Exam 15: Contributed Capital

Exam 1: The Demand for and Supply of Financial Accounting Information85 Questions

Exam 2: Financial Reporting: Its Conceptual Framework83 Questions

Exam 3: Review of a Company S Accounting System148 Questions

Exam 5: The Income Statement and the Statement of Cash Flows Time Value of Money Module136 Questions

Exam 6: Cash and Receivables172 Questions

Exam 7: Inventories: Cost Measurement and Flow Assumptions114 Questions

Exam 8: Inventories: Special Valuation Issues141 Questions

Exam 9: Current Liabilities and Contingent Obligations125 Questions

Exam 10: Property, Plant, and Equipment: Acquisition and Subsequent Investments111 Questions

Exam 11: Depreciation, Depletion, Impairment, and Disposal136 Questions

Exam 12: Intangibles136 Questions

Exam 13: Investments and Long-Term Receivables135 Questions

Exam 14: Financing Liabilities: Bonds and Long-Term Notes Payable192 Questions

Exam 15: Contributed Capital153 Questions

Exam 17: Advanced Issues in Revenue Recognition103 Questions

Exam 18: Accounting for Income Taxes113 Questions

Exam 19: Accounting for Post-Retirement Benefits94 Questions

Exam 20: Accounting for Leases116 Questions

Exam 21: The Statement of Cash Flows103 Questions

Exam 22: Accounting for Changes and Errors130 Questions

Exam 23: Understanding Time Value of Money Formulas and Concepts142 Questions

Select questions type

Corporate shareholders can only lose the amount of their investment, in accordance with the concept of limited liability. State laws have established protection for a corporation's creditors with the concept of legal capital.

Required:

Explain how legal capital protects a corporation's creditors and discuss two different ways that legal capital can be established by a corporation.

(Essay)

4.8/5  (36)

(36)

Current GAAP recommends that the fair value method be used to account for compensatory stock option plans.

From a conceptual point of view, this method is an improvement over the intrinsic value method.

Required:

Explain how the fair value method is an improvement over the intrinsic value method.

(Essay)

4.8/5  (41)

(41)

The following are a list of terms.

______ 1) Additional paid in capital

______ 2) Authorized capital stock

______ 3) Legal capital

______ 4) Preemptive right

______ 5) Registrar

______ 6) Stated value

______ 7) Subscribed capital stock

______ 8) Transfer agent

______ 9) Treasury stock

______ 10) Voting right

Required:

Match the following definition with the terms listed above.

a) Installment purchase contract with an investor.

b) An independent party hired to handle the stock issuance. c) Maintains the shareholders records.

d) The ability to elect directors.

e) Maintains a proportionate share of ownership. f) Shares authorized by state charter.

g) Stocks that were issued and reacquired by the corporation. h) To protect the corporations creditors.

i) No-par value

j) The excess received is recorded in this account.

(Essay)

4.7/5  (32)

(32)

Exhibit 15-6

On January 1, 2016, 50 executives were given a performance-based share option plan that would award them with a maximum of 300 shares of $10 par common stock for $20 a share. On the grant date, the fair value of an option was

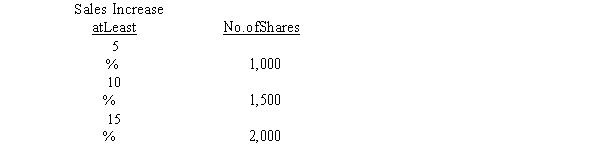

$16.50. The number of options that will vest depends on the size of the annual average increase in sales over the next three years according to the following table:  On the grant date, the company estimates the annual average sales increase will be 14%.

-Refer to Exhibit 15-6. The estimated total compensation cost will be

On the grant date, the company estimates the annual average sales increase will be 14%.

-Refer to Exhibit 15-6. The estimated total compensation cost will be

(Multiple Choice)

4.9/5  (45)

(45)

Exhibit 15-2

Lawrence, Inc., entered into a subscription contract with several subscribers that calls for the purchase of 2,000 shares of $5 par common stock for $15 a share. The contract calls for a 20% down payment and specifies that any amounts not paid within the contract period will be forfeited in full.

-Refer to Exhibit 15-2. Lawrence received final payment 80%) on 1,800 shares and issued those shares. Subscribers defaulted on 200 shares. The entry to record the default on 200 shares would include a

(Multiple Choice)

4.9/5  (40)

(40)

The corporate form of organization is important to the U.S. economy because

(Multiple Choice)

4.8/5  (29)

(29)

Exhibit 15-8

On January 1, 2016, Margarita Company granted share appreciation rights SARs) to the president, which permitted her to receive cash or stock for the difference between the quoted market price and $50 for 2,000 shares of the company's stock on the exercise date. The service period ends on December 31, 2018, and the rights must be exercised by December 31, 2021. Assume that on December 31, 2019, the president exercises all of her rights and receives cash. Using an options pricing model, the estimated fair values of the SARs were as follows:  -Refer to Exhibit 15-8. What is the compensation expense related to the SARs for the year ending December 31, 2017?

