Exam 8: Fraud, Internal Control, and Cash

Exam 1: Accounting in Action220 Questions

Exam 2: The Recording Process192 Questions

Exam 3: Adjusting the Accounts216 Questions

Exam 4: Completing the Accounting Cycle203 Questions

Exam 5: Accounting for Merchandising Operations221 Questions

Exam 6: Inventories204 Questions

Exam 7: Accounting Information Systems139 Questions

Exam 8: Fraud, Internal Control, and Cash212 Questions

Exam 9: Accounting for Receivables220 Questions

Exam 10: Plant Assets, Natural Resources, and Intangible Assets293 Questions

Exam 11: Current Liabilities and Payroll Accounting207 Questions

Exam 12: Accounting for Partnerships210 Questions

Exam 13: Corporations: Organization and Capital Stock Transactions195 Questions

Exam 14: Corporations: Dividends, Retained Earnings, and Income Reporting176 Questions

Exam 15: Long-Term Liabilities215 Questions

Exam 16: Investments178 Questions

Exam 17: Statement of Cash Flows203 Questions

Exam 18: Financial Analysis: the Big Picture225 Questions

Exam 19: Managerial Accounting197 Questions

Exam 20: Job Order Costing199 Questions

Exam 21: Process Costing198 Questions

Exam 22: Cost-Volume-Profit217 Questions

Exam 23: Incremental Analysis208 Questions

Exam 24: Budgetary Planning207 Questions

Exam 25: Budgetary Control and Responsibility Accounting207 Questions

Exam 26: Standard Costs and Balanced Scorecard221 Questions

Select questions type

Allowing only designated personnel to handle cash receipts is an example of

Free

(Multiple Choice)

4.9/5  (36)

(36)

Correct Answer:

A

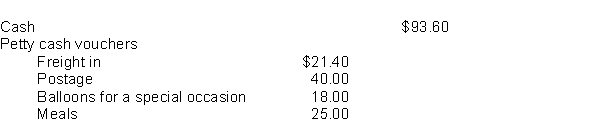

The petty cash fund of $200 for Vernon Company appeared as follows on December 31, 2010:  Instructions

1. Briefly describe when the petty cash fund should be replenished. Because there is cash on hand, is there a need to replenish the fund at year end on December 31? Explain.

2. Prepare in general journal form the entry to replenish the fund.

3. On December 31, the office manager gives instructions to increase the petty cash fund by $100. Make the appropriate journal entry.

Instructions

1. Briefly describe when the petty cash fund should be replenished. Because there is cash on hand, is there a need to replenish the fund at year end on December 31? Explain.

2. Prepare in general journal form the entry to replenish the fund.

3. On December 31, the office manager gives instructions to increase the petty cash fund by $100. Make the appropriate journal entry.

Free

(Essay)

4.9/5  (26)

(26)

Correct Answer:

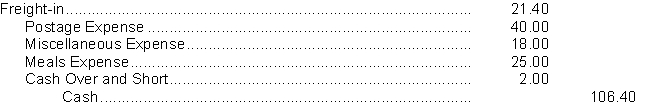

1. Petty cash should be replenished on a periodic basis or when the cash is low. It must be replenished on the balance sheet date so that the expenses represented by the petty cash vouchers can be recorded in the proper accounting period.

2.

3.

3.

The custodian of a company asset should

Free

(Multiple Choice)

4.8/5  (40)

(40)

Correct Answer:

C

A $100 petty cash fund has cash of $15 and receipts of $80. The journal entry to replenish the account would include a credit to

(Multiple Choice)

4.9/5  (40)

(40)

There are three parties to a check: (1)_______________, (2)______________, and the (3)______________.

(Short Answer)

4.7/5  (38)

(38)

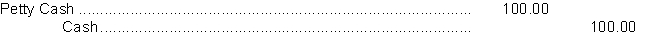

On April 30, the bank reconciliation of Baxter Company shows three outstanding checks: no. 354, $650, no. 355, $820, and no. 357, $615. The May bank statement and the May cash payments journal show the following.  Instructions

Using step 2 in the reconciliation procedure, list the outstanding checks at May 31.

Instructions

Using step 2 in the reconciliation procedure, list the outstanding checks at May 31.

