Exam 16: Decision Analysis

Exam 1: Introduction to Labour Market Economics62 Questions

Exam 2: Database Analytics30 Questions

Exam 3: Data Visualization30 Questions

Exam 4: Descriptive Statistics109 Questions

Exam 5: Probability Distributions and Data Modeling33 Questions

Exam 6: Sampling and Estimation55 Questions

Exam 7: Statistical Inference46 Questions

Exam 8: Trendlines and Regression Analysis58 Questions

Exam 9: Forecasting Techniques47 Questions

Exam 10: Introduction to Data Mining43 Questions

Exam 11: Spreadsheet Modeling and Analysis60 Questions

Exam 12: Simulation and Risk Analysis29 Questions

Exam 13: Linear Optimization62 Questions

Exam 14: Integer and Nonlinear Optimization Models93 Questions

Exam 15: Optimization Analytics48 Questions

Exam 16: Decision Analysis49 Questions

Select questions type

Use the information below to answer the following questions)

Misty Inc. launches a new range of perfumes for men and women. The probability of high consumer demand for the product is 0.6 and low consumer demand is 0.4. The probability of a favorable survey response given high consumer demand is 0.9 and the probability of a favorable survey response given low consumer demand is 0.2.

-Greg is indifferent between receiving $2,000, and taking a chance at $2,500 with probability 0.7 and losing $1200 with probability 0.5. What is the expected value of this gamble?

Free

(Multiple Choice)

4.8/5  (41)

(41)

Correct Answer:

A

Use the information given below to answer the following questions). Below is a payoff table that lists three mortgage options: Outcome Decision Rates Rise Rates Stable Rates Fall 2-year ARM \ 66,645 \ 43,650 \ 38,560 5-year ARM \ 62,857 \ 47,698 \ 42,726 25-year fixed \ 52,276 \ 52,276 \ 52,276

-What is the maximum opportunity loss incurred for the 2-year ARM?

Free

(Multiple Choice)

4.9/5  (39)

(39)

Correct Answer:

C

Use the information below to answer the following questions)

Misty Inc. launches a new range of perfumes for men and women. The probability of high consumer demand for the product is 0.6 and low consumer demand is 0.4. The probability of a favorable survey response given high consumer demand is 0.9 and the probability of a favorable survey response given low consumer demand is 0.2.

-What is the likelihood for high demand knowing that the market report is favorable?

Free

(Multiple Choice)

4.8/5  (46)

(46)

Correct Answer:

C

Use the information below to answer the following questions). Below is a payoff table that lists four mortgage options: Outcome Decision Rates Rise Rates Stable Rates Fall 1-year ARM \ 66,645 \ 43,650 \ 38,560 3-year ARM \ 62,857 \ 47,698 \ 42,726 5-year ARM \ 55,895 \ 50,894 \ 48,134 30-year fiXed \ 52,276 \ 52,276 \ 52,276

-An) is also called a minimax regret strategy.

(Multiple Choice)

4.8/5  (38)

(38)

Answer the following questions by creating a decision tree.

-Which of the following is considered the worst expected value decision?

(Multiple Choice)

4.7/5  (29)

(29)

Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. ![Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. -What is the value of mean obtained from the simulation results? [Hint: Choose the approximate value.]](https://storage.examlex.com/TB7093/11eb1da5_c3a5_951e_be73_bb4e77d4f34a_TB7093_00.jpg) Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of

$200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of -

$550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1.

Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of

$200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of -

$550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. ![Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. -What is the value of mean obtained from the simulation results? [Hint: Choose the approximate value.]](https://storage.examlex.com/TB7093/11eb1da5_c3a5_951f_be73_e366b7761335_TB7093_00.jpg) -What is the value of mean obtained from the simulation results? [Hint: Choose the approximate value.]

-What is the value of mean obtained from the simulation results? [Hint: Choose the approximate value.]

(Multiple Choice)

4.8/5  (31)

(31)

Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. ![Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. -What is the mean absolute deviation obtained from the simulation results? [Hint: Choose the approximate value.]](https://storage.examlex.com/TB7093/11eb1da5_c3a5_951e_be73_bb4e77d4f34a_TB7093_00.jpg) Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of

$200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of -

$550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1.

Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of

$200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of -

$550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. ![Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. -What is the mean absolute deviation obtained from the simulation results? [Hint: Choose the approximate value.]](https://storage.examlex.com/TB7093/11eb1da5_c3a5_951f_be73_e366b7761335_TB7093_00.jpg) -What is the mean absolute deviation obtained from the simulation results? [Hint: Choose the approximate value.]

-What is the mean absolute deviation obtained from the simulation results? [Hint: Choose the approximate value.]

(Multiple Choice)

4.7/5  (46)

(46)

Use the information below to answer the following questions). Below are four options for an investment decision. Decision/event Rates Rise Rates Stable Rates Fall Bank CD 0.80 0.80 Bond fund -0.75 0.86 1.50 Index fund 0.00 0.90 1.20 Growth fund -0.30 0.70 1.40

-Based on the average utility, which of the following is considered the best decision?

