Exam 8: Inventory

Exam 1: The Canadian Financial Reporting Environment44 Questions

Exam 2: Conceptual Framework Underlying Financial Reporting56 Questions

Exam 3: The Accounting Information System and Measurement Issues68 Questions

Exam 4: Reporting Financial Performance79 Questions

Exam 5: Financial Position and Cash Flows78 Questions

Exam 6: Revenue Recognition79 Questions

Exam 7: Cash and Receivables75 Questions

Exam 8: Inventory127 Questions

Exam 9: Investments96 Questions

Exam 10: Property, Plant, and Equipment: Accounting Model Basics69 Questions

Exam 11: Depreciation, Impairment, and Disposition74 Questions

Exam 12: Intangible Assets and Goodwill72 Questions

Exam 13: Non-Financial Andcurrent Liabilities70 Questions

Exam 14: Long-Term Financial Liabilities62 Questions

Exam 16: Complex Financial Instruments76 Questions

Exam 18: Income Taxes55 Questions

Exam 19: Pensions and Other Employee Future Benefits72 Questions

Exam 20: Leases69 Questions

Exam 21: Accounting Changes and Error Analysis44 Questions

Exam 22: Statement of Cash Flows53 Questions

Exam 23: Other Measurement and Disclosure Issues37 Questions

Select questions type

A manufacturing company typically maintains the following inventory account(s):

(Multiple Choice)

4.8/5  (30)

(30)

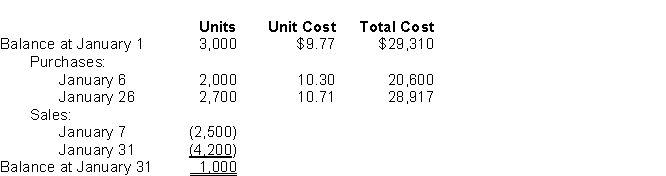

Use the following information for questions.

The following information was available from the inventory records of Key Company for January:  -Assuming that Key uses the perpetual inventory system, what should the inventory be at January 31, using the moving-average inventory method, rounded to the nearest dollar?

-Assuming that Key uses the perpetual inventory system, what should the inventory be at January 31, using the moving-average inventory method, rounded to the nearest dollar?

(Multiple Choice)

4.7/5  (30)

(30)

All of the following costs should be charged to expense in the period in which they are incurred EXCEPT for

(Multiple Choice)

4.8/5  (27)

(27)

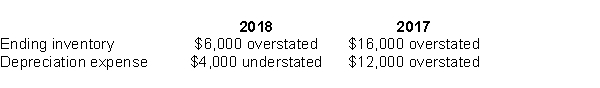

Use the following information for questions.

Shanti Inc.is a calendar-year corporation.Its financial statements for the years 2018 and 2017 contained errors as follows:  -Assume that no correcting entries were made at December 31, 2017.Ignoring income taxes, by how much will retained earnings at December 31, 2018 be overstated or understated?

-Assume that no correcting entries were made at December 31, 2017.Ignoring income taxes, by how much will retained earnings at December 31, 2018 be overstated or understated?

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following inventories may NOT be valued at fair value less costs to sell?

(Multiple Choice)

4.8/5  (35)

(35)

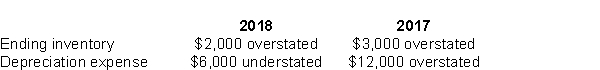

Use the following information for questions.

Giselle Ltd.is a calendar-year corporation.Its financial statements for the years 2018 and 2017 contained errors as follows:  -Assume that the proper correcting entries were made at December 31, 2017.By how much will 2018 pre-tax income be overstated or understated?

-Assume that the proper correcting entries were made at December 31, 2017.By how much will 2018 pre-tax income be overstated or understated?

(Multiple Choice)

4.7/5  (44)

(44)

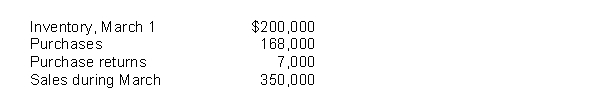

Portland Ltd.estimates the cost of its physical inventory at March 31 for use in interim financial statements.The rate of markup on cost is 25%.The following account balances are available:  What is the estimated dollar value of the inventory at March 31?

