Exam 8: Valuation of Inventories: a Cost-Basis Approach

Exam 1: Financial Accounting and Accounting Standards86 Questions

Exam 2: Conceptual Framework Underlying Financial Accounting123 Questions

Exam 3: The Accounting Information System110 Questions

Exam 4: Income Statement and Related Information59 Questions

Exam 5: Statement of Financial Position and Statement of Cash Flows111 Questions

Exam 6: Accounting and the Time Value of Money118 Questions

Exam 7: Cash and Receivables135 Questions

Exam 8: Valuation of Inventories: a Cost-Basis Approach136 Questions

Exam 9: Inventories: Additional Valuation Issues120 Questions

Exam 10: Acquisition and Disposition of Property, Plant, and Equipment137 Questions

Exam 11: Depreciation, Impairments, and Depletion123 Questions

Exam 12: Intangible Assets126 Questions

Exam 13: Current Liabilities, Provisions, and Contingencies129 Questions

Exam 14: Non-Current Liabilities108 Questions

Exam 15: Equity108 Questions

Exam 17: Investments74 Questions

Exam 18: Revenue83 Questions

Exam 19: Accounting for Income Taxes92 Questions

Exam 20: Accounting for Pensions and Postretirement Benefits100 Questions

Exam 21: Accounting for Leases105 Questions

Exam 22: Accounting Changes and Error Analysis78 Questions

Exam 23: Statement of Cash Flows112 Questions

Exam 24: Presentation and Disclosure in Financial Reporting83 Questions

Select questions type

Green Co.received merchandise on consignment.As of January 31, Green included the goods in inventory, but did not record the transaction.The effect of this on its financial statements for January 31 would be

(Multiple Choice)

4.8/5  (42)

(42)

Dolan Co.received merchandise on consignment.As of March 31, Dolan had recorded the transaction as a purchase and included the goods in inventory.The effect of this on its financial statements for March 31 would be

(Multiple Choice)

4.9/5  (40)

(40)

In a period of falling prices which inventory method generally provides the lowest reported inventory?

(Multiple Choice)

4.8/5  (40)

(40)

LIFO liquidations can occur frequently when using a specific-goods approach.

(True/False)

4.8/5  (32)

(32)

The LIFO conformity rule requires that if a company uses LIFO for tax purposes, it must also use LIFO for financial accounting purposes.

(True/False)

4.7/5  (36)

(36)

Both merchandising and manufacturing companies normally have multiple inventory accounts.

(True/False)

4.9/5  (39)

(39)

Which method of inventory pricing best approximates specific identification of the actual flow of costs and units in most manufacturing situations?

(Multiple Choice)

4.9/5  (40)

(40)

Web World began using dollar-value LIFO for costing its inventory last year.The base year layer consists of $250,000.Assuming the current inventory at end of year prices equals $345,000 and the index for the current year is 1.10, what is the ending inventory using dollar-value LIFO?

(Multiple Choice)

4.9/5  (29)

(29)

When using a perpetual inventory system, freight charges on goods purchased are debited to Freight-In.f.o.b.destination, title passes to the buyer when the supplier delivers the goods to the common carrier.

(True/False)

4.8/5  (41)

(41)

Checkers uses the periodic inventory system.For the current month, the beginning inventory consisted of 1,200 units that cost $12 each.During the month, the company made two purchases: 500 units at $13 each and 2,000 units at $13.50 each.Checkers also sold 2,150 units during the month.Using the FIFO method, what is the ending inventory?

(Multiple Choice)

4.8/5  (38)

(38)

Chess Top uses the periodic inventory system.For the current month, the beginning inventory consisted of 200 units that cost $65 each.During the month, the company made two purchases: 300 units at $68 each and 150 units at $70 each.Chess Top also sold 500 units during the month.Using the FIFO method, what is the amount of cost of goods sold for the month?

(Multiple Choice)

4.7/5  (39)

(39)

What happens when inventory in base year dollars decreases?

(Multiple Choice)

4.8/5  (37)

(37)

The use of a Discounts Lost account implies that the recorded cost of a purchased inventory item is its

(Multiple Choice)

4.8/5  (44)

(44)

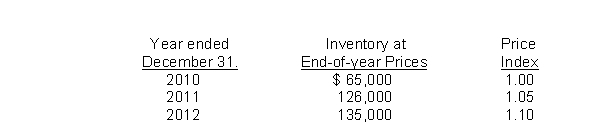

Opera Corp.uses the dollar-value LIFO method of computing its inventory cost.Data for the past four years is as follows:  What is the 2010 inventory balance using dollar-value LIFO?

What is the 2010 inventory balance using dollar-value LIFO?

(Multiple Choice)

4.7/5  (29)

(29)

Purchase Discounts Lost is a financial expense and is reported in the "other income and expense" section of the income statement.

(True/False)

4.9/5  (40)

(40)

What is the effect of a $50,000 overstatement of last year's inventory on current years ending retained earning balance?

(Multiple Choice)

4.9/5  (35)

(35)

Companies must allocate the cost of all the goods available for sale (or use) between the income statement and the statement of financial position.

(True/False)

4.8/5  (46)

(46)

Which of the following types of interest cost incurred in connection with the purchase or manufacture of inventory should be capitalized as a product cost?

(Multiple Choice)

4.8/5  (48)

(48)

Which of the following accounts is not reported in inventory?

(Multiple Choice)

4.9/5  (30)

(30)

Showing 101 - 120 of 136

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)