Exam 6: Reporting and Analyzing Inventory

Exam 1: Introduction to Financial Statements229 Questions

Exam 2: A Further Look at Financial Statements239 Questions

Exam 3: The Accounting Information System283 Questions

Exam 4: Accrual Accounting Concepts312 Questions

Exam 5: Merchandising Operations and the Multiple-Step Income Statement273 Questions

Exam 6: Reporting and Analyzing Inventory259 Questions

Exam 7: Fraud, Internal Control, and Cash264 Questions

Exam 8: Reporting and Analyzing Receivables261 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets303 Questions

Exam 10: Reporting and Analyzing Liabilities310 Questions

Exam 11: Reporting and Analyzing Stockholders Equity277 Questions

Exam 12: Statement of Cash Flows235 Questions

Exam 13: Financial Analysis: The Big Picture295 Questions

Exam 14: Understanding Investments and Acquisitions in Accounting314 Questions

Select questions type

The factor which determines whether or not goods should be included in a physical count of inventory is

Free

(Multiple Choice)

4.9/5  (33)

(33)

Correct Answer:

B

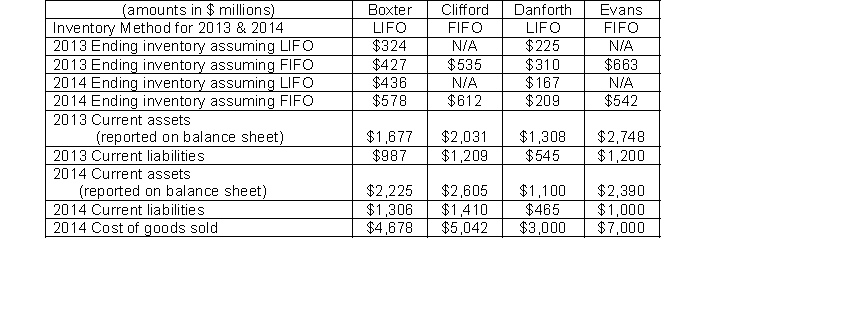

Use the following information for Boxter, Inc., Clifford Company, Danforth Industries, and Evans Services to answer the question "Using the LIFO reserve adjustment, which company would has the strongest liquidity position for 2014 as expressed by the current ratio?"

Free

(Multiple Choice)

4.9/5  (36)

(36)

Correct Answer:

C

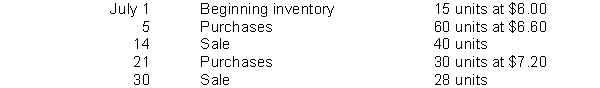

Classic Floors has the following inventory data:  Assuming that a perpetual inventory system is used, what is the value of ending inventory on a LIFO basis for July?

Assuming that a perpetual inventory system is used, what is the value of ending inventory on a LIFO basis for July?

Free

(Multiple Choice)

4.8/5  (35)

(35)

Correct Answer:

D

Shellan Kamp Company identifies the following items for possible inclusion in the physical inventory. Indicate whether each item should be included or excluded from the inventory taking.

1. Goods shipped on consignment by Shellan Kamp to another company.

2. Goods in transit from a supplier shipped FOB destination.

3. Goods shipped via common carrier to a customer with terms FOB shipping point.

4. Goods held on consignment from another company.

(Essay)

4.9/5  (40)

(40)

The First-in, First-out (FIFO) inventory method results in an ending inventory valued at the most recent cost.

(True/False)

4.9/5  (46)

(46)

Which of the following items will increase inventoriable costs for the buyer of goods?

(Multiple Choice)

4.9/5  (36)

(36)

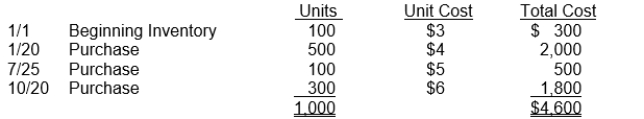

Hansen Company uses the periodic inventory method and had the following inventory information available:  A physical count of inventory on December 31 revealed that there were 380 units on hand.

Instructions

Answer the following independent questions and show computations supporting your answers.

