Exam 4: Completion of the Accounting Cycle

Exam 1: Accounting in Action162 Questions

Exam 2: The Recording Process163 Questions

Exam 3: Adjusting the Accounts179 Questions

Exam 4: Completion of the Accounting Cycle151 Questions

Exam 5: Accounting for Merchandising Operations201 Questions

Exam 6: Inventory Costing176 Questions

Exam 7: Internal Control and Cash130 Questions

Exam 9: Long-Lived Assets243 Questions

Exam 10: Current Liabilities98 Questions

Exam 11: Accounting Principles116 Questions

Exam 12: Accounting for Partnerships153 Questions

Exam 13: Introduction to Corporations195 Questions

Exam 14: Corporations: Additional Topics and Ifrs136 Questions

Exam 15: Non-Current Liabilities139 Questions

Exam 16: The Cash Flow Statement158 Questions

Exam 17: Financial Statement Analysis155 Questions

Exam 18: Investments68 Questions

Select questions type

The owner's drawings account is closed to the Income Summary account in order to properly determine Profit (or loss) for the period.

(True/False)

4.9/5  (39)

(39)

The following items are taken from the financial statements of Maxon Service for 2013:  Instructions

a. Prepare an income statement and a classified balance sheet for Maxon Sales.

b. Calculate the following ratios and values:

1. Current ratio

2. Working capital

3. Acid-test ratio

a. Prepare an income statement and a classified balance sheet for Maxon Sales.

b. Calculate the following ratios and values:

Instructions

a. Prepare an income statement and a classified balance sheet for Maxon Sales.

b. Calculate the following ratios and values:

1. Current ratio

2. Working capital

3. Acid-test ratio

a. Prepare an income statement and a classified balance sheet for Maxon Sales.

b. Calculate the following ratios and values:

(Essay)

4.8/5  (32)

(32)

Common Canadian practice shows current assets as the first items listed on a classified balance sheet.

(True/False)

4.9/5  (39)

(39)

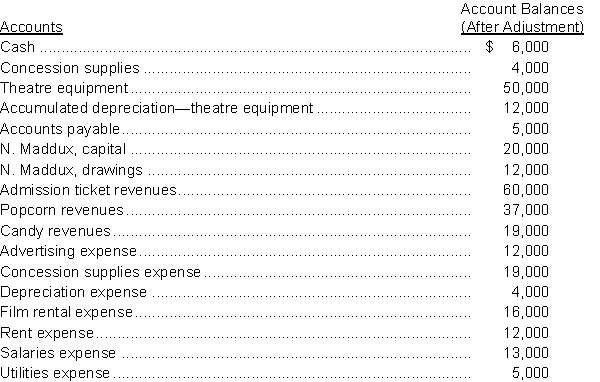

At March 31, 2014, account balances after adjustments for Maddux Cinema are as follows:  Instructions

a. Prepare the closing journal entries for Maddux Cinema.

b. Prepare a post-closing trial balance.

Instructions

a. Prepare the closing journal entries for Maddux Cinema.

b. Prepare a post-closing trial balance.

(Essay)

4.9/5  (41)

(41)

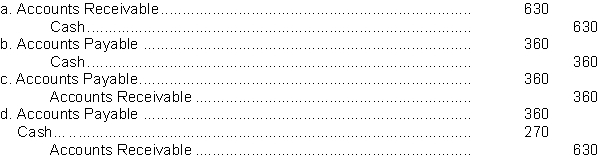

The Saint John River Company received $630 on account from a customer. The transaction was erroneously recorded as a debit to Cash of $360 and a credit to Accounts Payable, $360. The correcting entry is

(Short Answer)

4.9/5  (42)

(42)

If a work sheet is used, financial statements can be prepared before adjusting entries are journalized.

(True/False)

4.8/5  (36)

(36)

The balances that appear on the post-closing trial balance will match the

(Multiple Choice)

4.8/5  (35)

(35)

The acid-test ratio is a measure of a company's long term liquidity.

(True/False)

4.8/5  (37)

(37)

Jasmine Company received a $350 cheque from a customer for the balance due on an accounts receivable. The transaction was erroneously recorded as a debit to cash of $530 and a credit to service revenue of $530. The correcting entry is

(Multiple Choice)

4.9/5  (31)

(31)

The final step in the accounting cycle is the pre-closing trial balance.

(True/False)

4.9/5  (44)

(44)

The most important information needed to determine if companies can pay their current obligations is the

(Multiple Choice)

4.7/5  (34)

(34)

Transaction and adjustment data for Portiski Company for the year ended September 30 is as follows:

1. September 24 (initial salary entry): $12,000 of salaries earned between September 1 and September 24 are paid.

2. September 30 (adjusting entry): Salaries earned between September 25 and September 30 are $5,000. These will be paid in the October 8 payroll.

3. October 8 (subsequent salary entry): Total salary payroll amounting to $9,000 was paid.

Instructions

Prepare two sets of journal entries as specified below. The first set of journal entries should assume that the company does not use reversing entries, and the second set should assume that reversing entries are utilized by the company.

(Essay)

4.8/5  (41)

(41)

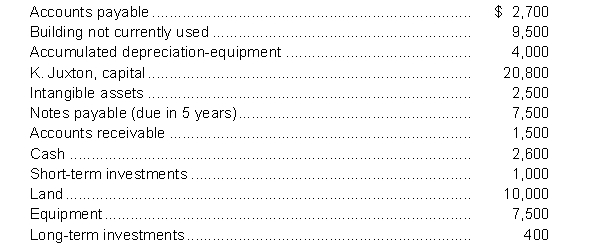

The following information is available for Juxton Company for the year ended December 31, 2013:  Instructions

Use the above information to prepare a classified balance sheet for the year ended December 31, 2013.

Instructions

Use the above information to prepare a classified balance sheet for the year ended December 31, 2013.

(Essay)

5.0/5  (31)

(31)

After closing entries have been journalized and posted, all temporary accounts in the ledger should have zero balances.

(True/False)

4.8/5  (39)

(39)

Current assets are normally listed in the balance sheet in order of permanency.

(True/False)

4.8/5  (43)

(43)

Showing 61 - 80 of 151

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)