Exam 10: Finance, Saving, and Investment

Exam 1: Getting Started200 Questions

Exam 2: The Us and Global Economies199 Questions

Exam 3: The Economic Problem99 Questions

Exam 4: Demand and Supply140 Questions

Exam 5: GDP: a Measure of Total Production and Income131 Questions

Exam 6: Jobs and Unemployment149 Questions

Exam 7: The Cpi and the Cost of Living101 Questions

Exam 8: Potential Gdp and the Natural Unemployment Rate153 Questions

Exam 9: Economic Growth152 Questions

Exam 10: Finance, Saving, and Investment151 Questions

Exam 11: The Monetary System129 Questions

Exam 12: Money, Interest, and Inflation130 Questions

Exam 13: Aggregate Supply Ad Aggregate Demand135 Questions

Exam 14: Aggregate Expenditure Multiplier72 Questions

Exam 15: The Short-Run Policy Tradeoff111 Questions

Exam 16: Fiscal Policy133 Questions

Exam 17: Monetary Policy106 Questions

Exam 18: International Trade Policy93 Questions

Exam 19: International Finance86 Questions

Select questions type

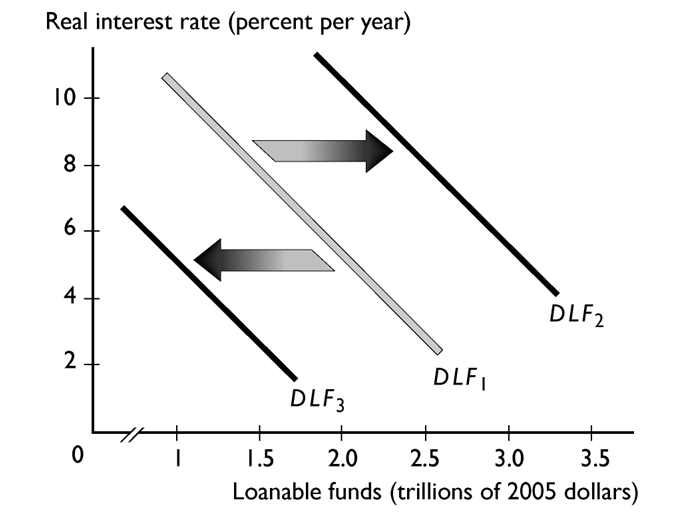

In the figure above, the leftward shift from the demand for loanable funds curve DLF1 to the demand for loanable funds curve DLF3, could be the result of

In the figure above, the leftward shift from the demand for loanable funds curve DLF1 to the demand for loanable funds curve DLF3, could be the result of

(Multiple Choice)

4.8/5  (30)

(30)

What happens to the demand for loanable funds curve when the economy enters a recession?

(Multiple Choice)

4.8/5  (41)

(41)

Investment Private saving Net taxes Government expenditures Real interest rate (billions of (billions of (billions of (billions of (percent per year) 2005 dollars) 2005 dollars) 2005 dollars) 2005 dollars) 3 60 20 40 20 4 50 30 40 20 5 40 40 40 20 6 30 50 40 20 7 20 60 40 20

The table above gives a nation's investment demand and saving supply schedules. It also has the government's net taxes and expenditures.

- The loanable funds market is in equilibrium when the real interest rate is

(Multiple Choice)

4.8/5  (44)

(44)

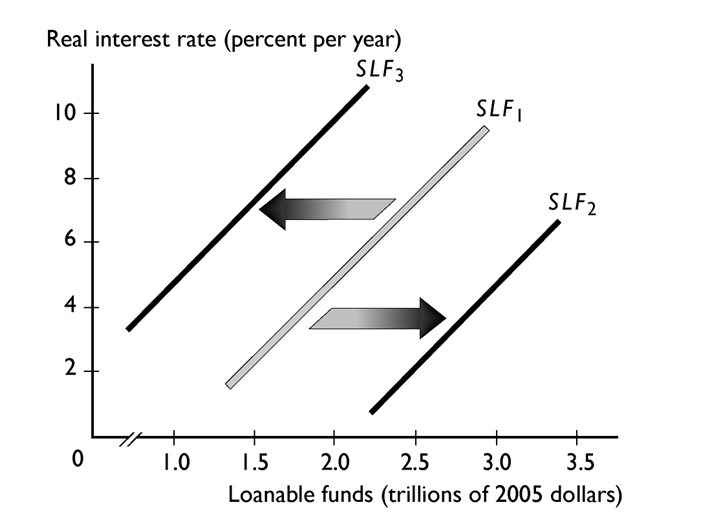

Suppose that the initial supply of loanable funds curve is SLF1. In the figure above, an increase in the real interest rate leads to

I. a shift in the supply of loanable funds curve from SLF1 to SLF2.

Ii. a shift in the supply of loanable funds curve from SLF1 to SLF3.

iii. a movement along the supply of loanable funds curve SLF1.

