Exam 22: Cost-Volume-Profit

Exam 1: Accounting in Action220 Questions

Exam 2: The Recording Process192 Questions

Exam 3: Adjusting the Accounts216 Questions

Exam 4: Completing the Accounting Cycle203 Questions

Exam 5: Accounting for Merchandising Operations221 Questions

Exam 6: Inventories204 Questions

Exam 7: Accounting Information Systems139 Questions

Exam 8: Fraud, Internal Control, and Cash212 Questions

Exam 9: Accounting for Receivables220 Questions

Exam 10: Plant Assets, Natural Resources, and Intangible Assets293 Questions

Exam 11: Current Liabilities and Payroll Accounting207 Questions

Exam 12: Accounting for Partnerships210 Questions

Exam 13: Corporations: Organization and Capital Stock Transactions195 Questions

Exam 14: Corporations: Dividends, Retained Earnings, and Income Reporting176 Questions

Exam 15: Long-Term Liabilities215 Questions

Exam 16: Investments178 Questions

Exam 17: Statement of Cash Flows203 Questions

Exam 18: Financial Analysis: the Big Picture225 Questions

Exam 19: Managerial Accounting197 Questions

Exam 20: Job Order Costing199 Questions

Exam 21: Process Costing198 Questions

Exam 22: Cost-Volume-Profit217 Questions

Exam 23: Incremental Analysis208 Questions

Exam 24: Budgetary Planning207 Questions

Exam 25: Budgetary Control and Responsibility Accounting207 Questions

Exam 26: Standard Costs and Balanced Scorecard221 Questions

Select questions type

Both variable and fixed costs are included in calculating the contribution margin.

(True/False)

4.9/5  (24)

(24)

Fessler, Inc. has a product with a selling price per unit of $200, the unit variable cost is $75, and the total monthly fixed costs are $300,000. How much is Fessler's contribution margin ratio?

(Multiple Choice)

4.9/5  (31)

(31)

Larue Company reports the following operating results for the month of August: Sales $300,000 (units 5,000); variable costs $210,000; and fixed costs $70,000. Management is considering the following independent courses of action to increase net income.

1. Increase selling price by 10% with no change in total variable costs.

2. Reduce variable costs to 65% of sales.

3. Reduce fixed costs by $10,000.

Instructions

Compute the net income to be earned under each alternative. Which course of action will produce the highest net income?

(Essay)

4.8/5  (31)

(31)

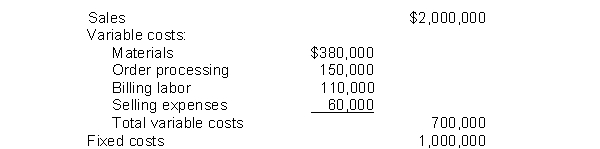

A division sold 200,000 calculators during 2010:  How much is the contribution margin per unit?

How much is the contribution margin per unit?

(Multiple Choice)

4.8/5  (31)

(31)

Nunley Company estimates that variable costs will be 60% of sales and fixed costs will total $1,920,000. The selling price of the product is $10, and 600,000 units will be sold.

Instructions

Using the mathematical equation,

(a) Compute the break-even point in units and dollars.

(b) Compute the margin of safety in dollars and as a ratio.

(c) Compute net income.

(Essay)

4.8/5  (34)

(34)

When units produced are greater than units sold, income under ________________ costing is higher than under ______________ costing.

(Short Answer)

4.7/5  (42)

(42)

Maxfield Company has fixed costs of $200,000 and variable costs are 60% of sales. How much will Maxfield Company report as sales when its net income equals $20,000?

(Multiple Choice)

4.8/5  (39)

(39)

If the activity index decreases, total variable costs will decrease proportionately.

(True/False)

4.8/5  (44)

(44)

Which of the following would not be an acceptable way to express contribution margin?

(Multiple Choice)

4.9/5  (44)

(44)

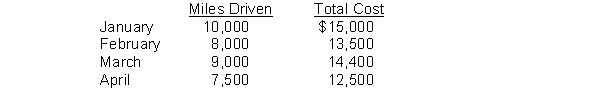

Keys Company accumulates the following data concerning a mixed cost, using miles as the activity level.  Instructions

Compute the variable and fixed cost elements using the high-low method.

Instructions

Compute the variable and fixed cost elements using the high-low method.

(Essay)

5.0/5  (36)

(36)

Mandy's Music, Inc. produces a hip-hop CD that is sold for $15. The contribution margin ratio is 40%. Fixed expenses total $6,750.

Instructions

(a) Compute the variable cost per unit.

(b) Compute how many CDs Mandy's Music will have to sell in order to break even.

(c) Compute how many CDs Mandy's Music will have to sell in order to make a target net income of $16,200.

(Essay)

4.8/5  (33)

(33)

The margin of safety ratio is equal to the margin of safety in dollars divided by the actual or (expected) sales.

(True/False)

4.9/5  (29)

(29)

Eusey Company requires sales of $2,000,000 to cover its fixed costs of $700,000 and to earn net income of $500,000. What percent are variable costs of sales?

(Multiple Choice)

5.0/5  (41)

(41)

Showing 201 - 217 of 217

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)