Exam 8: Paying, Recording, and Reporting Payroll and Payroll Taxes:

Exam 1: Accounting Concepts and Procedures125 Questions

Exam 2: Debits and Credits: Analyzing and Recording Business Transactions125 Questions

Exam 3: Beginning the Accounting Cycle125 Questions

Exam 4: The Accounting Cycle Continued126 Questions

Exam 5: The Accounting Cycle Completed126 Questions

Exam 6: Banking Procedure and Control of Cash125 Questions

Exam 7: Calculating Pay and Payroll Taxes: the Beginning of the Payroll Process138 Questions

Exam 8: Paying, Recording, and Reporting Payroll and Payroll Taxes:113 Questions

Exam 9: Sales and Cash Receipts125 Questions

Exam 10: Purchases and Cash Payments110 Questions

Exam 11: Preparing a Worksheet for a Merchandise Company123 Questions

Exam 12: Completion of the Accounting Cycle for a Merchandise Company125 Questions

Exam 13: Accounting for Bad Debts120 Questions

Exam 14: Notes Receivable and Notes Payable132 Questions

Exam 15: Accounting for Merchandise Inventory125 Questions

Exam 16: Accounting for Property, Plant, Equipment, and Intangible Assets147 Questions

Exam 17: Partnership130 Questions

Exam 18: Corporations: Organizations and Stock124 Questions

Exam 19: Corporations: Stock Values, Dividends, Treasury Stocks,122 Questions

Exam 20: Corporations and Bonds Payable138 Questions

Exam 21: Statement of Cash Flows125 Questions

Exam 22: Analyzing Financial Statements124 Questions

Exam 23: The Voucher System133 Questions

Exam 24: Departmental Accounting140 Questions

Exam 25: Manufacturing Accounting126 Questions

Select questions type

Mike's Door Service's payroll data for the second week of June included the following:  Taxable earnings for state unemployment taxes: $2,000

Assume the following tax rates:

FICA-OASDI 6.2%

FICA-Medicare 1.45%

State unemployment 1.5%

Federal unemployment 0.06%

Required: Prepare the payroll tax expense entry for Mike's for the second week of June.

Taxable earnings for state unemployment taxes: $2,000

Assume the following tax rates:

FICA-OASDI 6.2%

FICA-Medicare 1.45%

State unemployment 1.5%

Federal unemployment 0.06%

Required: Prepare the payroll tax expense entry for Mike's for the second week of June.

(Essay)

4.8/5  (40)

(40)

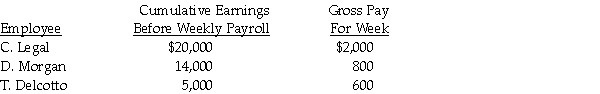

Record in the general journal the payroll tax entry for the week ended August 31. Use the following information gathered to make the entry.  a) FICA tax rate is: OASDI 6.2% on a limit of $106,800, and Medicare is 1.45%

b) Federal Unemployment is 0.8% on a limit of $7,000

c) State Unemployment is 2% on a limit of $7,000

a) FICA tax rate is: OASDI 6.2% on a limit of $106,800, and Medicare is 1.45%

b) Federal Unemployment is 0.8% on a limit of $7,000

c) State Unemployment is 2% on a limit of $7,000

(Essay)

4.8/5  (34)

(34)

Sweeney's Recording Studio payroll records show the following information:  Assume the following:

a) FICA: OASDI, 6.2% on a limit of $128,400; Medicare, 1.45%.

b) Each employee contributes $40 per week for union dues.

c) State income tax is 5% of gross pay.

d) Federal income tax is 20% of gross pay.

Prepare a general journal payroll entry: for the payment of the above weekly salary only.

Assume the following:

a) FICA: OASDI, 6.2% on a limit of $128,400; Medicare, 1.45%.

b) Each employee contributes $40 per week for union dues.

c) State income tax is 5% of gross pay.

d) Federal income tax is 20% of gross pay.

