Exam 6: Inventories

Exam 1: Accounting in Action220 Questions

Exam 2: The Recording Process192 Questions

Exam 3: Adjusting the Accounts216 Questions

Exam 4: Completing the Accounting Cycle203 Questions

Exam 5: Accounting for Merchandising Operations221 Questions

Exam 6: Inventories204 Questions

Exam 7: Accounting Information Systems139 Questions

Exam 8: Fraud, Internal Control, and Cash212 Questions

Exam 9: Accounting for Receivables220 Questions

Exam 10: Plant Assets, Natural Resources, and Intangible Assets293 Questions

Exam 11: Current Liabilities and Payroll Accounting207 Questions

Exam 12: Accounting for Partnerships210 Questions

Exam 13: Corporations: Organization and Capital Stock Transactions195 Questions

Exam 14: Corporations: Dividends, Retained Earnings, and Income Reporting176 Questions

Exam 15: Long-Term Liabilities215 Questions

Exam 16: Investments178 Questions

Exam 17: Statement of Cash Flows203 Questions

Exam 18: Financial Analysis: the Big Picture225 Questions

Exam 19: Managerial Accounting197 Questions

Exam 20: Job Order Costing199 Questions

Exam 21: Process Costing198 Questions

Exam 22: Cost-Volume-Profit217 Questions

Exam 23: Incremental Analysis208 Questions

Exam 24: Budgetary Planning207 Questions

Exam 25: Budgetary Control and Responsibility Accounting207 Questions

Exam 26: Standard Costs and Balanced Scorecard221 Questions

Select questions type

The manager of Yates Company is given a bonus based on income before income taxes. Net income, after taxes, is $5,600 for FIFO and $5,040 for LIFO. The tax rate is 30%. The bonus rate is 20%. How much higher is the manager's bonus if FIFO is adopted instead of LIFO?

(Multiple Choice)

4.7/5  (34)

(34)

The accountant at Reber Company has determined that income before income taxes amounted to $6,750 using the FIFO costing assumption. If the income tax rate is 30% and the amount of income taxes paid would be $225 greater if the LIFO assumption were used, what would be the amount of income before taxes under the LIFO assumption?

(Multiple Choice)

4.7/5  (40)

(40)

Which costing method cannot be used to determine the cost of inventory items before lower-of-cost-or-market is applied?

(Multiple Choice)

4.8/5  (27)

(27)

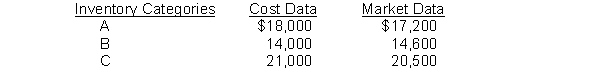

Compute the lower-of-cost-or-market valuation for Aber Company's total inventory based on the following:

(Essay)

4.7/5  (32)

(32)

Moore Company reported net income of $60,000 in 2010 and $80,000 in 2011. However, ending inventory was overstated by $5,000 in 2010.

Instructions

Compute the correct net income for Moore Company for 2010 and 2011.

(Essay)

4.9/5  (41)

(41)

Which one of the following inventory methods is often impractical to use?

(Multiple Choice)

4.9/5  (30)

(30)

The lower-of-cost-or-market basis is an example of the accounting concept of conservatism.

(True/False)

4.9/5  (45)

(45)

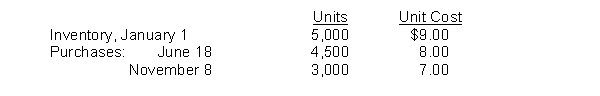

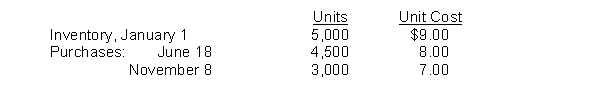

Holliday Company's inventory records show the following data:  A physical inventory on December 31 shows 2,000 units on hand. Holliday sells the units for $12 each. The company has an effective tax rate of 20%. Holliday uses the periodic inventory method. The weighted-average cost per unit is

A physical inventory on December 31 shows 2,000 units on hand. Holliday sells the units for $12 each. The company has an effective tax rate of 20%. Holliday uses the periodic inventory method. The weighted-average cost per unit is

(Multiple Choice)

4.8/5  (31)

(31)

