Exam 15: Contributed Capital

Exam 1: The Demand for and Supply of Financial Accounting Information85 Questions

Exam 2: Financial Reporting: Its Conceptual Framework83 Questions

Exam 3: Review of a Company S Accounting System148 Questions

Exam 5: The Income Statement and the Statement of Cash Flows Time Value of Money Module136 Questions

Exam 6: Cash and Receivables172 Questions

Exam 7: Inventories: Cost Measurement and Flow Assumptions114 Questions

Exam 8: Inventories: Special Valuation Issues141 Questions

Exam 9: Current Liabilities and Contingent Obligations125 Questions

Exam 10: Property, Plant, and Equipment: Acquisition and Subsequent Investments111 Questions

Exam 11: Depreciation, Depletion, Impairment, and Disposal136 Questions

Exam 12: Intangibles136 Questions

Exam 13: Investments and Long-Term Receivables135 Questions

Exam 14: Financing Liabilities: Bonds and Long-Term Notes Payable192 Questions

Exam 15: Contributed Capital153 Questions

Exam 17: Advanced Issues in Revenue Recognition103 Questions

Exam 18: Accounting for Income Taxes113 Questions

Exam 19: Accounting for Post-Retirement Benefits94 Questions

Exam 20: Accounting for Leases116 Questions

Exam 21: The Statement of Cash Flows103 Questions

Exam 22: Accounting for Changes and Errors130 Questions

Exam 23: Understanding Time Value of Money Formulas and Concepts142 Questions

Select questions type

Martian Magic issued 800 shares of $50 par preferred stock and 1000 shares of $1 par common stock in a "package" sale for $150,000. The preferred stock market value was $88 per share, and the common stock market value was $156 per share.

Required:

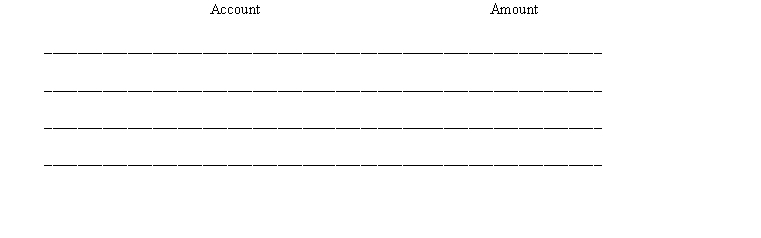

Fill in the lines below to indicate the accounts and amounts credited in the entry to record the issuance of the stock.

(Essay)

4.8/5  (30)

(30)

Miscellaneous fees arising from the issuance of stock are charged to the organization expense account only if this is

not the company's first issuance of stock.

(True/False)

4.9/5  (40)

(40)

What are the variables that must be considered when a corporation uses the option pricing model?

(Essay)

4.9/5  (42)

(42)

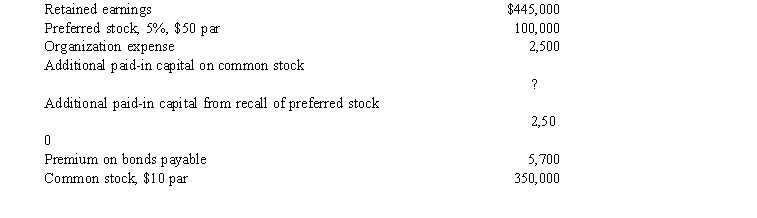

The following information is provided for Wolf Company:  If total contributed capital is $506,000, what is the amount of additional paid-in capital on common stock for Wolf Company?

If total contributed capital is $506,000, what is the amount of additional paid-in capital on common stock for Wolf Company?

(Multiple Choice)

4.7/5  (46)

(46)

During 2016, Goodfellow has the following transactions involving its common and preferred stock:

a. Issued 15,000 shares of $5 par common stock for $15 a share. This brings total shares outstanding to 50,000 shares and 100,000 shares are authorized.

b. Issued 5,000 shares of $100 par, 6%, cumulative preferred stock for $121 per share.

c. When the market value of the common stock reached $15 a share, Goodfellow declared a

3-for-1 stock split, reducing the par value to $1.67 per share.

