Exam 6: Reporting and Analyzing Inventory

Exam 1: Introduction to Financial Statements229 Questions

Exam 2: A Further Look at Financial Statements239 Questions

Exam 3: The Accounting Information System283 Questions

Exam 4: Accrual Accounting Concepts312 Questions

Exam 5: Merchandising Operations and the Multiple-Step Income Statement273 Questions

Exam 6: Reporting and Analyzing Inventory259 Questions

Exam 7: Fraud, Internal Control, and Cash264 Questions

Exam 8: Reporting and Analyzing Receivables261 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets303 Questions

Exam 10: Reporting and Analyzing Liabilities310 Questions

Exam 11: Reporting and Analyzing Stockholders Equity277 Questions

Exam 12: Statement of Cash Flows235 Questions

Exam 13: Financial Analysis: The Big Picture295 Questions

Exam 14: Understanding Investments and Acquisitions in Accounting314 Questions

Select questions type

A low number of days in inventory may indicate all of the following except

(Multiple Choice)

4.8/5  (36)

(36)

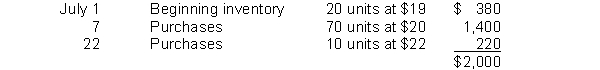

Quiet Phones Company has the following inventory data:  A physical count of merchandise inventory on July 30 reveals that there are 32 units on hand. Using the LIFO inventory method, the amount allocated to cost of goods sold for July is

A physical count of merchandise inventory on July 30 reveals that there are 32 units on hand. Using the LIFO inventory method, the amount allocated to cost of goods sold for July is

(Multiple Choice)

4.7/5  (41)

(41)

The average cost inventory method relies on a simple average calculation.

(True/False)

4.9/5  (50)

(50)

Glenda Carson is studying for the next accounting midterm examination. What should Glenda know about (a) departing from the cost basis of accounting for inventories and (b) the meaning of "market" in the lower-of-cost-or-market method?

(Essay)

4.9/5  (38)

(38)

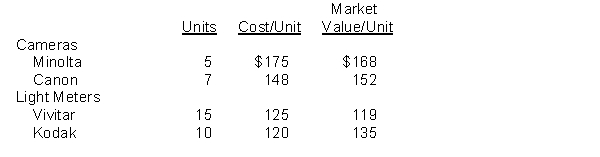

Wolf Camera Shop Inc. uses the lower-of-cost-or-market basis for its inventory. The following data are available at December 31.  Instructions

What amount should be reported on Wolf Camera Shop's financial statements, assuming the lower-of-cost-or-market rule is applied?

Instructions

What amount should be reported on Wolf Camera Shop's financial statements, assuming the lower-of-cost-or-market rule is applied?

(Essay)

4.9/5  (37)

(37)

Given equal circumstances and generally rising costs, which inventory method will increase the tax expense the most?

(Multiple Choice)

4.9/5  (35)

(35)

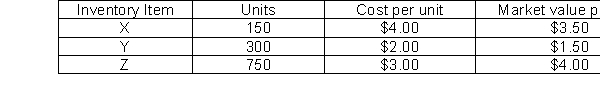

Nelson Corporation sells three different products. The following information is available on December 31:  When applying the lower of cost or market rule to each item, what will Nelson's total ending inventory balance be?

When applying the lower of cost or market rule to each item, what will Nelson's total ending inventory balance be?

(Multiple Choice)

4.8/5  (42)

(42)

Computers has made the periodic inventory system more popular and easier to apply.

(True/False)

4.9/5  (41)

(41)

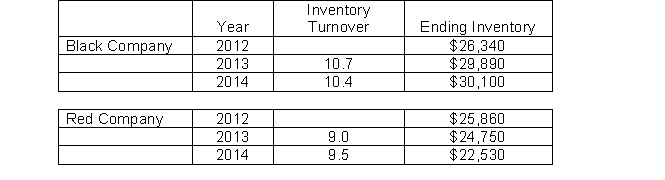

Use the following information regarding Black Company and Red Company to answer the question "Which amount is equal to Black Company's "days in inventory" for 2014 (to the closest decimal place)?"

(Multiple Choice)

4.9/5  (43)

(43)

Ace Company is a retailer operating in an industry that experiences inflation (rising prices). Ace wants the most realistic ending inventory. Which inventory costing method should Ace consider using?

(Multiple Choice)

4.7/5  (38)

(38)

Cost of goods available for sale must be allocated between cost of goods ___________ and ______________.

(Short Answer)

4.9/5  (36)

(36)

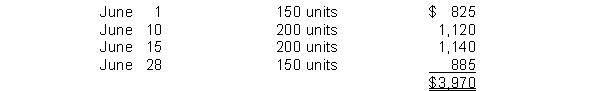

Quark Inc. just began business and made the following four inventory purchases in June:  A physical count of merchandise inventory on June 30 reveals that there are 200 units on hand. Using the FIFO inventory method, the amount allocated to ending inventory for June is

A physical count of merchandise inventory on June 30 reveals that there are 200 units on hand. Using the FIFO inventory method, the amount allocated to ending inventory for June is

(Multiple Choice)

4.9/5  (43)

(43)

The specific identification method of costing inventories tracks the actual physical flow of the goods available for sale.

(True/False)

4.8/5  (34)

(34)

When the average cost method is applied to a perpetual inventory system, a moving average cost per unit is computed with each purchase.

(True/False)

4.8/5  (46)

(46)

The following information was available for Camara Company at December 31, 2014: beginning inventory $80,000; ending inventory $120,000; cost of goods sold $560,000; and sales $800,000. Camara's days in inventory in 2014 was

(Multiple Choice)

4.7/5  (35)

(35)

Accountants believe that the write down from cost to market should not be made in the period in which the price decline occurs.

(True/False)

4.8/5  (29)

(29)

In periods of inflation, phantom or paper profits may be reported as a result of using the

(Multiple Choice)

4.8/5  (43)

(43)

The expense recognition principle requires that the cost of goods sold be matched against the ending merchandise inventory in order to determine income.

(True/False)

4.7/5  (37)

(37)

Which of the following statements is true regarding inventory cost flow assumptions?

(Multiple Choice)

4.9/5  (33)

(33)

Showing 221 - 240 of 259

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)