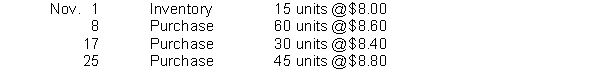

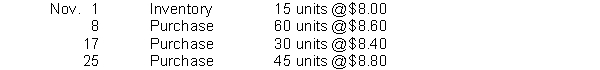

Shandy Shutters has the following inventory information.  A physical count of merchandise inventory on November 30 reveals that there are 50 units on hand. Assume a periodic inventory system is used. Ending inventory under FIFO is

A physical count of merchandise inventory on November 30 reveals that there are 50 units on hand. Assume a periodic inventory system is used. Ending inventory under FIFO is

(Multiple Choice)

4.8/5  (39)

(39)

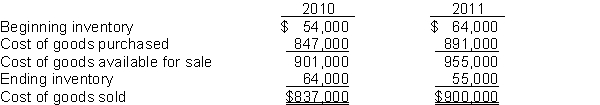

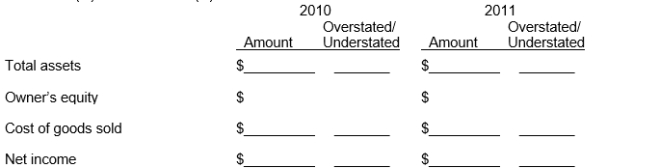

Graves Pharmacy reported cost of goods sold as follows:  Hill, the bookkeeper, made two errors:

(1) 2010 ending inventory was overstated by $6,000.

(2) 2011 ending inventory was understated by $15,000.

Instructions

Assuming the errors had not been corrected, indicate the dollar effect that the errors had on the items appearing on the financial statements listed below. Also indicate if the amounts are overstated (O) or understated (U).

Hill, the bookkeeper, made two errors:

(1) 2010 ending inventory was overstated by $6,000.

(2) 2011 ending inventory was understated by $15,000.

Instructions

Assuming the errors had not been corrected, indicate the dollar effect that the errors had on the items appearing on the financial statements listed below. Also indicate if the amounts are overstated (O) or understated (U).

(Essay)

4.8/5  (30)

(30)

Manufacturer usually classify inventory into all the following general categories except:

(Multiple Choice)

4.8/5  (46)

(46)

Inventories are reported in the current assets section of the balance sheet immediately below receivables.

(True/False)

4.8/5  (42)

(42)

The cost of goods purchased during a period plus the beginning inventory is the amount of goods ________________ during the period.

(Short Answer)

4.8/5  (38)

(38)

Inventory turnover is calculated by dividing cost of goods sold by

(Multiple Choice)

4.8/5  (27)

(27)

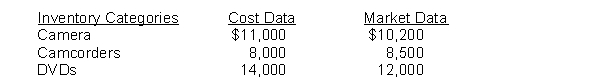

The Entertainment Center accumulates the following cost and market data at December 31.  What is the lower-of-cost-or-market value of the inventory?

What is the lower-of-cost-or-market value of the inventory?

(Essay)

4.7/5  (35)

(35)

Holliday Company's inventory records show the following data:  A physical inventory on December 31 shows 2,000 units on hand. Holliday sells the units for $12 each. The company has an effective tax rate of 20%. Holliday uses the periodic inventory method. What is the cost of goods available for sale?

A physical inventory on December 31 shows 2,000 units on hand. Holliday sells the units for $12 each. The company has an effective tax rate of 20%. Holliday uses the periodic inventory method. What is the cost of goods available for sale?

(Multiple Choice)

4.9/5  (44)

(44)

The following accounts are included in the ledger of Dean Company:

Advertising expense

Freight-in

Inventory

Purchases

Purchase returns and allowances

Sales

Sales returns and allowances

Which of the accounts would be included in calculating cost of goods sold?

(Essay)

4.7/5  (30)

(30)

Shandy Shutters has the following inventory information.  A physical count of merchandise inventory on November 30 reveals that there are 50 units on hand. Assume a periodic inventory system is used. Cost of goods sold under the average-cost method is

A physical count of merchandise inventory on November 30 reveals that there are 50 units on hand. Assume a periodic inventory system is used. Cost of goods sold under the average-cost method is

(Multiple Choice)

4.9/5  (39)

(39)

Showing 181 - 200 of 204

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)