Exam 8: Valuation of Inventories: a Cost-Basis Approach

Exam 1: Financial Accounting and Accounting Standards86 Questions

Exam 2: Conceptual Framework Underlying Financial Accounting123 Questions

Exam 3: The Accounting Information System110 Questions

Exam 4: Income Statement and Related Information59 Questions

Exam 5: Statement of Financial Position and Statement of Cash Flows111 Questions

Exam 6: Accounting and the Time Value of Money118 Questions

Exam 7: Cash and Receivables135 Questions

Exam 8: Valuation of Inventories: a Cost-Basis Approach136 Questions

Exam 9: Inventories: Additional Valuation Issues120 Questions

Exam 10: Acquisition and Disposition of Property, Plant, and Equipment137 Questions

Exam 11: Depreciation, Impairments, and Depletion123 Questions

Exam 12: Intangible Assets126 Questions

Exam 13: Current Liabilities, Provisions, and Contingencies129 Questions

Exam 14: Non-Current Liabilities108 Questions

Exam 15: Equity108 Questions

Exam 17: Investments74 Questions

Exam 18: Revenue83 Questions

Exam 19: Accounting for Income Taxes92 Questions

Exam 20: Accounting for Pensions and Postretirement Benefits100 Questions

Exam 21: Accounting for Leases105 Questions

Exam 22: Accounting Changes and Error Analysis78 Questions

Exam 23: Statement of Cash Flows112 Questions

Exam 24: Presentation and Disclosure in Financial Reporting83 Questions

Select questions type

Where should raw materials be classified on the statement of financial position?

(Multiple Choice)

4.8/5  (44)

(44)

Checkers uses the periodic inventory system.For the current month, the beginning inventory consisted of 1,200 units that cost $12 each.During the month, the company made two purchases: 500 units at $13 each and 2,000 units at $13.50 each.Checkers also sold 2,150 units during the month.Using the LIFO method, what is the ending inventory?

(Multiple Choice)

4.9/5  (33)

(33)

Which of the following inventories carried by a manufacturer is similar to the merchandise inventory of a retailer?

(Multiple Choice)

4.8/5  (28)

(28)

Many companies use LIFO for both tax and internal reporting purposes.

(True/False)

4.9/5  (34)

(34)

Tanner Corporation's inventory cost on its statement of financial position was lower using first-in, first-out than it would have been using average cost.Assuming no beginning inventory, in what direction did the cost of purchases move during the period?

(Multiple Choice)

4.8/5  (32)

(32)

In a period of falling prices, which inventory method generally provides the lowest amount of net income?

(Multiple Choice)

4.8/5  (29)

(29)

Freight costs incurred by the seller to ship merchandise to the purchaser are accounted for by the seller as part of inventory on the statement of financial position.

(True/False)

4.8/5  (31)

(31)

An inventory pricing procedure in which the oldest costs incurred rarely have an effect on the ending inventory valuation is

(Multiple Choice)

4.9/5  (32)

(32)

Use the following information for questions.

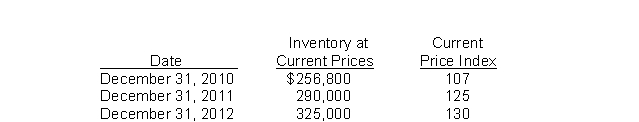

Gross Corporation adopted the dollar-value LIFO method of inventory valuation on December 31, 2009.Its inventory at that date was $220,000 and the relevant price index was 100.Information regarding inventory for subsequent years is as follows:  -What is the cost of the ending inventory at December 31, 2010 under dollar-value LIFO?

-What is the cost of the ending inventory at December 31, 2010 under dollar-value LIFO?

(Multiple Choice)

4.9/5  (43)

(43)

A disadvantage of LIFO is that it does not match more recent costs against current revenues as well as FIFO.

(True/False)

4.9/5  (42)

(42)

Culver Company purchases the majority of its inventory from three primary suppliers for re-sale to customers around the world.Culver Company's statement of financial position will include

(Multiple Choice)

4.7/5  (35)

(35)

A trade discount that is granted as an incentive for a first-time customer or as a reward for large order should be accounted for by the purchaser as revenue.

(True/False)

4.9/5  (35)

(35)

Amazon.com (USA) and other e-tailers account for certain selling costs--fulfillment costs related to inventory shipping and warehousing--as part of administrative expenses, instead of as cost of goods sold.Which of the following is incorrect regarding this treatment?

(Multiple Choice)

4.8/5  (47)

(47)

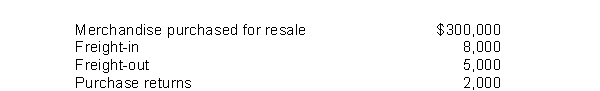

The following information applied to Howe, Inc.for 2010:  Howe's 2010 inventoriable cost was

Howe's 2010 inventoriable cost was

(Multiple Choice)

4.9/5  (44)

(44)

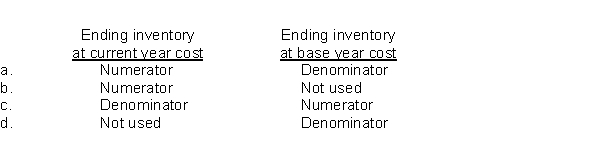

When the double extension approach to the dollar-value LIFO inventory cost flow method is used, the inventory layer added in the current year is multiplied by an index number.How would the following be used in the calculation of this index number?

(Short Answer)

4.8/5  (41)

(41)

Showing 121 - 136 of 136

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)