What is the estimated dollar value of the inventory at March 31?

(Multiple Choice)

4.8/5  (28)

(28)

Under ASPE, agricultural produce, forest products, and mineral products inventories may be accounted for at net realizable value if

(Multiple Choice)

4.8/5  (46)

(46)

Tehran Ltd.uses FIFO to cost its inventory.The following information is available for Tehran's inventory of product # 101:

Beginning inventory: 120 units @ $3.14 per unit

March 1: Purchase of 250 units @ $3.50 per unit

April 10: Sale of 100 units @ $5.10 per unit

Assuming Tehran uses the perpetual inventory system, the second entry to account for the April 10 sale is

(Multiple Choice)

4.8/5  (36)

(36)

An inventory method which is designed to approximate inventory valuation at the lower of average cost and market is

(Multiple Choice)

5.0/5  (34)

(34)

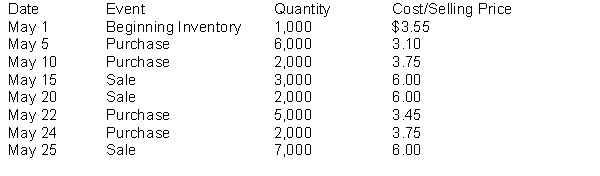

The following inventory transactions took place for NPR Corporation for the month of May:  The ending inventory balance for NPR Corporation, assuming the company uses a perpetual inventory system, and a first-in, first-out (FIFO)cost formula is

The ending inventory balance for NPR Corporation, assuming the company uses a perpetual inventory system, and a first-in, first-out (FIFO)cost formula is

(Multiple Choice)

4.8/5  (39)

(39)

To produce an inventory valuation which approximates the lower of average cost and market using the conventional retail inventory method, the calculation of the ratio of cost to retail should

(Multiple Choice)

4.9/5  (27)

(27)

Which of the following does NOT correctly describe the concept of net realizable value (NRV)?

(Multiple Choice)

4.8/5  (35)

(35)

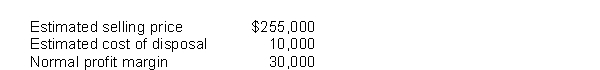

Washington Distribution Co.has determined its December 31, 2017 inventory on a FIFO basis at $240,000.Information pertaining to that inventory follows:  Washington records losses that result from applying the lower of cost and net realizable value rule.At December 31, 2017, the loss that Washington should recognize is

Washington records losses that result from applying the lower of cost and net realizable value rule.At December 31, 2017, the loss that Washington should recognize is

(Multiple Choice)

4.7/5  (34)

(34)

When using the moving-average cost formula with a perpetual system,

(Multiple Choice)

4.8/5  (36)

(36)

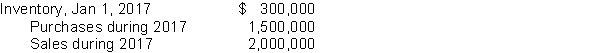

Tennessee Ltd.'s accounting records reported the following information:  A physical inventory taken on December 31, 2017 resulted in an ending inventory of $350,000.Tennessee's gross profit on sales has remained constant at 30% in recent years.Tennessee suspects some inventory may have been taken by a new employee.At December 31, 2017, what is the estimated cost of the missing inventory?

A physical inventory taken on December 31, 2017 resulted in an ending inventory of $350,000.Tennessee's gross profit on sales has remained constant at 30% in recent years.Tennessee suspects some inventory may have been taken by a new employee.At December 31, 2017, what is the estimated cost of the missing inventory?

(Multiple Choice)

4.8/5  (39)

(39)

Which statement is NOT true about the gross profit method of inventory valuation?

(Multiple Choice)

4.9/5  (37)

(37)

An inventory cost formula in which the oldest costs incurred rarely have an effect on the ending inventory valuation is

(Multiple Choice)

4.7/5  (42)

(42)

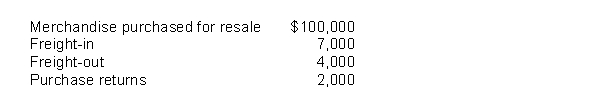

The following information was reported by Montana Inc.for 2017:  Based on this data, Montana's 2017 inventoriable cost was

Based on this data, Montana's 2017 inventoriable cost was

(Multiple Choice)

4.7/5  (37)

(37)

Showing 101 - 120 of 127

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)