Exam 10: The Basics of Capital Budgeting: Evaluating Cash Flows

Exam 1: Overview of Financial Management and the Financial Environment51 Questions

Exam 2: Financial Statements, Cash Flow, and Taxes86 Questions

Exam 3: Analysis of Financial Statements108 Questions

Exam 4: Time Value of Money113 Questions

Exam 5: Financial Planning and Forecasting Financial Statements44 Questions

Exam 6: Bonds, Bond Valuation, and Interest Rates119 Questions

Exam 7: Risk, Return, and the Capital Asset Pricing Model137 Questions

Exam 8: Stocks, Stock Valuation, and Stock Market Equilibrium80 Questions

Exam 9: The Cost of Capital80 Questions

Exam 10: The Basics of Capital Budgeting: Evaluating Cash Flows108 Questions

Exam 11: Cash Flow Estimation and Risk Analysis69 Questions

Exam 12: Capital Structure Decisions79 Questions

Exam 14: Initial Public Offerings, Investment Banking, and Financial Restructuring69 Questions

Exam 15: Lease Financing39 Questions

Exam 16: Capital Market Financing: Hybrid and Other Securities59 Questions

Exam 17: Working Capital Management and Short-Term Financing118 Questions

Exam 18: Current Asset Management114 Questions

Exam 19: Financial Options and Applications in Corporate Finance28 Questions

Exam 20: Decision Trees, Real Options, and Other Capital Budgeting Techniques19 Questions

Exam 21: Derivatives and Risk Management14 Questions

Exam 22: International Financial Management50 Questions

Exam 23: Corporate Valuation, Value-Based Management, and Corporate Governance24 Questions

Exam 24: Mergers, Acquisitions, and Restructuring67 Questions

Select questions type

Which of the following statements best describes normal cash flows?

(Multiple Choice)

4.7/5  (36)

(36)

Projects S and L are equally risky, mutually exclusive, and have normal cash flows. Project S has an IRR of 15%, while Project L's IRR is 12%. The two projects have the same NPV when the WACC is

7%) Which of the following statements is correct?

(Multiple Choice)

4.8/5  (38)

(38)

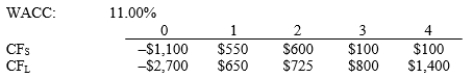

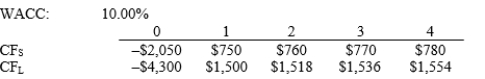

Pappas Products is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO believes the IRR is the best selection criterion, while the CFO advocates the MIRR. If the decision is made by choosing the project with the higher IRR rather than the one with the higher MIRR, how much, if any, value will be forgone? Note that under some conditions the choice will have no effect on the value gained or lost.

(Multiple Choice)

5.0/5  (42)

(42)

A decrease in the firm's discount rate (r, or WACC) will INCREASE projects' NPVs, which could change the accept/reject decision for any potential project. However, such a change would have no impact on the project's IRR; therefore, the accept/reject decision under the IRR method is independent of the cost of capital.

(True/False)

4.8/5  (32)

(32)

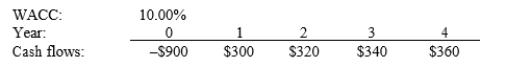

Hindelang Inc. is considering a project that has the following cash flow and WACC data. What is the project's MIRR? Note that a project's projected MIRR can be less than the WACC (and even negative), in which case it will be rejected.

(Multiple Choice)

4.9/5  (37)

(37)

If the IRR of normal Project X is greater than the IRR of mutually exclusive Project Y (also normal), we can conclude that the firm should select X rather than Y if X has NPV > 0.

(True/False)

4.7/5  (40)

(40)

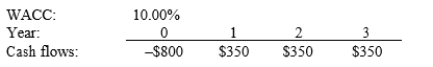

Edelman Electric Systems is considering a project that has the following cash flow and WACC data. What is the project's MIRR? Note that a project's projected MIRR can be less than the WACC (and even negative), in which case it will be rejected.

(Multiple Choice)

4.9/5  (34)

(34)

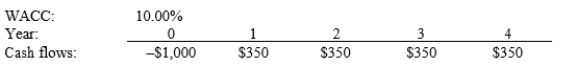

Johnson Enterprises is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that if a project's projected NPV is negative, it should be rejected.

(Multiple Choice)

4.8/5  (36)

(36)

Conflicts between two mutually exclusive projects, where the NPV method chooses one project but the IRR method chooses the other, should generally be resolved in favour of the project with the higher NPV.

(True/False)

4.8/5  (29)

(29)

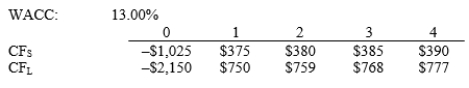

Scanlon Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under certain conditions, choosing projects on the basis of the IRR will not cause any value to be lost because the one with the higher IRR will also have the higher NPV, so no value will be lost if the IRR method is used.

(Multiple Choice)

4.9/5  (42)

(42)

One advantage of the payback method for evaluating potential investments is that it provides some information about a project's liquidity and risk.

(True/False)

4.9/5  (47)

(47)

If you were evaluating two mutually exclusive projects for a firm with a zero cost of capital, the payback method and NPV method would always lead to the same decision on which project to undertake.

(True/False)

4.8/5  (39)

(39)

Thompson Stores is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's projected IRR can be less than the WACC (and even negative), in which case it will be rejected. Year: 0 1 2 3 4 5

Cash flows: -$1,000$300 $295 $290 $285 $270

(Multiple Choice)

4.9/5  (35)

(35)

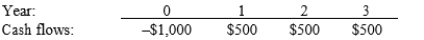

Wells Inc. is considering a project that has the following cash flow data. What is the project's payback?

(Multiple Choice)

4.9/5  (29)

(29)

Other things held constant, an INCREASE in the cost of capital will result in a DECREASE in a project's IRR.

(True/False)

4.8/5  (40)

(40)

Which of the following statements is correct? Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows.

(Multiple Choice)

4.8/5  (36)

(36)

A firm is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO wants to use the IRR criterion, while the CFO favours the NPV method, and you were hired to advise the firm on the best procedure. If the CEO's preferred criterion is used, how much value will the firm lose as a result of this decision?

(Multiple Choice)

4.9/5  (36)

(36)

Normal Projects Q and R have the same NPV when the discount rate is zero. However, Project Q's cash flows come in faster than those of R. Therefore, we know that at any discount rate greater than zero, R will have a higher NPV than Q.

(True/False)

4.7/5  (35)

(35)

Showing 61 - 80 of 108

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)