions

Exam 12: Intangible Assets126 Questions

Exam 13: Current Liabilities, Provisions, and Contingencies129 Questions

Exam 14: Non-Current Liabilities108 Questions

Exam 15: Equity108 Questions

Exam 17: Investments74 Questions

Exam 18: Revenue83 Questions

Exam 19: Accounting for Income Taxes92 Questions

Exam 20: Accounting for Pensions and Postretirement Benefits100 Questions

Exam 21: Accounting for Leases105 Questions

Exam 22: Accounting Changes and Error Analysis78 Questions

Exam 23: Statement of Cash Flows112 Questions

Exam 24: Presentation and Disclosure in Financial Reporting83 Questions

Select questions type

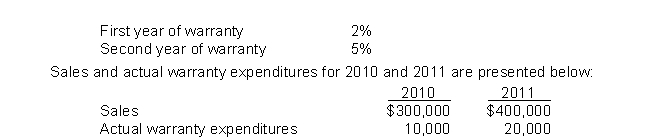

In 2010, Payton Corporation began selling a new line of products that carry a two-year warranty against defects.Based upon past experience with other products, the estimated warranty costs related to dollar sales are as follows:  What is the estimated warranty liability at the end of 2011?

What is the estimated warranty liability at the end of 2011?

(Multiple Choice)

4.8/5  (41)

(41)

On June 20, Ying Company purchased goods from Chee-Chow Company for HK$30,000, terms 2\10, n\30.The invoice was paid on June 27.The company uses a perpetual inventory system and records purchases gross.The June 27 journal entry to record payment of the account would include:

(Multiple Choice)

4.9/5  (39)

(39)

LeMay Frosted Flakes Company offers its customers a pottery cereal bowl if they send in 4 boxtops from LeMay Frosted Flakes boxes and $1.00.The company estimates that 60% of the boxtops will be redeemed.In 2010, the company sold 500,000 boxes of Frosted Flakes and customers redeemed 220,000 boxtops receiving 55,000 bowls.If the bowls cost LeMay Company $2.50 each, how much liability for outstanding premiums should be recorded at the end of 2010?

(Multiple Choice)

5.0/5  (40)

(40)

Ermler Corporation has $1,800,000 of short-term debt it expects to retire with proceeds from the sale of 60,000 ordinary shares.If the shares are sold for $20 per share subsequent to the statement of financial position date, but before the statement of financial position is issued, what amount of short-term debt could be excluded from current liabilities?

(Multiple Choice)

4.9/5  (33)

(33)

Contingent assets are not reported in the statement of financial position.

(True/False)

4.8/5  (35)

(35)

Which of the following should not be included in the current liabilities section of the statement of financial position?

(Multiple Choice)

4.7/5  (48)

(48)

Use the following information for questions.

Stine Co.is a retail store operating in a state with a 6% retail sales tax.The retailer may keep 2% of the sales tax collected.Stine Co.records the sales tax in the Sales account.The amount recorded in the Sales account during May was $148,400.

-The amount of sales taxes payable (to the nearest dollar) to the state for the month of May is

(Multiple Choice)

4.7/5  (40)

(40)

Recycle Exploration is involved with innovative approaches to finding energy reserves.Recycle recently built a facility to extract natural gas at a cost of $15 million.However, Recycle is also legally responsible to remove the facility at the end of its useful life of twenty years.This cost is estimated to be $21 million (the present value of which is $8 million).What is the journal entry required to record the environmental liability?

(Multiple Choice)

4.9/5  (31)

(31)

Which of the following best describes the cash-basis method of accounting for warranty costs?

(Multiple Choice)

4.9/5  (35)

(35)

Under what conditions is an employer required to accrue a liability for sick pay?

(Multiple Choice)

4.9/5  (33)

(33)

A company gives each of its 50 employees (assume they were all employed continuously through 2010 and 2011) 12 days of vacation a year if they are employed at the end of the year.The vacation accumulates and may be taken starting January 1 of the next year.The employees work 8 hours per day.In 2010, they made $14 per hour and in 2011 they made $16 per hour.During 2011, they took an average of 9 days of vacation each.The company's policy is to record the liability existing at the end of each year at the wage rate for that year.What amount of vacation liability would be reflected on the 2010 and 2011 balance sheets, respectively?

(Multiple Choice)

4.9/5  (37)

(37)

Contingent assets are disclosed when an inflow of economic benefits is considered more likely than not to occur.

(True/False)

4.8/5  (37)

(37)

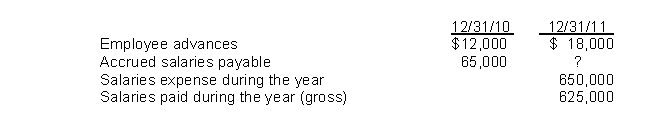

Edge Company's salaried employees are paid biweekly.Occasionally, advances made to employees are paid back by payroll deductions.Information relating to salaries for the calendar year 2011 is as follows:  At December 31, 2011, what amount should Edge report for accrued salaries payable?

At December 31, 2011, what amount should Edge report for accrued salaries payable?

(Multiple Choice)

4.8/5  (37)

(37)

Hatcher Corporation sold 10,500 dishwashers for £1,100 each during 2011.The dishwashers are under warranty for one year following the sale.Maintenance on the dishwashers during the warranty period averages £90 each.Actual warranty costs incurred during 2011 for units sold that year were £296,000.The statement of financial position at year end will report a related liability of:

(Multiple Choice)

4.8/5  (41)

(41)

Purest owes $1 million that is due on February 28.The company borrows $800,000 on February 25 (5-year note) and uses the proceeds to pay down the $1 million note and uses other cash to pay the balance.How much of the $1 million note is classified as long-term in the December 31 financial statements?

(Multiple Choice)

4.9/5  (43)

(43)

IFRS allows for reduced disclosure of contingent liabilities if the disclosure could increase the company's chance of losing a lawsuit.

(True/False)

4.8/5  (37)

(37)

Purchase Retailer made cash sales during the month of October of $132,600.The sales are subject to a 6% sales tax that was also collected.Which of the following would be included in the summary journal entry to reflect the sale transactions?

(Multiple Choice)

5.0/5  (36)

(36)

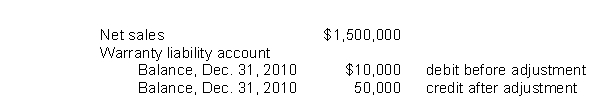

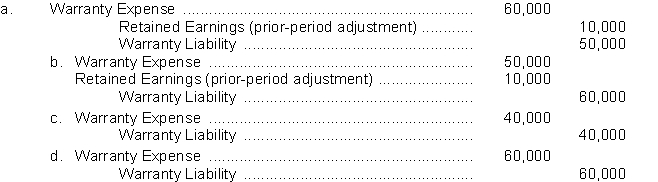

Nance Company estimates its annual warranty expense as 4% of annual net sales.The following data relate to the calendar year 2010:  Which one of the following entries was made to record the 2010 estimated warranty expense?

Which one of the following entries was made to record the 2010 estimated warranty expense?

(Short Answer)

4.9/5  (43)

(43)

Short-term debt obligations are classified as current liabilities unless an agreement to refinance is completed before the financial statements are issued.

(True/False)

4.7/5  (43)

(43)

Which of the following is a characteristic of the expense warranty approach, but not the sales warranty approach?

(Multiple Choice)

4.9/5  (34)

(34)

Showing 61 - 80 of 129

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)