Required:

Prepare a journal entry for each transaction.

(Essay)

4.9/5  (41)

(41)

Under IFRS companies are allowed to revalue their property, plant, and equipment as well as intangible assets.The revaluation is based upon market value and can be either adjusted up or down.

(True/False)

5.0/5  (27)

(27)

Companies can reacquire their own stock to reduce the likelihood of a hostile takeover.

(True/False)

4.9/5  (32)

(32)

On January 3, 2016, Maris Corporation issued 4,000 shares of $50 par convertible preferred stock at $90 per share.

Each share is convertible into four shares of $10 par common stock.

Required:

a. Prepare the journal entry to record the issuance of the stock on January 3, 2016.

b. On March 5, 2018, each share of preferred was converted. Prepare the journal entry to record this conversion.

c. Assume that instead of the above circumstances regarding conversion, the company agrees to convert each share of preferred into ten shares of $10 par common stock on March 5,

2018. Prepare the journal entry to record this conversion.

a. Prepare the journal entry to record the issuance of the stock on January 3, 2016.

b. On March 5, 2018, each share of preferred was converted. Prepare the journal entry to record this conversion.

c. Assume that instead of the above circumstances regarding conversion, the company agrees to convert each share of preferred into ten shares of $10 par common stock on March 5,

(Essay)

4.7/5  (43)

(43)

The intrinsic value method of measuring options based compensation is no longer supported by FASB and the IASB.

(True/False)

4.9/5  (39)

(39)

Norwalk Corporation issued 10,000 shares of $50 par preferred stock at $74 a share. A stock warrant attached to each preferred share allows the holder to buy one share of $10 par common stock for $20. Right after issuance, the preferred stock sells ex-rights for $63 per share. The warrants began selling at $7 per warrant. The amount credited to Common Stock Warrants at issuance of the preferred stock is

(Multiple Choice)

4.8/5  (39)

(39)

Match the following definition with the terms listed above.

Correct Answer:

Premises:

Responses:

(Matching)

4.9/5  (35)

(35)

What account should be debited when stock issuance costs are associated with the initial issuance of stock at incorporation?

(Multiple Choice)

4.8/5  (35)

(35)

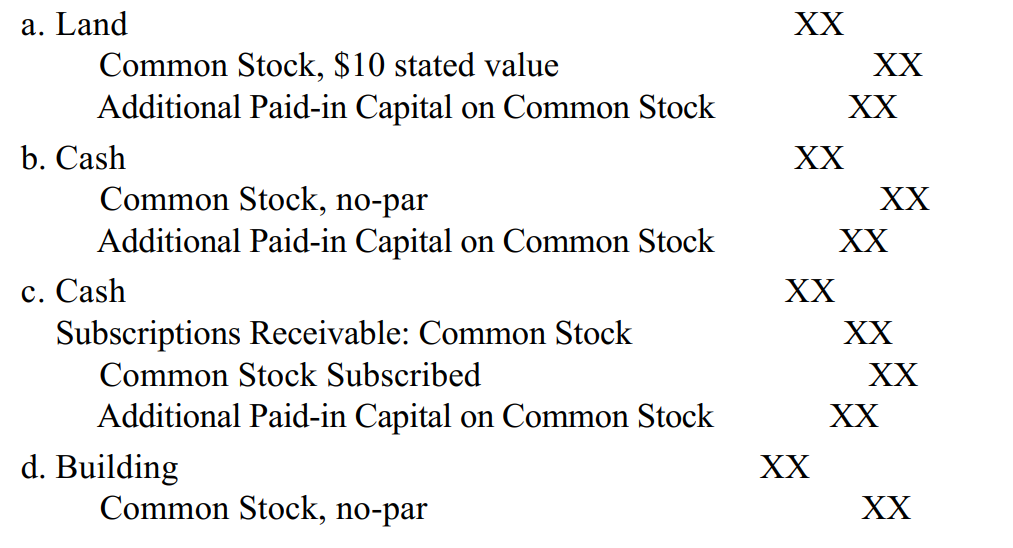

Which one of the following entries would not be likely to be made by a corporation?