(Essay)

4.7/5  (27)

(27)

Nolan Company had checks outstanding totaling $5,400 on its June bank reconciliation. In July, Nolan Company issued checks totaling $38,900. The July bank statement shows that $24,300 in checks cleared the bank in July. A check from one of Nolan Company's customers in the amount of $300 was also returned marked "NSF." The amount of outstanding checks on Nolan Company's July bank reconciliation should be

(Multiple Choice)

4.8/5  (42)

(42)

A disbursement system that uses wire, telephone, computers, etc., to transfer cash from one location to another is referred to as ______________.

(Short Answer)

4.9/5  (29)

(29)

Cash equivalents are highly liquid investments that can be converted into a specific amount of cash with maturities of

(Multiple Choice)

4.7/5  (37)

(37)

The cash records of Morris Company show the following:

1. The June 30 bank reconciliation indicated that deposits in transit totaled $390. During July the general ledger account Cash shows deposits of $9,800, but the bank statement indicates that only $9,240 in deposits were received during the month.

2. The June 30 bank reconciliation also reported outstanding checks of $800. During the month of July, Morris Company books show that $11,070 of checks were issued, yet the bank statement showed that $11,100 of checks cleared the bank in July.

There were no bank debit or credit memoranda and no errors were made by either the bank or Morris Company.

Answer the following questions:

(a) What were the deposits in transit at July 31?

(b) What were the outstanding checks at July 31?

(Essay)

4.8/5  (39)

(39)

From an internal control standpoint, the asset most susceptible to improper diversion and use is

(Multiple Choice)

4.9/5  (36)

(36)

Two individuals at a retail store work the same cash register. You evaluate this situation as

(Multiple Choice)

4.8/5  (33)

(33)

Cash which is restricted for a specific use should be separately reported.

(True/False)

4.9/5  (30)

(30)

The daily cash count of cash register receipts made by department supervisors is an example of

(Multiple Choice)

4.8/5  (29)

(29)

A bank reconciliation is generally prepared by the bank and sent to the depositor along with cancelled checks.

(True/False)

4.8/5  (33)

(33)

Dillman Food Store developed the following information in recording its bank statement for the month of March.  -------------------------------------------

(1) Checks written in March but still outstanding $7,000.

(2) Checks written in February but still outstanding $2,800.

(3) Deposits of March 30 and 31 not yet recorded by bank $5,200.

(4) NSF check of customer returned by bank $1,200.

(5) Check No. 210 for $594 was correctly issued and paid by bank but incorrectly entered in the cash payments journal as payment on account for $549.

(6) Bank service charge for March was $50.

(7) A payment on account was incorrectly entered in the cash payments journal and posted to the accounts payable subsidiary ledger for $824 when Check No. 318 was correctly prepared for $284. The check cleared the bank in March.

(8) The bank collected a note receivable for the company for $4,000 plus $150 interest revenue.

Instructions

Prepare a bank reconciliation at March 31.

-------------------------------------------

(1) Checks written in March but still outstanding $7,000.

(2) Checks written in February but still outstanding $2,800.

(3) Deposits of March 30 and 31 not yet recorded by bank $5,200.

(4) NSF check of customer returned by bank $1,200.

(5) Check No. 210 for $594 was correctly issued and paid by bank but incorrectly entered in the cash payments journal as payment on account for $549.

(6) Bank service charge for March was $50.

(7) A payment on account was incorrectly entered in the cash payments journal and posted to the accounts payable subsidiary ledger for $824 when Check No. 318 was correctly prepared for $284. The check cleared the bank in March.

(8) The bank collected a note receivable for the company for $4,000 plus $150 interest revenue.

Instructions

Prepare a bank reconciliation at March 31.

(Essay)

4.7/5  (42)

(42)

The following reconciling items are applicable to the bank reconciliation for the Hunsicker Company. Indicate how each item should be shown on a bank reconciliation.

a. Outstanding checks.

b. Bank credit memorandum for collecting a note for the depositor.

c. Bank debit memorandum for service charge.

d. Deposit in transit.

(Essay)

4.7/5  (38)

(38)

A $100 petty cash fund has cash of $17 and receipts of $80. The journal entry to replenish the account would include a

(Multiple Choice)

4.8/5  (38)

(38)

A voucher system is used by many large companies as a means of controlling cash receipts.

(True/False)

4.8/5  (42)

(42)

Showing 1 - 20 of 212

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)