Exam 4: Completion of the Accounting Cycle

Exam 1: Accounting in Action162 Questions

Exam 2: The Recording Process163 Questions

Exam 3: Adjusting the Accounts179 Questions

Exam 4: Completion of the Accounting Cycle151 Questions

Exam 5: Accounting for Merchandising Operations201 Questions

Exam 6: Inventory Costing176 Questions

Exam 7: Internal Control and Cash130 Questions

Exam 9: Long-Lived Assets243 Questions

Exam 10: Current Liabilities98 Questions

Exam 11: Accounting Principles116 Questions

Exam 12: Accounting for Partnerships153 Questions

Exam 13: Introduction to Corporations195 Questions

Exam 14: Corporations: Additional Topics and Ifrs136 Questions

Exam 15: Non-Current Liabilities139 Questions

Exam 16: The Cash Flow Statement158 Questions

Exam 17: Financial Statement Analysis155 Questions

Exam 18: Investments68 Questions

Select questions type

Which one of the following is an optional step in the accounting cycle of a business enterprise?

(Multiple Choice)

4.8/5  (42)

(42)

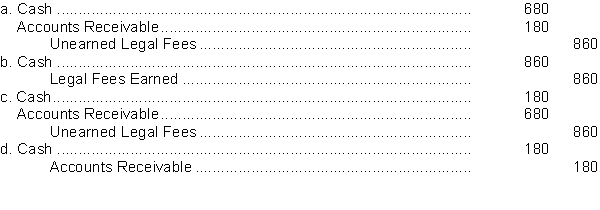

A lawyer collected $860 of legal fees in advance. He erroneously debited Cash for $680 and credited Accounts Receivable for $680. The correcting entry is

(Short Answer)

4.8/5  (34)

(34)

Which of the following would NOT be classified a non-current liability?

(Multiple Choice)

4.8/5  (31)

(31)

An examination of the accounts of Kenny Company for the month of June revealed the following errors after the transactions were journalized and posted:

1. A cheque for $750 from R. Chang, a customer on account, was debited to Cash $750 and credited to Service Revenue, $750.

2. A payment for Advertising Expense costing $520 was debited to Utilities Expense, $250 and credited to Cash $250.

3. A bill for $640 for Office Supplies purchased on account was debited to Office Equipment, $460 and credited to Accounts Payable $460.

4. A payment on account from a customer was credited to cash $450 and debited to Accounts Receivable.

5. A new computer purchased for $5,500 was recorded as a debit to Cash of $5,500 and a credit to Repairs and Maintenance Expense of $5,500.

Instructions

Prepare correcting entries for each of the above, assuming the erroneous entries are not reversed. Explain how the transaction as originally recorded affected profit for the month of June.

(Essay)

4.9/5  (25)

(25)

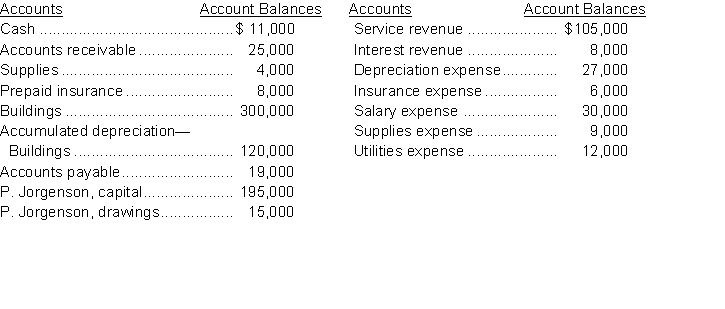

The adjusted account balances of Fitness Centre at July 31 are as follows:  Instructions

Prepare the end of the period closing entries for the Fitness Centre.

Instructions

Prepare the end of the period closing entries for the Fitness Centre.

(Essay)

4.8/5  (38)

(38)

The amounts appearing on an income statement should agree with the amounts appearing on the post-closing trial balance.

(True/False)

4.7/5  (26)

(26)

Although it may look unusual, when preparing a reversing entry you may create

(Multiple Choice)

4.8/5  (36)

(36)

An incorrect debit to Accounts Receivable instead of the correct account Notes Receivable does not require a correcting entry because total assets will not be misstated.

