Exam 5: Merchandising Operations and the Multiple-Step Income Statement

Exam 1: Introduction to Financial Statements229 Questions

Exam 2: A Further Look at Financial Statements239 Questions

Exam 3: The Accounting Information System283 Questions

Exam 4: Accrual Accounting Concepts312 Questions

Exam 5: Merchandising Operations and the Multiple-Step Income Statement273 Questions

Exam 6: Reporting and Analyzing Inventory259 Questions

Exam 7: Fraud, Internal Control, and Cash264 Questions

Exam 8: Reporting and Analyzing Receivables261 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets303 Questions

Exam 10: Reporting and Analyzing Liabilities310 Questions

Exam 11: Reporting and Analyzing Stockholders Equity277 Questions

Exam 12: Statement of Cash Flows235 Questions

Exam 13: Financial Analysis: The Big Picture295 Questions

Exam 14: Understanding Investments and Acquisitions in Accounting314 Questions

Select questions type

This information relates to Sherper Co.

1. On April 5 purchased merchandise from Newport Company for $22,000, terms 2/10, n/10.

2. On April 6 paid freight costs of $900 on merchandise purchased from Newport.

3. On April 7 purchased equipment on account for $26,000.

4. On April 8 returned some of April 5 merchandise to Newport Company which cost $2,000.

5. On April 15 paid the amount due to Newport Company in full.

Instructions

(a) Prepare the journal entries to record the transactions listed above on the books of Sherper Co. Sherper Co. uses a perpetual inventory system.

(b) Assume that Sherper Co. paid the balance due to Newport Company on May 4 instead of April 15. Prepare the journal entry to record this payment.

(Essay)

5.0/5  (37)

(37)

At the beginning of the year, Uptown Athletic had an inventory of $400,000. During the year, the company purchased goods costing $1,500,000. If Uptown Athletic reported ending inventory of $500,000 and sales of $2,000,000, their cost of goods sold and gross profit rate would be

(Multiple Choice)

4.8/5  (38)

(38)

With the periodic inventory system, goods available for sale must be calculated before cost of goods sold.

(True/False)

4.8/5  (35)

(35)

A Sales Returns and Allowances account is not debited if a customer

(Multiple Choice)

4.8/5  (26)

(26)

When using the periodic system the physical inventory count is used to determine

(Multiple Choice)

5.0/5  (39)

(39)

Assume that Mitchell Company uses a periodic inventory system and has these account balances: Purchases $620,000; Purchase Returns and Allowances $25,000; Purchases Discounts $11,000; and Freight-In $19,000; beginning inventory of $45,000; ending inventory of $55,000; and net sales of $750,000. Determine the amounts to be reported for cost of goods sold and gross profit.

(Essay)

4.8/5  (45)

(45)

The operating cycle of a merchandising company ordinarily is shorter than that of a service company.

(True/False)

4.9/5  (30)

(30)

Assume Grammar Company uses the periodic inventory system and has a beginning inventory balance of $5,000, purchases of $75,000, and sales of $125,000. Grammar closes its records once a year on December 31. In the accounting records, the inventory account would be expected to have a balance on December 31 prior to adjusting and closing entries that was

(Multiple Choice)

4.9/5  (44)

(44)

A merchandising company's net income is determined by subtracting operating expenses from gross profit.

(True/False)

4.8/5  (30)

(30)

The Sales Returns and Allowances account and the Sales Discount account are both classified as expense accounts.

(True/False)

4.9/5  (35)

(35)

What is an advantage of using the multiple-step income statement?

(Multiple Choice)

4.7/5  (30)

(30)

Stan's Market recorded the following events involving a recent purchase of inventory: Received goods for $90,000, terms 2/10, n/30.

Returned $1,800 of the shipment for credit.

Paid $450 freight on the shipment.

Paid the invoice within the discount period.

As a result of these events, the company's inventory

(Multiple Choice)

5.0/5  (35)

(35)

On September 1, Hendricks Supply had an inventory of 18 backpacks at a cost of $20 each. The company uses a periodic inventory system. During September, the following transactions and events occurred.

Sept. 4 Purchased 50 backpacks at $20 each from Neufeld, terms 2/10, n/30.

6 Received credit of $100 for the return of 5 backpacks purchased on Sept. 4 that were defective.

9 Sold 30 backpacks for $30 each to Brewer Books, terms 2/10, n/30.

13 Sold 10 backpacks for $30 each to Stoner Office Supply, terms n/30.

14 Paid Neufeld in full, less discount.

Instructions

Journalize the September transactions for Hendricks Supply.

(Essay)

4.9/5  (33)

(33)

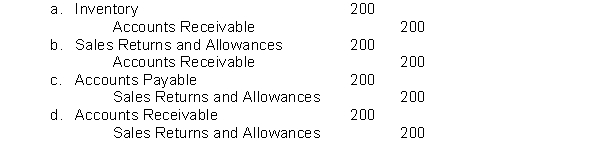

Crowder Corporation recorded the return of $200 of goods originally sold on credit to Discount Industries. Using the periodic inventory approach, Crowder would record this transaction as:

(Short Answer)

4.9/5  (35)

(35)

The figure for which of the following items is determined at a different time under the perpetual inventory method than under the periodic method?

(Multiple Choice)

4.8/5  (33)

(33)

Tony's Market recorded the following events involving a recent purchase of inventory: Received goods for $40,000, terms 2/10, n/30.

Returned $800 of the shipment for credit.

Paid $200 freight on the shipment.

Paid the invoice within the discount period.

As a result of these events, the company's inventory

(Multiple Choice)

4.9/5  (39)

(39)

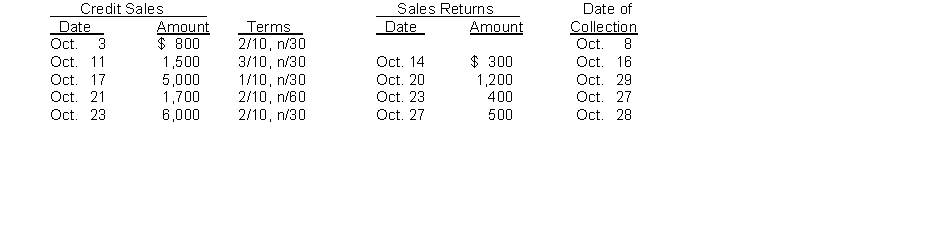

Norman Company completed the following transactions in October: Norman uses a perpetual inventory system.  Instructions

(a) Indicate the cash received for each collection. Show your calculations.

(b) Prepare the journal entry for the

(1) Oct. 17 sale. The merchandise sold had a cost of $3,000.

(2) Oct. 23 sales return. The merchandise returned had a cost of $200.

(3) Oct. 28 collection.

Instructions

(a) Indicate the cash received for each collection. Show your calculations.

(b) Prepare the journal entry for the

(1) Oct. 17 sale. The merchandise sold had a cost of $3,000.

(2) Oct. 23 sales return. The merchandise returned had a cost of $200.

(3) Oct. 28 collection.

(Essay)

4.9/5  (33)

(33)

Showing 201 - 220 of 273

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)