(Multiple Choice)

4.8/5  (32)

(32)

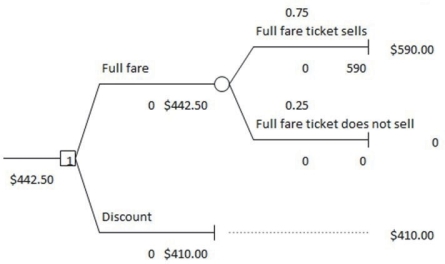

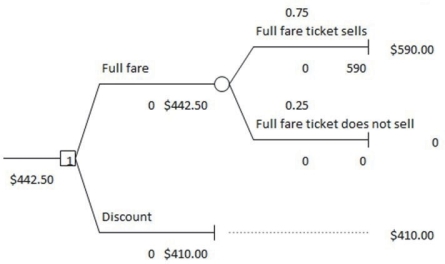

Use the information below to answer the following questions). Below is a decision tree for the airline revenue management.  Create a one-way table and answer the following questions.

-The expected value of perfect information EVPI) is equal to the .

Create a one-way table and answer the following questions.

-The expected value of perfect information EVPI) is equal to the .

(Multiple Choice)

4.9/5  (37)

(37)

If the payoff is $2200 and R is equal to $500, what is the utility function?

(Multiple Choice)

4.9/5  (43)

(43)

Which of the following formulas is used to determine the exponential utility function?

(Multiple Choice)

4.8/5  (38)

(38)

Use the information below to answer the following questions). Below is a decision tree for the airline revenue management.  Create a one-way table and answer the following questions.

-If the probability of selling the full-fare ticket is 0.80, what is the expected value of the ticket?

Create a one-way table and answer the following questions.

-If the probability of selling the full-fare ticket is 0.80, what is the expected value of the ticket?

(Multiple Choice)

4.8/5  (31)

(31)

In a minimin strategy, the decision which minimizes the minimum payoff is chosen.

(True/False)

5.0/5  (44)

(44)

Use the below information to answer the following questions). Below is a payoff table with three mortgage options: Outcame Probability 0.6 0.3 0.1 Decision Rates Rise Rates Stable Rates Fall 1-year ARM \ 66,645 \ 43,650 \ 38,560 3-year ARM \ 62,857 \ 47,698 \ 42,726 30-year fixed \ 52,276 \ 52,276 \ 52,276

-The expected value of sample information EVSI) is equal to the .

(Multiple Choice)

4.7/5  (42)

(42)

A payoff table is a matrix whose rows correspond to events and whose columns correspond to decisions.

(True/False)

4.8/5  (40)

(40)

Use the below information to answer the following questions). Below is a payoff table with three mortgage options: Outcame Probability 0.6 0.3 0.1 Decision Rates Rise Rates Stable Rates Fall 1-year ARM \ 66,645 \ 43,650 \ 38,560 3-year ARM \ 62,857 \ 47,698 \ 42,726 30-year fixed \ 52,276 \ 52,276 \ 52,276

-What is the expected opportunity loss for the 1-year ARM?

(Multiple Choice)

4.8/5  (45)

(45)

Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. ![Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. -What is the coefficiIIt of variation obtained from the simulation results? [Hint: Choose the approximate value.]](https://storage.examlex.com/TB7093/11eb1da5_c3a5_951e_be73_bb4e77d4f34a_TB7093_00.jpg) Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of

$200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of -

$550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1.

Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of

$200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of -

$550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. ![Use the information below to answer the following questions). Below is a decision tree illustrating the R&D process for a new drug. Let us assume that if market is large, payoff is lognormally distributed with a mean of $4,900 million and a standard deviation of $1,000 million; if market is medium, payoff is lognormally distributed with a mean of $2,500 million and a standard deviation of $500 million; and if market is small, payoff is normally distributed with a mean of $1,800 million and standard deviation of $200 million. Let us also assume that the cost of clinical trials is uncertain and estimates are modeled with a triangular distribution with a minimum of -$700 million, a most likely value of - $550 million, and a maximum of -$500 million. Use 10,000 trials and a random seed of 1. -What is the coefficiIIt of variation obtained from the simulation results? [Hint: Choose the approximate value.]](https://storage.examlex.com/TB7093/11eb1da5_c3a5_951f_be73_e366b7761335_TB7093_00.jpg) -What is the coefficiIIt of variation obtained from the simulation results? [Hint: Choose the approximate value.]

-What is the coefficiIIt of variation obtained from the simulation results? [Hint: Choose the approximate value.]

(Multiple Choice)

5.0/5  (40)

(40)

Use the information below to answer the following questions). Below are four options for an investment decision. Decision/event Rates Rise Rates Stable Rates Fall Bank CD 0.80 0.80 Bond fund -0.75 0.86 1.50 Index fund 0.00 0.90 1.20 Growth fund -0.30 0.70 1.40

-Based on the average utility, which of the following is considered the worst decision?

(Multiple Choice)

4.9/5  (37)

(37)

Use the information given below to answer the following questions). Below is a payoff table that lists three mortgage options: Outcome Decision Rates Rise Rates Stable Rates Fall 2-year ARM \ 66,645 \ 43,650 \ 38,560 5-year ARM \ 62,857 \ 47,698 \ 42,726 25-year fixed \ 52,276 \ 52,276 \ 52,276

-What is the maximum opportunity loss incurred for the 5-year ARM?

(Multiple Choice)

4.9/5  (43)

(43)

Use the information given below to answer the following questions). Below is a payoff table that lists three mortgage options: Outcome Decision Rates Rise Rates Stable Rates Fall 2-year ARM \ 66,645 \ 43,650 \ 38,560 5-year ARM \ 62,857 \ 47,698 \ 42,726 25-year fixed \ 52,276 \ 52,276 \ 52,276

-What is the maximum opportunity loss incurred for the 25-year fixed decision?

(Multiple Choice)

4.9/5  (36)

(36)

Showing 1 - 20 of 49

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)