Prepare a general journal payroll entry: for the payment of the above weekly salary only.

(Essay)

4.9/5  (39)

(39)

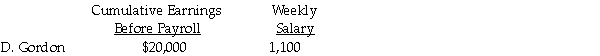

Using the information provided below, prepare a journal entry to record the payroll tax expense for Mr. B's Carpentry.  Assume:

FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

State unemployment tax rate is 2% on the first $7,000.

Federal unemployment tax rate is 0.8% on the first $7,000.

Assume:

FICA tax rates are: OASDI 6.2% on a limit of $128,400 and Medicare 1.45%.

State unemployment tax rate is 2% on the first $7,000.

Federal unemployment tax rate is 0.8% on the first $7,000.

(Essay)

4.8/5  (44)

(44)

An employer must always use a calendar year for payroll purposes.

(True/False)

4.8/5  (38)

(38)

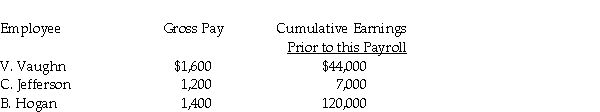

Prepare the general journal entry to record the employer's payroll tax expense.

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

(Essay)

4.9/5  (40)

(40)

Prepare the general journal entry to record the payroll.

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

(Essay)

4.8/5  (42)

(42)

What liability account is reduced when the employees are paid?

(Multiple Choice)

4.8/5  (38)

(38)

Which form is sent to the Social Security Administration along with the W-2s? It reports total wages, FICA tax withheld, etc., for the previous year.

(Multiple Choice)

4.9/5  (35)

(35)

The employer records deductions from the employee's paycheck:

(Multiple Choice)

4.9/5  (37)

(37)

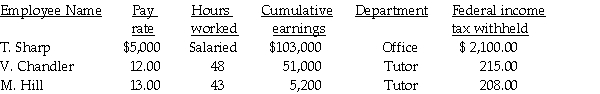

Ben's Mentoring had the following information for the pay period ending September 30:  Assume:

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the net pay.

Assume:

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the net pay.

(Short Answer)

4.9/5  (36)

(36)

Prepare the general journal entry to record the payroll.

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

___________________________________________ _________ _________

(Essay)

4.7/5  (45)

(45)

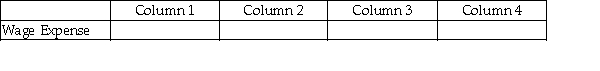

For each of the following, identify in Column 1 the category to which the account belongs, in Column 2 the normal balance for the account, in Column 3 the financial statement on which the account balance is reported, and in Column 4 the nature of the account (permanent/temporary).

-

(Essay)

4.9/5  (41)

(41)

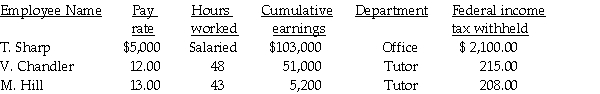

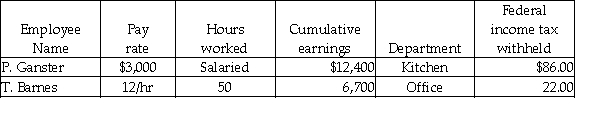

Grammy's Bakery had the following information before the pay period ending June 30:  Assume: Each hourly employee is paid 1-1/2 times pay rate for time worked in excess of 40 hours.

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to Kitchen Salaries Expense?

Assume: Each hourly employee is paid 1-1/2 times pay rate for time worked in excess of 40 hours.

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to Kitchen Salaries Expense?

(Multiple Choice)

4.9/5  (33)

(33)

Ben's Mentoring had the following information for the pay period ending September 30:  Assume:

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total overtime earnings.

Assume:

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total overtime earnings.

(Short Answer)

4.8/5  (37)

(37)

Showing 41 - 60 of 113

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)