Exam 8: Paying, Recording, and Reporting Payroll and Payroll Taxes:

Exam 1: Accounting Concepts and Procedures125 Questions

Exam 2: Debits and Credits: Analyzing and Recording Business Transactions125 Questions

Exam 3: Beginning the Accounting Cycle125 Questions

Exam 4: The Accounting Cycle Continued126 Questions

Exam 5: The Accounting Cycle Completed126 Questions

Exam 6: Banking Procedure and Control of Cash125 Questions

Exam 7: Calculating Pay and Payroll Taxes: the Beginning of the Payroll Process138 Questions

Exam 8: Paying, Recording, and Reporting Payroll and Payroll Taxes:113 Questions

Exam 9: Sales and Cash Receipts125 Questions

Exam 10: Purchases and Cash Payments110 Questions

Exam 11: Preparing a Worksheet for a Merchandise Company123 Questions

Exam 12: Completion of the Accounting Cycle for a Merchandise Company125 Questions

Exam 13: Accounting for Bad Debts120 Questions

Exam 14: Notes Receivable and Notes Payable132 Questions

Exam 15: Accounting for Merchandise Inventory125 Questions

Exam 16: Accounting for Property, Plant, Equipment, and Intangible Assets147 Questions

Exam 17: Partnership130 Questions

Exam 18: Corporations: Organizations and Stock124 Questions

Exam 19: Corporations: Stock Values, Dividends, Treasury Stocks,122 Questions

Exam 20: Corporations and Bonds Payable138 Questions

Exam 21: Statement of Cash Flows125 Questions

Exam 22: Analyzing Financial Statements124 Questions

Exam 23: The Voucher System133 Questions

Exam 24: Departmental Accounting140 Questions

Exam 25: Manufacturing Accounting126 Questions

Select questions type

If an employer owes less than $2,500 for FICA (OASDI and Medicare) and FIT, they can submit:

(Multiple Choice)

4.7/5  (39)

(39)

If Wages and Salaries Payable is debited, what account would most likely be credited?

(Multiple Choice)

4.7/5  (31)

(31)

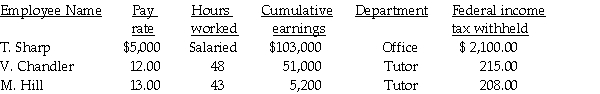

The following data applies to the July 15 payroll for the Woodard Research Firm (overtime is paid at 1 1/2)  Assume:

FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

-Compute the employees' FICA-Medicare.

Assume:

FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

-Compute the employees' FICA-Medicare.

(Short Answer)

4.8/5  (43)

(43)

The following data applies to the July 15 payroll for the Woodard Research Firm (overtime is paid at 1 1/2)  Assume:

FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

-Compute the total gross earnings.

Assume:

FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

-Compute the total gross earnings.

(Short Answer)

4.9/5  (37)

(37)

Ben's Mentoring had the following information for the pay period ending September 30:  Assume:

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total state income tax.

Assume:

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total state income tax.

(Short Answer)

4.9/5  (41)

(41)

The following data applies to the July 15 payroll for the Woodard Research Firm (overtime is paid at 1 1/2)  Assume:

FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

-Compute the total overtime earnings.

Assume:

FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

-Compute the total overtime earnings.

(Short Answer)

5.0/5  (47)

(47)

Which of the following does NOT apply to both a W-2 and a W-3?

(Multiple Choice)

4.8/5  (43)

(43)

Businesses will make their payroll tax deposits based on payroll taxes collected.

(True/False)

4.7/5  (40)

(40)

Which form contains information about gross earnings and is given to the employee by January 31?

(Multiple Choice)

4.8/5  (37)

(37)

Why are the employee deductions recorded as payables on the employer's books?

(Essay)

4.7/5  (41)

(41)

The following data applies to the July 15 payroll for the Woodard Research Firm (overtime is paid at 1 1/2)  Assume:

FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

-Compute the total state income tax.

Assume:

FICA-OASDI is 6.2% based on a limit of $128,400.

FICA-Medicare is 1.45%.

FUTA is .8% based on a limit of $7,000.

SUTA is 5.6% based on a limit of $7,000.

State income tax is 2.8%.

-Compute the total state income tax.

(Short Answer)

4.9/5  (42)

(42)

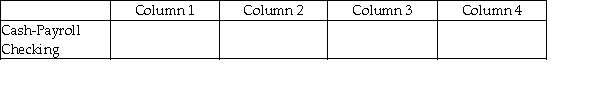

For each of the following, identify in Column 1 the category to which the account belongs, in Column 2 the normal balance for the account, in Column 3 the financial statement on which the account balance is reported, and in Column 4 the nature of the account (permanent/temporary).

-

(Essay)

4.8/5  (29)

(29)

Showing 81 - 100 of 113

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)