Exam 7: Risk, Return, and the Capital Asset Pricing Model

Exam 1: Overview of Financial Management and the Financial Environment51 Questions

Exam 2: Financial Statements, Cash Flow, and Taxes86 Questions

Exam 3: Analysis of Financial Statements108 Questions

Exam 4: Time Value of Money113 Questions

Exam 5: Financial Planning and Forecasting Financial Statements44 Questions

Exam 6: Bonds, Bond Valuation, and Interest Rates119 Questions

Exam 7: Risk, Return, and the Capital Asset Pricing Model137 Questions

Exam 8: Stocks, Stock Valuation, and Stock Market Equilibrium80 Questions

Exam 9: The Cost of Capital80 Questions

Exam 10: The Basics of Capital Budgeting: Evaluating Cash Flows108 Questions

Exam 11: Cash Flow Estimation and Risk Analysis69 Questions

Exam 12: Capital Structure Decisions79 Questions

Exam 14: Initial Public Offerings, Investment Banking, and Financial Restructuring69 Questions

Exam 15: Lease Financing39 Questions

Exam 16: Capital Market Financing: Hybrid and Other Securities59 Questions

Exam 17: Working Capital Management and Short-Term Financing118 Questions

Exam 18: Current Asset Management114 Questions

Exam 19: Financial Options and Applications in Corporate Finance28 Questions

Exam 20: Decision Trees, Real Options, and Other Capital Budgeting Techniques19 Questions

Exam 21: Derivatives and Risk Management14 Questions

Exam 22: International Financial Management50 Questions

Exam 23: Corporate Valuation, Value-Based Management, and Corporate Governance24 Questions

Exam 24: Mergers, Acquisitions, and Restructuring67 Questions

Select questions type

The coefficient of variation, calculated as the standard deviation of expected returns divided by the expected return, is a standardized measure of the risk per unit of expected return.

Free

(True/False)

4.8/5  (30)

(30)

Correct Answer:

True

Stocks A and B both have an expected return of 10% and a standard deviation of returns of 25%. Stock A has a beta of 0.8 and Stock B has a beta of 1.2. The correlation coefficient, r, between the two stocks is 0.6. Portfolio P is a portfolio with 50% invested in Stock A and 50% invested in B. Which of the following statements is correct?

Free

(Multiple Choice)

4.7/5  (33)

(33)

Correct Answer:

C

Which of the following statements is correct?

Free

(Multiple Choice)

4.8/5  (46)

(46)

Correct Answer:

D

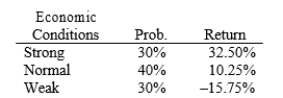

Your firm's analyst believes that economic conditions during the next year will be either strong, normal, or weak, and she thinks that Crary Inc.'s returns will have the probability distribution shown below. What's the standard deviation of Crary's returns as estimated by your analyst? (Hint: Use the formula for the standard deviation of a population, not a sample.)

(Multiple Choice)

4.9/5  (38)

(38)

The real risk-free rate is 2%, the expected inflation rate is 3.00%, the market risk premium is 4.70%, and Kohers Enterprises has a beta of 1.10. What is the required rate of return on Kohers' stock?

(Multiple Choice)

4.9/5  (37)

(37)

A portfolio's risk is measured by the weighted average of the standard deviations of the securities in the portfolio. It is this aspect of portfolios that allows investors to combine stocks and actually reduce the riskiness of a portfolio.

(True/False)

4.8/5  (40)

(40)

Bad managerial judgments or unforeseen negative events that happen to a firm are defined as "company-specific," or "unsystematic," events, and their effects on investment risk can in theory be diversified away.

(True/False)

4.9/5  (39)

(39)

The risk-free rate is 6% and the market risk premium is 5%. Your $1 million portfolio consists of $700,000 invested in a stock that has a beta of 1.2 and $300,000 invested in a stock that has a beta of

0)8. Which of the following statements is correct?

(Multiple Choice)

4.7/5  (37)

(37)

A firm can change its beta through managerial decisions, including capital budgeting and capital structure decisions.

(True/False)

4.9/5  (39)

(39)

Stock A has a beta of 0.8 and Stock B has a beta of 1.2. Fifty percent of Portfolio P is invested in Stock A and 50% is invested in Stock B. If the market risk premium (rM - rRF) were to increase but the risk-free rate (rRF) remained constant, which of the following would occur?

(Multiple Choice)

5.0/5  (36)

(36)

Diversifiable risk is the only risk that affects the required rate of return because non-diversifiable risk can be eliminated.

(True/False)

4.8/5  (34)

(34)

Stock A's beta is 1.5 and Stock B's beta is 0.5. Which of the following statements MUST be true, assuming the CAPM is correct.

(Multiple Choice)

4.9/5  (43)

(43)

Diversifiable risk plays an important factor pricing role in the arbitrage pricing theory.

(True/False)

4.9/5  (34)

(34)

Keith Johnson has $100,000 invested in a two-stock portfolio. Thirty thousand dollars is invested in Potts Manufacturing and the remainder is invested in Stohs Corporation. Potts' beta is 1.60 and Stohs' beta is 0.60. What is the portfolio's beta?

(Multiple Choice)

4.9/5  (41)

(41)

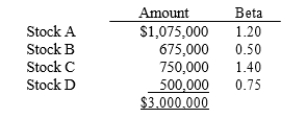

Assume that you are the portfolio manager of the Coastal Fund, a $3 million hedge fund that contains the following stocks. The required rate of return on the market is 14.00% and the risk-free rate is 6.00%. What rate of return should investors expect (and require) on this fund?

(Multiple Choice)

4.9/5  (39)

(39)

Showing 1 - 20 of 137

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)