1. Assume that the company uses the FIFO method. The value of the ending inventory at December 31 is $__________.

2. Assume that the company uses the average cost method. The value of the ending inventory on December 31 is $__________.

3. Assume that the company uses the LIFO method. The value of the ending inventory on December 31 is $__________.

4. Determine the difference in the amount of income that the company would have reported if it had used the FIFO method instead of the LIFO method. Would income have been greater or less?

A physical count of inventory on December 31 revealed that there were 380 units on hand.

Instructions

Answer the following independent questions and show computations supporting your answers.

1. Assume that the company uses the FIFO method. The value of the ending inventory at December 31 is $__________.

2. Assume that the company uses the average cost method. The value of the ending inventory on December 31 is $__________.

3. Assume that the company uses the LIFO method. The value of the ending inventory on December 31 is $__________.

4. Determine the difference in the amount of income that the company would have reported if it had used the FIFO method instead of the LIFO method. Would income have been greater or less?

(Essay)

4.8/5  (39)

(39)

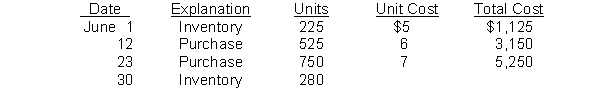

Johnson Company reports the following for the month of June.  (a) Compute the cost of the ending inventory and the cost of goods sold under (1) FIFO, (2) LIFO, and (3) average cost.

(b) Which costing method gives the highest ending inventory? The highest cost of goods sold? Why?

(c) How do the average-cost values for ending inventory and cost of goods sold relate to ending inventory and cost of goods sold for FIFO and LIFO?

(a) Compute the cost of the ending inventory and the cost of goods sold under (1) FIFO, (2) LIFO, and (3) average cost.

(b) Which costing method gives the highest ending inventory? The highest cost of goods sold? Why?

(c) How do the average-cost values for ending inventory and cost of goods sold relate to ending inventory and cost of goods sold for FIFO and LIFO?

(Essay)

4.8/5  (41)

(41)

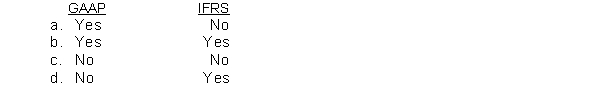

Inventory written down under lower-of-cost-or market may be written back up to original cost in a subsequent period under

(Short Answer)

4.8/5  (34)

(34)

The LIFO inventory method agrees with the actual physical movement of goods in most businesses.

(True/False)

4.9/5  (30)

(30)

When the market value of inventory is lower than its cost, the inventory is written down to its market value.

(True/False)

4.8/5  (45)

(45)

Which of the following terms best describes the assumption made in applying the four inventory methods?

(Multiple Choice)

4.9/5  (37)

(37)

If the unit cost of inventory has continuously increased, the ______________, first-out inventory valuation method will result in a higher valued ending inventory than if the ______________, first-out method had been used.

(Short Answer)

4.9/5  (42)

(42)

If prices never changed there would be no need for alternative inventory methods.

(True/False)

4.8/5  (28)

(28)

Reeves Company is taking a physical inventory on March 31, the last day of its fiscal year. Which of the following must be included in this inventory count?

(Multiple Choice)

4.9/5  (48)

(48)

Butler Company reported ending inventory at December 31, 2014 of $1,200,000 under LIFO. It also reported a LIFO reserve of $210,000 at January 1, 2014, and $300,000 at December 31, 2014. Cost of goods sold for 2014 was $4,600,000. If Butler Company had used FIFO during 2014, its cost of goods sold for 2014 would have been

(Multiple Choice)

4.9/5  (37)

(37)

If companies have identical inventoriable costs but use different inventory flow assumptions when the price of goods have not been constant, then the

(Multiple Choice)

4.9/5  (39)

(39)

The LIFO inventory method assumes that the cost of the latest units purchased are

(Multiple Choice)

4.9/5  (36)

(36)

Given equal circumstances, which inventory method would probably be the most time consuming?

(Multiple Choice)

4.9/5  (38)

(38)

Showing 1 - 20 of 259

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)