(Short Answer)

4.9/5  (39)

(39)

Noncompensatory share purchase plans are utilized to increase employee ownership.

(True/False)

5.0/5  (35)

(35)

The preference to dividends that preferred shareholders have is

(Multiple Choice)

4.9/5  (32)

(32)

Exhibit 15-4

On January 1, 2016, Masters, Inc., grants a compensatory share option plan to 15 of its executives. The plan allows each executive to buy 1,000 shares of its $1 par common stock at $30 per share after a three-year service period. At January 1, 2016, the value of each option is estimated to be $9. The company also estimates it will have an annual

3% employee turnover rate during the service period.

-Refer to Exhibit 15-4. By how much has contributed capital increased as of the beginning of 2019?

(Multiple Choice)

4.9/5  (34)

(34)

Exhibit 15-4

On January 1, 2016, Masters, Inc., grants a compensatory share option plan to 15 of its executives. The plan allows each executive to buy 1,000 shares of its $1 par common stock at $30 per share after a three-year service period. At January 1, 2016, the value of each option is estimated to be $9. The company also estimates it will have an annual

3% employee turnover rate during the service period.

-Refer to Exhibit 15-4. What is the compensation expense for the year ended December 31, 2017?

(Multiple Choice)

4.9/5  (34)

(34)

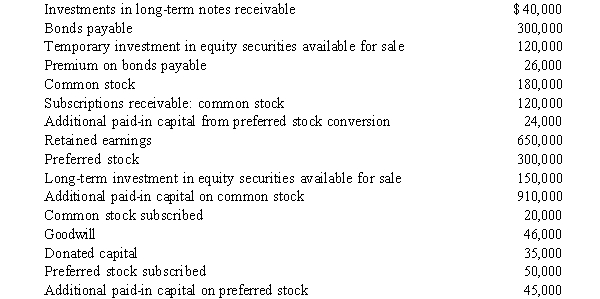

A partial listing of accounts and ending balances for Carver, Inc., on December 31, 2016, is shown below:  Following is additional information relative to the above accounts:

· The preferred stock is 8% cumulative with par value of $50. For the preferred stock, 10,000 shares have been authorized, 6,000 shares are issued and outstanding, and 1,000 shares

have been subscribed at a price of $65 per share. Each share of preferred stock is convertible into four shares of common.

· Bonds payable mature on September 30, 2020. They have a stated interest rate of 10%, payable semiannually. The straight-line method is used to amortize the premium.

· Common stock has a par value of $4 per share. For the common stock, 60,000 shares have been authorized, 45,000 shares are issued and outstanding, and 5,000 shares have been subscribed at $32 per share.

Required:

Prepare the contributed capital section of the December 31, 2016 balance sheet for Carver, Inc. Include appropriate parenthetical notes for the common and preferred stock.

Following is additional information relative to the above accounts:

· The preferred stock is 8% cumulative with par value of $50. For the preferred stock, 10,000 shares have been authorized, 6,000 shares are issued and outstanding, and 1,000 shares

have been subscribed at a price of $65 per share. Each share of preferred stock is convertible into four shares of common.

· Bonds payable mature on September 30, 2020. They have a stated interest rate of 10%, payable semiannually. The straight-line method is used to amortize the premium.

· Common stock has a par value of $4 per share. For the common stock, 60,000 shares have been authorized, 45,000 shares are issued and outstanding, and 5,000 shares have been subscribed at $32 per share.

Required:

Prepare the contributed capital section of the December 31, 2016 balance sheet for Carver, Inc. Include appropriate parenthetical notes for the common and preferred stock.

(Essay)

4.9/5  (38)

(38)

Showing 41 - 60 of 153

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)