Exam 5: The Income Statement and the Statement of Cash Flows Time Value of Money Module

Exam 1: The Demand for and Supply of Financial Accounting Information85 Questions

Exam 2: Financial Reporting: Its Conceptual Framework83 Questions

Exam 3: Review of a Company S Accounting System148 Questions

Exam 5: The Income Statement and the Statement of Cash Flows Time Value of Money Module136 Questions

Exam 6: Cash and Receivables172 Questions

Exam 7: Inventories: Cost Measurement and Flow Assumptions114 Questions

Exam 8: Inventories: Special Valuation Issues141 Questions

Exam 9: Current Liabilities and Contingent Obligations125 Questions

Exam 10: Property, Plant, and Equipment: Acquisition and Subsequent Investments111 Questions

Exam 11: Depreciation, Depletion, Impairment, and Disposal136 Questions

Exam 12: Intangibles136 Questions

Exam 13: Investments and Long-Term Receivables135 Questions

Exam 14: Financing Liabilities: Bonds and Long-Term Notes Payable192 Questions

Exam 15: Contributed Capital153 Questions

Exam 17: Advanced Issues in Revenue Recognition103 Questions

Exam 18: Accounting for Income Taxes113 Questions

Exam 19: Accounting for Post-Retirement Benefits94 Questions

Exam 20: Accounting for Leases116 Questions

Exam 21: The Statement of Cash Flows103 Questions

Exam 22: Accounting for Changes and Errors130 Questions

Exam 23: Understanding Time Value of Money Formulas and Concepts142 Questions

Select questions type

Which of the following is not recognized by the FASB as an expense recognition principle that properly matches expenses against revenues?

(Multiple Choice)

4.9/5  (36)

(36)

Which of the following are components of the income statement?

(Multiple Choice)

4.9/5  (32)

(32)

Information reported or disclosed about the profit or loss of reportable segments consists of

(Multiple Choice)

4.9/5  (45)

(45)

When a parent company owns a majority of the common shares of a subsidiary company but not 100% of them, the parent company will consolidate all of the subsidiary's revenues and expenses into its financial statements.

(True/False)

4.9/5  (35)

(35)

Gregory Company is disposing of a component of its company. The net loss from the sale is estimated to be $600,000. Included in the $600,000 is termination pay of $100,000, which is directly associated with the decision to dispose of the component; and net losses from component asset write-downs of $400,000. Ignoring taxes, Gregory's income statement should report a loss on sale of a business component of

(Multiple Choice)

4.8/5  (32)

(32)

Expenses that affect the operating activities of more than one interim period are allocated among the periods based on an estimate of

(Multiple Choice)

4.8/5  (45)

(45)

U.S. GAAP and IFRS companies commonly measure and report net income and comprehensive income.

(True/False)

4.7/5  (46)

(46)

What criteria must be met in order for a company to classify a component as held for sale?

(Essay)

4.9/5  (35)

(35)

The information contained in the statement of cash flows allows external users to assess a company's risk, liquidity, financial flexibility, and operating capability.

(True/False)

4.9/5  (41)

(41)

There is no prescribed income statement format under IFRS whereas U.S. GAAP requires the use of the single- step or the multiple-step format.

(True/False)

4.8/5  (43)

(43)

The major components of the income statement are listed below: A = revenues

B = income from continuing operations C = earnings per share

D = results from discontinued operations E = operating income

In what sequence do they normally appear on the income statement?

(Multiple Choice)

4.8/5  (34)

(34)

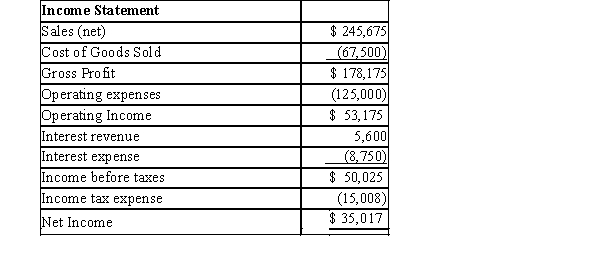

Exhibit 5-2

The following is an income statement from the financial records of Peace, Love and Joy Company for the year ended December 31, 2015:  -Refer to Exhibit 5-2. Compute the gross profit margin for Peace, Love, and Joy Company.

-Refer to Exhibit 5-2. Compute the gross profit margin for Peace, Love, and Joy Company.

(Multiple Choice)

4.9/5  (36)

(36)

Which of the following expenses is an example of expense recognition under the immediate recognition principle?

(Multiple Choice)

4.8/5  (34)

(34)

In 2014, Dallas Company had sales of $600,000; cost of sales of $430,000; interest expense of $12,000; and a gain on the sale of a component of $52,000; For its income statement, Dallas uses the single-step format and the all- inclusive concept. What was Dallas's reported pretax income from continuing operations?

(Multiple Choice)

4.9/5  (33)

(33)

The amount of money that can be distributed to shareholders as a return of capital, without being a return on capital, is the capital financial concept.

(True/False)

4.9/5  (39)

(39)

If a company does not have any discontinued operations to list on its income statement, the labels should still be there with a zero balance noted.

(True/False)

4.8/5  (29)

(29)

Below is a list of terms:

1) Expenses

2) Gains

3) Income from continuing operations

4) Losses

5) Net income

6) Operating Income

7) Other comprehensive income items

8) Revenues

Required:

Match the appropriate term with the definitions shown below by placing the appropriate letter in the space provided.

a) Increases in assets or settlement of liabilities from delivering goods or producing goods

b) Outflows or using up assets

c) Other increases in equity resulting from transactions other than revenue producing

d) Decreases in equity

e) Subtotal that represents the company's ability to execute its business strategy and generate profitability from its core, central operations

f) Income total after income tax expense

g) Bottom line of the income statement

h) Change in equity of a company during a period from transactions, other events, and circumstances relating to nonowner sources.

(Short Answer)

4.7/5  (29)

(29)

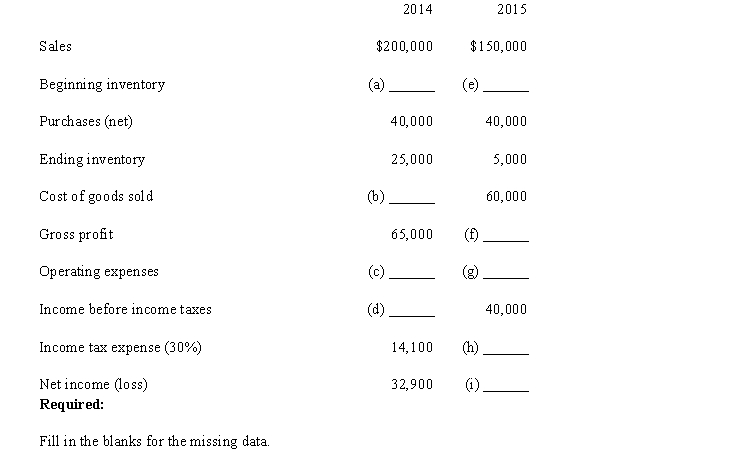

The following income statement information for 2014 and 2015 was obtained from the accounting records of Upperco Company.

(Short Answer)

4.8/5  (33)

(33)

Showing 41 - 60 of 136

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)