Exam 11: Reporting and Analyzing Stockholders Equity

Exam 1: Introduction to Financial Statements229 Questions

Exam 2: A Further Look at Financial Statements239 Questions

Exam 3: The Accounting Information System283 Questions

Exam 4: Accrual Accounting Concepts312 Questions

Exam 5: Merchandising Operations and the Multiple-Step Income Statement273 Questions

Exam 6: Reporting and Analyzing Inventory259 Questions

Exam 7: Fraud, Internal Control, and Cash264 Questions

Exam 8: Reporting and Analyzing Receivables261 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets303 Questions

Exam 10: Reporting and Analyzing Liabilities310 Questions

Exam 11: Reporting and Analyzing Stockholders Equity277 Questions

Exam 12: Statement of Cash Flows235 Questions

Exam 13: Financial Analysis: The Big Picture295 Questions

Exam 14: Understanding Investments and Acquisitions in Accounting314 Questions

Select questions type

Two classifications appearing in the paid-in capital section of the balance sheet are

(Multiple Choice)

4.7/5  (40)

(40)

Which one of the following events would not require a journal entry on a corporation's books?

(Multiple Choice)

4.8/5  (38)

(38)

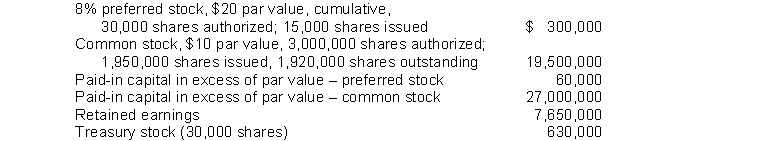

Nance Corporation's December 31, 2014 balance sheet showed the following:  Nance declared and paid a $75,000 cash dividend on December 15, 2014. If the company's dividends in arrears prior to that date were $18,000, Nance's common stockholders received

Nance declared and paid a $75,000 cash dividend on December 15, 2014. If the company's dividends in arrears prior to that date were $18,000, Nance's common stockholders received

(Multiple Choice)

4.8/5  (28)

(28)

From the information below, compute the payout ratio for Kevin's Trailers. Net Income \ 200 Cash Dividends (common) 40 Retained Earnings 500 Stock Dividends (common) 10

(Multiple Choice)

4.8/5  (41)

(41)

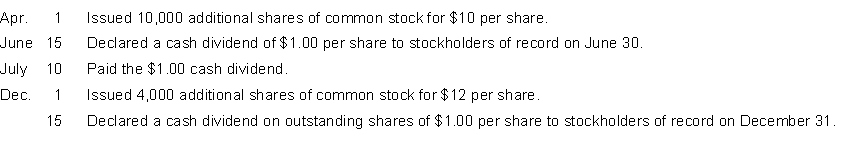

On January 1 Weiss Corporation had 60,000 shares of no-par common stock issued and outstanding. The stock has a stated value of $5 per share. During the year, the following transactions occurred:  Instructions

(a) Prepare the entries, if any, on each of the three dates that involved dividends.

(b) How are dividends and dividends payable reported in the financial statements prepared at December 31?

Instructions

(a) Prepare the entries, if any, on each of the three dates that involved dividends.

(b) How are dividends and dividends payable reported in the financial statements prepared at December 31?

(Essay)

4.9/5  (38)

(38)

Which of the following statements reflects the transferability of ownership rights in a corporation?

(Multiple Choice)

4.9/5  (41)

(41)

CAB Inc. has 1,000 shares of 6%, $100 par value, cumulative preferred stock and 50,000 shares of $1 par value common stock outstanding at December 31, 2014. What is the annual dividend on the preferred stock?

(Multiple Choice)

4.8/5  (28)

(28)

If Pratt Company issues 5,000 shares of $5 par value common stock for $210,000, the account

(Multiple Choice)

4.8/5  (32)

(32)

The return on common stockholders' equity is computed by dividing net income

(Multiple Choice)

4.9/5  (31)

(31)

If a corporation pays taxes on its income, then stockholders will not have to pay taxes on the dividends received from that corporation.

(True/False)

4.7/5  (43)

(43)

A corporation has the following account balances: Common Stock, $1 par value, $80,000; Paid-in Capital in Excess of Par Value, $2,700,000. Based on this information, the

(Multiple Choice)

4.9/5  (40)

(40)

Three important dates associated with dividends are the: (1)___________________, (2)__________________, and (3)__________________.

(Short Answer)

4.9/5  (33)

(33)

All of the following statements regarding retained earnings are true except

(Multiple Choice)

4.9/5  (21)

(21)

The two ways that a corporation can be classified by ownership are

(Multiple Choice)

4.8/5  (41)

(41)

A corporation purchases 15,000 shares of its own $20 par common stock for $35 per share, recording it at cost. What will be the effect on total stockholders' equity?

(Multiple Choice)

4.9/5  (35)

(35)

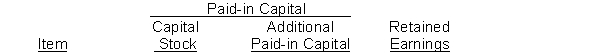

During 2014 Kenton Corporation had the following transactions and events:

1. Issued par value preferred stock for cash at par value

2. Issued par value common stock for cash at an amount greater than par value

3. Completed a 2 for 1 stock split in which the $10 par value common stock was changed to $5 par value stock

*4. Declared a small stock dividend when the market value was higher than the par value

5. Declared a cash dividend

*6. Issued the shares of common stock required by the stock dividend declaration in 4. above

7. Issued par value common stock for cash at par value

8. Paid the cash dividend

Instructions

Indicate the effect(s) of each of the foregoing items on the subdivisions of stockholders' equity. Present your answers in tabular form with the following columns. Use (I) for increase, (D) for decrease, and (NE) for no effect.

(Essay)

4.8/5  (39)

(39)

Showing 181 - 200 of 277

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)