Exam 9: Inventories: Additional Valuation Issues

Exam 1: Financial Accounting and Accounting Standards86 Questions

Exam 2: Conceptual Framework Underlying Financial Accounting123 Questions

Exam 3: The Accounting Information System110 Questions

Exam 4: Income Statement and Related Information59 Questions

Exam 5: Statement of Financial Position and Statement of Cash Flows111 Questions

Exam 6: Accounting and the Time Value of Money118 Questions

Exam 7: Cash and Receivables135 Questions

Exam 8: Valuation of Inventories: a Cost-Basis Approach136 Questions

Exam 9: Inventories: Additional Valuation Issues120 Questions

Exam 10: Acquisition and Disposition of Property, Plant, and Equipment137 Questions

Exam 11: Depreciation, Impairments, and Depletion123 Questions

Exam 12: Intangible Assets126 Questions

Exam 13: Current Liabilities, Provisions, and Contingencies129 Questions

Exam 14: Non-Current Liabilities108 Questions

Exam 15: Equity108 Questions

Exam 17: Investments74 Questions

Exam 18: Revenue83 Questions

Exam 19: Accounting for Income Taxes92 Questions

Exam 20: Accounting for Pensions and Postretirement Benefits100 Questions

Exam 21: Accounting for Leases105 Questions

Exam 22: Accounting Changes and Error Analysis78 Questions

Exam 23: Statement of Cash Flows112 Questions

Exam 24: Presentation and Disclosure in Financial Reporting83 Questions

Select questions type

The inventory turnover ratio is computed by dividing the cost of goods sold by

(Multiple Choice)

4.8/5  (37)

(37)

Given the historical cost of product Z is $150, the selling price of product Z is $190, costs to sell product Z are $11, and the cost to complete product Z is $20, what is the amount that should be used to value the inventory under the lower-of-cost-or-net realizable value method?

(Multiple Choice)

5.0/5  (43)

(43)

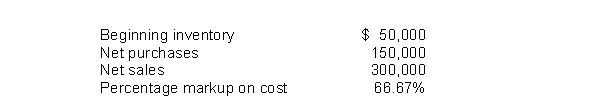

The following information is available for October for Barton Company.  A fire destroyed Barton's October 31 inventory, leaving undamaged inventory with a cost of $3,000.Using the gross profit method, the estimated ending inventory destroyed by fire is

A fire destroyed Barton's October 31 inventory, leaving undamaged inventory with a cost of $3,000.Using the gross profit method, the estimated ending inventory destroyed by fire is

(Multiple Choice)

5.0/5  (44)

(44)

Under International Financial Reporting Standards (IFRS), which of the following is true regarding inventory write-downs and\or recovery of a write-down?

(Multiple Choice)

4.8/5  (41)

(41)

Which of the following statements is correct regarding International Financing Reporting Standards (IFRS) and U.S.GAAP with regard to inventory?

(Multiple Choice)

4.8/5  (35)

(35)

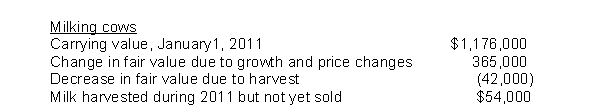

Dub Dairy produces milk to sell to local and national ice cream producers.Dub Dairy began operations on January 1, 2011 by purchasing 840 milk cows for $1,176,000.The company controller had the following information available at year end relating to the cows:  On Dub Dairy's income statement for the year ending December 31, 2011, what amount of unrealized gain on harvested milk will be reported?

On Dub Dairy's income statement for the year ending December 31, 2011, what amount of unrealized gain on harvested milk will be reported?

(Multiple Choice)

4.9/5  (42)

(42)

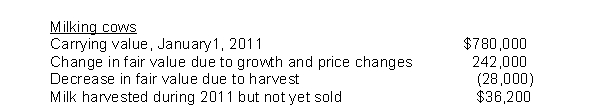

Braum Dairy produces milk to sell to local and national ice cream producers.Braum Dairy began operations on January 1, 2011 by purchasing 650 milk cows for $780,000.The company controller had the following information available at year end relating to the cows:  On Braum Dairy's income statement for the year ending December 31, 2011, what amount of unrealized gain on harvest milk will be reported?

On Braum Dairy's income statement for the year ending December 31, 2011, what amount of unrealized gain on harvest milk will be reported?

(Multiple Choice)

4.8/5  (35)

(35)

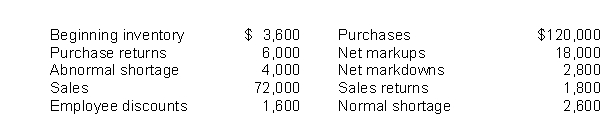

Drake Corporation had the following amounts, all at retail:  What is Drake's ending inventory at retail?

What is Drake's ending inventory at retail?

(Multiple Choice)

4.9/5  (44)

(44)

Dicer uses the conventional retail method to determine its ending inventory at cost.Assume the beginning inventory at cost (retail) were $130,000 ($198,000), purchases during the current year at cost (retail) were $685,000 ($1,100,000), freight-in on these purchases totaled $43,000, sales during the current year totaled $1,050,000, and net markups (markdowns) were $24,000 ($36,000).What is the ending inventory value at cost?

(Multiple Choice)

4.9/5  (41)

(41)

Reyes Company had a gross profit of $360,000, total purchases of $420,000, and an ending inventory of $240,000 in its first year of operations as a retailer.Reyes's sales in its first year must have been

(Multiple Choice)

4.9/5  (30)

(30)

On October 31, a fire destroyed PH Inc.'s entire retail inventory.The inventory on hand as of January 1 totaled $680,000.From January 1 through the time of the fire, the company made purchases of $165,000 and had sales of $360,000.Assuming the rate of gross profit to selling price is 40%, what is the approximate value of the inventory that was destroyed?

(Multiple Choice)

4.7/5  (38)

(38)

What method yields results that are essentially the same as those of the conventional retail method?

(Multiple Choice)

4.8/5  (37)

(37)

What is the effect of freight-in on the cost-retail ratio when using the conventional retail method?

(Multiple Choice)

4.8/5  (38)

(38)

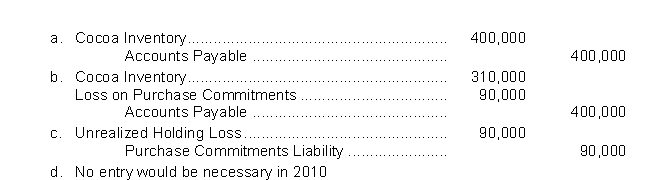

During 2010, Larue Co., a manufacturer of chocolate candies, contracted to purchase 100,000 pounds of cocoa beans at $4.00 per pound, delivery to be made in the spring of 2011.Because a record harvest is predicted for 2011, the price per pound for cocoa beans had fallen to $3.10 by December 31, 2010.

Of the following journal entries, the one which would properly reflect in 2010 the effect of the commitment of Larue Co.to purchase the 100,000 pounds of cocoa is

(Short Answer)

4.8/5  (34)

(34)

When inventory declines in value below original (historical) cost what is the maximum amount that the inventory can be valued at?

(Multiple Choice)

4.8/5  (40)

(40)

Which statement is not true about the gross profit method of inventory valuation?

(Multiple Choice)

5.0/5  (35)

(35)

If a material amount of inventory has been ordered through a formal purchase contract at the statement of financial position date for future delivery at firm prices,

(Multiple Choice)

4.9/5  (34)

(34)

Showing 61 - 80 of 120

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)