Exam 10: Reporting and Analyzing Liabilities

Exam 1: The Purpose and Use of Financial Statements105 Questions

Exam 2: A Further Look at Financial Statements129 Questions

Exam 3: The Accounting Information System145 Questions

Exam 4: Accrual Accounting Concepts134 Questions

Exam 5: Merchandising Operations159 Questions

Exam 6: Reporting and Analyzing Inventory103 Questions

Exam 7: Internal Control and Cash95 Questions

Exam 8: Reporting and Analyzing Receivables114 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets154 Questions

Exam 10: Reporting and Analyzing Liabilities92 Questions

Exam 12: Reporting and Analyzing Investments117 Questions

Exam 13: Statement of Cash Flows123 Questions

Exam 14: Performance Measurement127 Questions

Select questions type

All transactions between bondholders and other investors must be recorded by the issuing corporation.

(True/False)

4.9/5  (38)

(38)

If the market interest rate is 4.5%, a $100,000, 5.6%, 10-year bond that pays interest semi-annually would sell at an amount

(Multiple Choice)

4.9/5  (34)

(34)

$8 million, 6%, 10-year bonds are issued at less than face value.Interest will be paid semi-annually.When calculating the market price of the bond, the present value of

(Multiple Choice)

4.8/5  (32)

(32)

Under IFRS, contingent liabilities should be recorded in the accounts if there is a remote possibility that the contingency will occur.

(True/False)

4.8/5  (41)

(41)

The entry to record interest expense on a bank loan payable is a

(Multiple Choice)

4.9/5  (35)

(35)

$2 million, 6%, 10-year bonds are issued when the market rate is 8%.Interest will be paid quarterly.When calculating the issue price of the bond, the interest rate to be used to calculate the present value of the face amount and the present value of the periodic interest payments is

(Multiple Choice)

4.9/5  (41)

(41)

To the nearest dollar, how much bond interest expense is recorded on the first interest date?

(Multiple Choice)

4.9/5  (31)

(31)

Use the following information to answer questions

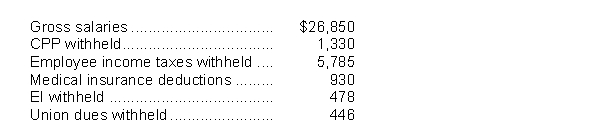

The following totals for the month of April were taken from the payroll register of Branson Corp.:

-The journal entry to record the accrual of the employee's portion of Canada Pension Plan (CPP) would include a

-The journal entry to record the accrual of the employee's portion of Canada Pension Plan (CPP) would include a

(Multiple Choice)

4.8/5  (29)

(29)

The effective-interest method is required for companies reporting under IFRS, but optional for companies using ASPE if other methods do not result in material differences.

(True/False)

4.7/5  (37)

(37)

A bond with a face value of $100,000 and a quoted price of 102.25 would have a selling price of

(Multiple Choice)

4.8/5  (38)

(38)

Bonds that are subject to retirement at a stated dollar amount prior to maturity at the option of the issuer are called

(Multiple Choice)

4.8/5  (27)

(27)

Payroll liabilities include the employer's share of CPP contributions and EI premiums.

(True/False)

4.9/5  (35)

(35)

For bond amortization, private companies reporting under ASPE

(Multiple Choice)

4.9/5  (38)

(38)

Showing 41 - 60 of 92

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)