-Refer to Exhibit 15-8. What is the compensation expense related to the SARs for the year ending December 31, 2017?

(Multiple Choice)

4.7/5  (32)

(32)

Accumulated other comprehensive income is not reported with shareholder's equity.

(True/False)

4.9/5  (30)

(30)

FASB requires companies to provide disclosure regarding the preferred stock characteristics.

(True/False)

4.8/5  (37)

(37)

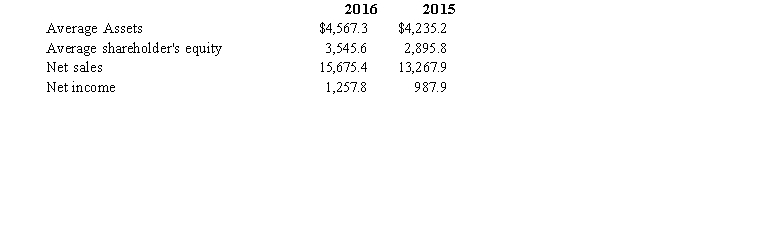

Below is information obtained from Carver's 2016 annual report:  Required:

Compute the ROE for 2015 and 2016 using the DuPont model.

Required:

Compute the ROE for 2015 and 2016 using the DuPont model.

(Essay)

4.9/5  (42)

(42)

Under a restricted share plan, the employees can sell the stock at their discretion.

(True/False)

4.8/5  (43)

(43)

The authorized shares of capital stock is the number of shares

(Multiple Choice)

5.0/5  (39)

(39)

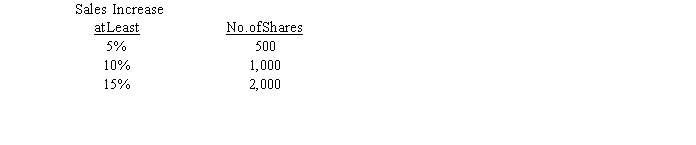

On January 1, 2016, Asquith Company adopts a performance-based stock option plan with a four-year vesting and service period, a $35 exercise price, and a $6 per option fair value. The plan grants a maximum of 2,000 shares of $5 par common stock to each of the company's 30 executives. The number of shares that vest depends on the increase in sales during the service period, based on the following scale:  Asquith estimates that sales will increase by 12% during the service period. The estimate is achieved and all options are exercised on January 1, 2020.

Required:

Assuming Asquith uses the fair value method to account for its stock option plan, prepare all of the journal entries over the life of Asquith's stock option plan 2016 through 2020).

Asquith estimates that sales will increase by 12% during the service period. The estimate is achieved and all options are exercised on January 1, 2020.

Required:

Assuming Asquith uses the fair value method to account for its stock option plan, prepare all of the journal entries over the life of Asquith's stock option plan 2016 through 2020).

(Essay)

4.7/5  (30)

(30)

On January 1, 2016, Nelson Company gave 45 executives a performance-based stock option plan that allowed them to buy a maximum of 2,000 shares each of the company's $5 par common stock at $15 a share. On the grant date, the fair value per option was $8. The shares will be awarded based on the increase in sales over a four-year service and vesting period as follows:  The company estimates sales will increase by 8% during the service period and that the annual employee turnover rate will be 4%. During 2018, the estimated annual employee turnover rate was changed to 3% for the entire service period. At the end of the four-year period, options vested for the remaining 40 executives and sales actually

increased by 12%.

Required:

Prepare the journal entries to reflect the events affecting Nelson's plan for the four-year service period.

The company estimates sales will increase by 8% during the service period and that the annual employee turnover rate will be 4%. During 2018, the estimated annual employee turnover rate was changed to 3% for the entire service period. At the end of the four-year period, options vested for the remaining 40 executives and sales actually

increased by 12%.

Required:

Prepare the journal entries to reflect the events affecting Nelson's plan for the four-year service period.

(Essay)

4.8/5  (34)

(34)

The Securities and Exchange Commission requires that Subscriptions Receivable be disclosed on the financial statements filed with it as an)

(Multiple Choice)

4.7/5  (34)

(34)

Fully participating preferred shareholders receive extra dividends equally with the rate of common shareholders.

(True/False)

4.7/5  (38)

(38)

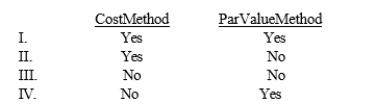

When a company reacquires its own stock, the entry to record the reacquisition could include an entry to Additional Paid-in Capital under which of the following methods?

(Multiple Choice)

4.8/5  (41)

(41)

Showing 21 - 40 of 153

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)