(True/False)

4.7/5  (42)

(42)

On August 1, Rothesay Boat Club provided services on account for $800. Rothesay received the entire balance on August 31 and recorded the payment by debiting Cash for $800 and crediting Service Revenue for $800. On the August 31 financial statements

(Multiple Choice)

4.8/5  (38)

(38)

The two optional steps in the accounting cycle are preparing

(Multiple Choice)

4.8/5  (26)

(26)

Which of the following will be affected by a reclassification of liabilities from current to non-current?

(Multiple Choice)

4.9/5  (33)

(33)

Both correcting entries and adjusting entries always affect at least one balance sheet account and one income statement account.

(True/False)

4.8/5  (35)

(35)

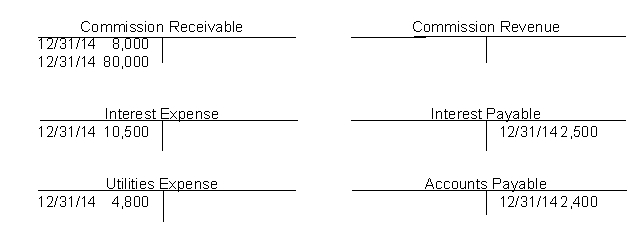

On December 31, 2014 selected accounts of the Brolin Personnel Agency, after all year end adjusting entries, show the following data:  Analysis indicates that adjusting entries were made for

1. $8,000 of commission revenue earned but not billed,

2. $2,500 of accrued but unpaid interest, and

3. $2,400 of utilities expense accrued but not paid.

Instructions

a. Prepare the closing entries at December 31, 2014.

b. Prepare the reversing entries on January 1, 2015.

c. Prepare the entries to record (1) the collection of the accrued commission on January 8, (2) payment of the utility bill on January 10, and (3) payment of all the interest due ($3,100) on January 15.

d. What is the interest expense for the month of January 2015?

Analysis indicates that adjusting entries were made for

1. $8,000 of commission revenue earned but not billed,

2. $2,500 of accrued but unpaid interest, and

3. $2,400 of utilities expense accrued but not paid.

Instructions

a. Prepare the closing entries at December 31, 2014.

b. Prepare the reversing entries on January 1, 2015.

c. Prepare the entries to record (1) the collection of the accrued commission on January 8, (2) payment of the utility bill on January 10, and (3) payment of all the interest due ($3,100) on January 15.

d. What is the interest expense for the month of January 2015?

(Essay)

4.7/5  (37)

(37)

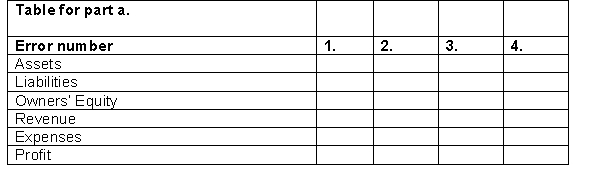

The new accountant for Wilson's Giftware was in a hurry to record the transactions for the month of March, and made the following errors:

1. February utilities of $560 had been recorded as an Account Payable in February. When the account was paid in March, the accountant recorded the payment as a debit to Utilities Expense and a credit to Cash.

2. March 15th salaries totalling $4,750 were recorded as a debit to Supplies instead of to Salaries Expense.

3. A customer payment in the amount of $1,200 was credited to Accounts Receivable. However the sale had never been invoiced or recorded and was a cash sale.

4. Samra Wilson withdrew $800 for personal use. The accountant recorded the entry as a debit to Cash and a credit to S. Wilson, Drawings.

Instructions:

a. For each of the four errors, indicate the effect of the error on the balance sheet and income statement, indicating whether the assets, liabilities, owner's equity, revenue, expenses, and Profit are overstated (O), understated (U), or not affected (NA). Use the table below for your answer.

b. For each of the four errors, prepare the correcting entries required at March 31.

(Essay)

4.8/5  (35)

(35)

When constructing a work sheet, accounts are often needed that are not listed in the trial balance already entered on the work sheet from the ledger. Where should these additional accounts be shown on the work sheet?

(Multiple Choice)

4.8/5  (29)

(29)

Queenstown Marina noticed an error in their financial statements after the financial statements had been submitted to their bank. The company is applying for a new loan to install a new wharf. The controller of Queenstown should

(Multiple Choice)

4.8/5  (32)

(32)

A reversing entry is made at the beginning of the next accounting period and is the exact opposite of the adjusting entry that was made in the previous period.

(True/False)

4.9/5  (41)

(41)

Showing 121 - 140 of 151

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)