Exam 18: Investments

Exam 1: Accounting in Action162 Questions

Exam 2: The Recording Process163 Questions

Exam 3: Adjusting the Accounts179 Questions

Exam 4: Completion of the Accounting Cycle151 Questions

Exam 5: Accounting for Merchandising Operations201 Questions

Exam 6: Inventory Costing176 Questions

Exam 7: Internal Control and Cash130 Questions

Exam 9: Long-Lived Assets243 Questions

Exam 10: Current Liabilities98 Questions

Exam 11: Accounting Principles116 Questions

Exam 12: Accounting for Partnerships153 Questions

Exam 13: Introduction to Corporations195 Questions

Exam 14: Corporations: Additional Topics and Ifrs136 Questions

Exam 15: Non-Current Liabilities139 Questions

Exam 16: The Cash Flow Statement158 Questions

Exam 17: Financial Statement Analysis155 Questions

Exam 18: Investments68 Questions

Select questions type

Under IFRS, trading investments are valued at amortized cost on the balance sheet.

(True/False)

4.7/5  (27)

(27)

For each item listed below determine if it is a non-strategic investment or a strategic investment.

Correct Answer:

Premises:

Responses:

(Matching)

4.9/5  (38)

(38)

All of the following are considered debt instruments EXCEPT

(Multiple Choice)

4.8/5  (45)

(45)

Losses and gains on the sale of instruments are reported on

(Multiple Choice)

4.9/5  (32)

(32)

A short-term debt instrument which is held to earn interest will be valued at fair value on the balance sheet.

(True/False)

4.8/5  (32)

(32)

Regardless of the bonds purchase price, their amortized cost at maturity will equal

(Multiple Choice)

5.0/5  (37)

(37)

On January 1, 2014, Connors Landscaping Ltd. purchased at face value, a $1,000, 5%, bond that pays interest on January 1 and July 1. Connors has a calendar year end.

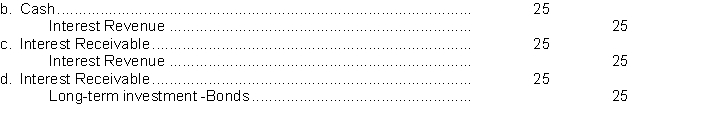

-The adjusting entry on December 31, 2014, is

A) not required.

(Short Answer)

4.9/5  (44)

(44)

When investing excess cash for short periods of time, corporations usually invest in shares of other companies.

(True/False)

4.8/5  (38)

(38)

The purchaser of the bonds, or the bondholder, is known as the investor.

(True/False)

4.9/5  (34)

(34)

Which of the following statements is INCORRECT with regards to non-strategic instruments?

(Multiple Choice)

4.8/5  (37)

(37)

Trading investments in equity instruments are reported on the balance sheet at

(Multiple Choice)

4.8/5  (43)

(43)

If an investment is valued at an amount that is most relevant to the type of investment, it will allow investors to better predict future cash flows of the company.

(True/False)

4.9/5  (40)

(40)

Nickel District Company purchased the following instruments during the year. Assume the company's fiscal year end is January 31, 2015.

Dec 1 2014 Purchased a $5,000 120 day treasury bill for $4,935. The treasury bills are trading at a market rate of interest of 4% annually.

Feb 1, 2015 Purchased at 101 a $15,000, 5% 5 year Laurentian Bond. Interest is paid semi-annually. The market rate of interest was 3.5%. The bonds were purchased to trade.

Mar 30, 2015 Treasury bill matured.

Aug 1, 2015 Received interest on the Laurentian Bond.

Aug 2, 2015 Sold the Laurentian Bonds at 99.

Instructions

Record the above transactions and any necessary adjusting entries for Nickel District required at January 31, 2015.

(Essay)

4.9/5  (34)

(34)

If the cost of a trading investment exceeds its fair value by $40,000, the entry to recognize the loss

(Multiple Choice)

4.9/5  (48)

(48)

The purpose of a strategic investment is to generate investment income.

(True/False)

4.9/5  (39)

(39)

Dividend revenue is reported under revenues from operations on the Income statement.

(True/False)

4.8/5  (37)

(37)

Short-term debt instruments that are held to earn interest income are recorded as

(Multiple Choice)

4.9/5  (30)

(30)

When a debt instrument is reported at amortized cost, the interest expense is calculated by multiplying the market rate of interest by the carrying value of the investment.

(True/False)

4.8/5  (34)

(34)

On January 5, 2013, Barker Limited purchased the following securities as trading investments:

300 McRae Corporation common shares for $4,200

500 Gupta Corporation common shares for $10,000

600 May Corporation common shares for $19,800

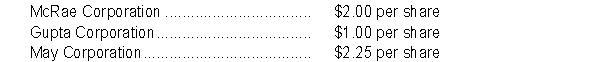

On June 30, 2013, Barker received the following cash dividends:  On November 15, 2013, Barker sold 100 May Corporation common shares for $4,000.

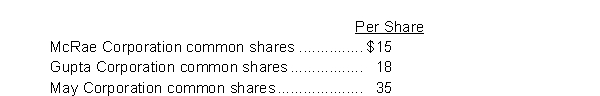

On December 31, 2013, the market value of the securities held by Barker is as follows:

On November 15, 2013, Barker sold 100 May Corporation common shares for $4,000.

On December 31, 2013, the market value of the securities held by Barker is as follows:  Instructions

Prepare the appropriate journal entries that Barker Limited should make on the following dates: January 5, 2013; June 30, 2013; November 15, 2013; and December 31, 2013.

Instructions

Prepare the appropriate journal entries that Barker Limited should make on the following dates: January 5, 2013; June 30, 2013; November 15, 2013; and December 31, 2013.

(Essay)

4.8/5  (31)

(31)

If there is a bond premium, interest revenue is increased by the amortization amount.

(True/False)

4.8/5  (34)

(34)

Showing 41 - 60 of 68

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)