Exam 10: The Basics of Capital Budgeting: Evaluating Cash Flows

Exam 1: Overview of Financial Management and the Financial Environment51 Questions

Exam 2: Financial Statements, Cash Flow, and Taxes86 Questions

Exam 3: Analysis of Financial Statements108 Questions

Exam 4: Time Value of Money113 Questions

Exam 5: Financial Planning and Forecasting Financial Statements44 Questions

Exam 6: Bonds, Bond Valuation, and Interest Rates119 Questions

Exam 7: Risk, Return, and the Capital Asset Pricing Model137 Questions

Exam 8: Stocks, Stock Valuation, and Stock Market Equilibrium80 Questions

Exam 9: The Cost of Capital80 Questions

Exam 10: The Basics of Capital Budgeting: Evaluating Cash Flows108 Questions

Exam 11: Cash Flow Estimation and Risk Analysis69 Questions

Exam 12: Capital Structure Decisions79 Questions

Exam 14: Initial Public Offerings, Investment Banking, and Financial Restructuring69 Questions

Exam 15: Lease Financing39 Questions

Exam 16: Capital Market Financing: Hybrid and Other Securities59 Questions

Exam 17: Working Capital Management and Short-Term Financing118 Questions

Exam 18: Current Asset Management114 Questions

Exam 19: Financial Options and Applications in Corporate Finance28 Questions

Exam 20: Decision Trees, Real Options, and Other Capital Budgeting Techniques19 Questions

Exam 21: Derivatives and Risk Management14 Questions

Exam 22: International Financial Management50 Questions

Exam 23: Corporate Valuation, Value-Based Management, and Corporate Governance24 Questions

Exam 24: Mergers, Acquisitions, and Restructuring67 Questions

Select questions type

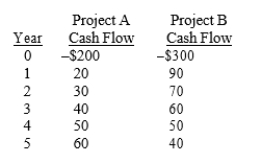

Rivoli Roofing is considering mutually exclusive Projects A and B, which have the following cash flows:  At what cost of capital would the two projects have the same NPV (NPV)?

At what cost of capital would the two projects have the same NPV (NPV)?

(Multiple Choice)

4.8/5  (28)

(28)

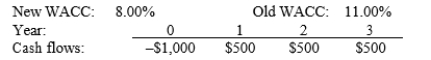

Last month, Smith Systems Inc. decided to accept the project whose cash flows are shown below. However, before actually starting the project, the Bank of Canada took actions that lowered interest rates and therefore Smith's WACC. By how much did the change in the WACC affect the project's forecasted NPV? Assume that the Bank of Canada's action does not affect the cash flows, and note that a project's projected NPV can be negative, in which case it should be rejected.

(Multiple Choice)

4.9/5  (30)

(30)

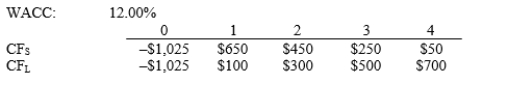

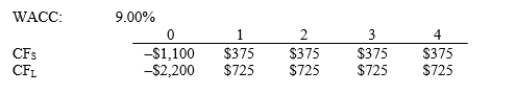

Moerdyk & Co. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the one with the higher IRR will also have the higher NPV, i.e., no conflict will exist.

(Multiple Choice)

4.8/5  (38)

(38)

If a project's NPV exceeds its IRR, then the project should be accepted.

(True/False)

4.8/5  (37)

(37)

You are considering two mutually exclusive, equally risky, projects. Both have IRRs that exceed the WACC that is used to evaluate them. Which of the following statements is correct? Assume that the projects have normal cash flows, with one outflow followed by a series of inflows.

(Multiple Choice)

4.8/5  (37)

(37)

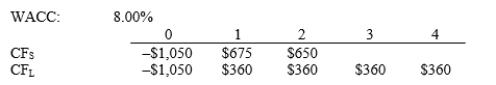

Sadik Company is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and are not repeatable. If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under some conditions choosing projects on the basis of the IRR will cause $0.00 value to be lost.

(Multiple Choice)

4.7/5  (40)

(40)

Nast Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher MIRR rather than the one with the higher NPV, how much value will be forgone? Note that under some conditions choosing projects on the basis of the MIRR will cause $0.00 value to be lost.

(Multiple Choice)

4.8/5  (32)

(32)

Showing 101 - 108 of 108

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)