Exam 7: Risk, Return, and the Capital Asset Pricing Model

Exam 1: Overview of Financial Management and the Financial Environment51 Questions

Exam 2: Financial Statements, Cash Flow, and Taxes86 Questions

Exam 3: Analysis of Financial Statements108 Questions

Exam 4: Time Value of Money113 Questions

Exam 5: Financial Planning and Forecasting Financial Statements44 Questions

Exam 6: Bonds, Bond Valuation, and Interest Rates119 Questions

Exam 7: Risk, Return, and the Capital Asset Pricing Model137 Questions

Exam 8: Stocks, Stock Valuation, and Stock Market Equilibrium80 Questions

Exam 9: The Cost of Capital80 Questions

Exam 10: The Basics of Capital Budgeting: Evaluating Cash Flows108 Questions

Exam 11: Cash Flow Estimation and Risk Analysis69 Questions

Exam 12: Capital Structure Decisions79 Questions

Exam 14: Initial Public Offerings, Investment Banking, and Financial Restructuring69 Questions

Exam 15: Lease Financing39 Questions

Exam 16: Capital Market Financing: Hybrid and Other Securities59 Questions

Exam 17: Working Capital Management and Short-Term Financing118 Questions

Exam 18: Current Asset Management114 Questions

Exam 19: Financial Options and Applications in Corporate Finance28 Questions

Exam 20: Decision Trees, Real Options, and Other Capital Budgeting Techniques19 Questions

Exam 21: Derivatives and Risk Management14 Questions

Exam 22: International Financial Management50 Questions

Exam 23: Corporate Valuation, Value-Based Management, and Corporate Governance24 Questions

Exam 24: Mergers, Acquisitions, and Restructuring67 Questions

Select questions type

Suppose you hold a diversified portfolio consisting of a $10,000 investment in each of 12 different common stocks. The portfolio's beta is 1.25. Now suppose you decided to sell one of your stocks that has a beta of 1.00 and to use the proceeds to buy a replacement stock with a beta of 1.34. What would the portfolio's new beta be?

(Multiple Choice)

4.9/5  (43)

(43)

Bob has a $50,000 stock portfolio with a beta of 1.2, an expected return of 10.8%, and a standard deviation of 25%. Becky also has a $50,000 portfolio, but it has a beta of 0.8, an expected return of 9.2%, and a standard deviation that is also 25%. The correlation coefficient, r, between Bob's and Becky's portfolios is zero. If Bob and Becky marry and combine their portfolios, which of the following best describes their combined $100,000 portfolio?

(Multiple Choice)

4.9/5  (34)

(34)

Stocks A, B, and C all have an expected return of 10% and a standard deviation of 25%. Stocks A and B have returns that are INDEPENDENT of one another, i.e., their correlation coefficient, r, equals zero. Stocks A and C have returns that are NEGATIVELY CORRELATED with one another, i.e., r is less than 0. Portfolio AB is a portfolio with half of its money invested in Stock A and half in Stock B. Portfolio AC is a portfolio with half of its money invested in Stock A and half invested in Stock C. Which of the following statements is correct?

(Multiple Choice)

4.8/5  (34)

(34)

In the absence of a risk-free rate, what is the minimum variance portfolio?

(Multiple Choice)

4.8/5  (41)

(41)

Consider the following information for three stocks, A, B, and C, and portfolios of these stocks. The stocks' returns are positively but not perfectly positively correlated with one another, i.e., the correlation coefficients are all between 0 and 1.  Portfolio AB has half of its funds invested in Stock A and half in Stock B. Portfolio ABC has one third of its funds invested in each of the three stocks. The risk-free rate is 5%, and the market is in equilibrium, so required returns equal expected returns. Which of the following statements is correct?

Portfolio AB has half of its funds invested in Stock A and half in Stock B. Portfolio ABC has one third of its funds invested in each of the three stocks. The risk-free rate is 5%, and the market is in equilibrium, so required returns equal expected returns. Which of the following statements is correct?

(Multiple Choice)

4.7/5  (33)

(33)

The realized return on a stock portfolio is the weighted average of the expected returns on the stocks in the portfolio.

(True/False)

4.9/5  (30)

(30)

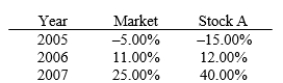

You are given the following returns on the Market and on Stock A. Calculate Stock A's beta coefficient.

(Multiple Choice)

4.8/5  (32)

(32)

Bertin Bicycles has a beta of 0.88 and an expected dividend growth rate of 4.00% per year. The T-bill rate is 4.00%, and the T-bond rate is 5.25%. The annual return on the stock market during the past 4 years was 10.25%. Investors expect the average annual future return on the market to be 11.50%. Using the SML, what is Bertin's required rate of return?

(Multiple Choice)

4.8/5  (40)

(40)

The larger the number of assets in a portfolio and the longer the time period, what can we say about the portfolio beta?

(Multiple Choice)

4.8/5  (33)

(33)

Risk-averse investors require higher rates of return on investments whose returns are highly uncertain.

(True/False)

4.8/5  (42)

(42)

For diversified investors, the appropriate measure of risk is how the return on an individual stock moves with the returns of other assets in the portfolio.

(True/False)

4.8/5  (40)

(40)

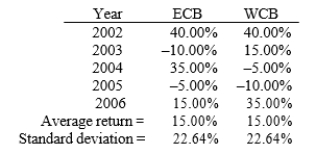

Campbell's father holds just one stock, East Coast Bank (ECB), which he thinks is a very low-risk security. Campbell agrees that the stock is relatively safe, but he wants to demonstrate that his father's risk would be even lower if he were more diversified. Campbell obtained the following returns data shown for West Coast Bank (WCB). Both have had less variability than most other stocks over the past 5 years. Measured by the standard deviation of returns, by how much would his father's historical risk have been reduced if he had held a portfolio consisting of 60% ECB and the remainder in WCB? (Hint: Use the sample standard deviation formula.)

(Multiple Choice)

4.8/5  (32)

(32)

Diversification can reduce the riskiness of a portfolio of stocks.

(True/False)

4.9/5  (33)

(33)

Any change in beta is likely to affect the required rate of return on a stock, which implies that a change in beta will likely have an impact on the stock's price.

(True/False)

4.8/5  (35)

(35)

Showing 121 - 137 of 137

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)