Iv. no change whatever.

Suppose that the initial supply of loanable funds curve is SLF1. In the figure above, an increase in the real interest rate leads to

I. a shift in the supply of loanable funds curve from SLF1 to SLF2.

Ii. a shift in the supply of loanable funds curve from SLF1 to SLF3.

iii. a movement along the supply of loanable funds curve SLF1.

Iv. no change whatever.

(Multiple Choice)

4.8/5  (37)

(37)

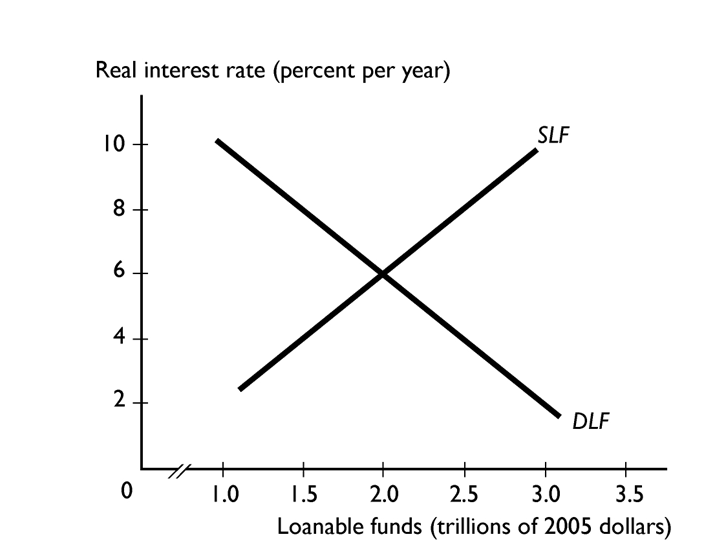

The figure above shows the loanable funds market.

- If the real interest rate is 10 percent, then

The figure above shows the loanable funds market.

- If the real interest rate is 10 percent, then

(Multiple Choice)

4.8/5  (40)

(40)

The quantity of loanable funds supplied increases if the real interest rate rises, all other things remaining the same, because the

(Multiple Choice)

4.8/5  (36)

(36)

When the real interest rate --------------------the equilibrium real interest rate, there is a --------------------of loanable funds and the real interest rate-------------------- .

(Multiple Choice)

4.7/5  (41)

(41)

The local Allied Moving Company begins this year with capital equal to $250,000. During the year the firm depreciates $150,000 worth of its capital and ends the year with capital equal to $250,000. Which statement correctly summarizes Allied Moving Company's investment?

(Multiple Choice)

4.9/5  (31)

(31)

Suppose that there is an increase in disposable income and simultaneously an increase in the expected profitability of investment. As a result, the equilibrium real interest rate --------------------and the

Equilibrium quantity of loanable funds---------------------------------------- .

(Multiple Choice)

4.7/5  (43)

(43)

Which of the following decreases the demand for loanable funds and shifts the demand for loanable funds curve leftward?

(Multiple Choice)

4.8/5  (49)

(49)

Bill's Lawn service starts the year with 20 lawn mowers. During the year, 3 mowers break and are not worth fixing. Bill also expands his business and buys 10 more mowers. Bill's net investment is

--------------------Mowers.

(Multiple Choice)

4.9/5  (36)

(36)

The difference between the amount of capital at the beginning of a year and the amount of capital at the end of the year is equal to

(Multiple Choice)

4.8/5  (37)

(37)

Wealth is to --------------------as capital stock is to --------------------

(Multiple Choice)

4.9/5  (32)

(32)

A bond's price is $80 and the bond pays $8 in interest every year. The bond's interest rate is --------------------.

(Multiple Choice)

4.9/5  (47)

(47)

Showing 21 - 40 of 151

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)