Exam 13: Comparative Forms of Doing Business

Exam 1: Understanding and Working With the Federal Tax Law92 Questions

Exam 2: The Deduction for Qualified Business Income for Pass-Through Entities65 Questions

Exam 3: Corporations: Introduction and Operating Rules105 Questions

Exam 4: Corporations: Organization and Capital Structure108 Questions

Exam 5: Corporations: Earnings and Profits and Dividend Distributions129 Questions

Exam 6: Corporations: Redemptions and Liquidations117 Questions

Exam 7: Corporations: Reorganizations139 Questions

Exam 8: Consolidated Tax Returns154 Questions

Exam 9: Taxation of International Transactions128 Questions

Exam 10: Partnerships: Formation, Operations, and Basis163 Questions

Exam 11: Partnerships: Distributions, Transfer of Interests, and Terminations164 Questions

Exam 12: S Corporations121 Questions

Exam 13: Comparative Forms of Doing Business113 Questions

Exam 14: Taxes on the Financial Statements71 Questions

Exam 15: Exempt Entities129 Questions

Exam 16: Multistate Corporate Taxation184 Questions

Exam 17: Tax Practice and Ethics174 Questions

Exam 18: The Federal Gift and Estate Taxes145 Questions

Exam 19: Family Tax Planning118 Questions

Exam 20: Income Taxation of Trusts and Estates166 Questions

Select questions type

Both Albert and Elva own 50% of the stock of Eagle, Inc. a C corporation). To cover what is perceived as temporary working capital needs, each shareholder loans Eagle $200,000 with an annual interest rate of 3% same as the Federal rate) and a maturity date of one year. The loan is made at the beginning of 2019.

a. What are the tax consequences to Albert, Elva, and Eagle if the loans are classified as debt?

b. What are the tax consequences to Albert, Elva, and Eagle if the loans are classified as equity?

(Essay)

4.8/5  (48)

(48)

Candace, who is in the 32% tax bracket, is establishing a business that could have potential environmental liability problems. Therefore, she is trying to decide between the C corporation form and the S corporation form. She projects that the business will generate earnings of about $75,000 each year. Advise Candace on the tax consequences of each entity form.

(Essay)

4.9/5  (33)

(33)

The Net Investment Income Tax NIIT) is owed by both high income individuals and corporations.

(True/False)

4.8/5  (37)

(37)

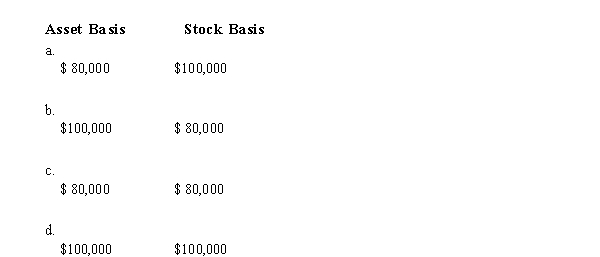

Chen contributes property with an adjusted basis of $80,000 and a fair market value of $100,000 to a newly formed business entity. If the entity is a C corporation and the transaction qualifies under § 351, the corporation's basis for the property and the shareholder's basis for the stock are:

(Short Answer)

4.8/5  (26)

(26)

Techniques that can be used to minimize the current period tax liability include:

(Multiple Choice)

4.7/5  (29)

(29)

List some techniques for reducing and/or avoiding double taxation by transferring funds to the shareholders that are deductible to the corporation.

(Essay)

4.7/5  (43)

(43)

Alice contributes equipment fair market value of $82,000; adjusted basis of $20,000), subject to a $14,000 liability, to form Orange Partnership, a general partnership. Mary contributes $68,000 cash. Alice and Mary share equally in partnership profits and losses. What is Alice's and Mary's basis for their partnership interests?

(Multiple Choice)

4.8/5  (41)

(41)

Techniques that may permit a C corporation to avoid double taxation are available.

(True/False)

4.8/5  (35)

(35)

Transferring funds that are deductible by the C corporation to shareholders can reduce or eliminate double taxation.

(True/False)

4.8/5  (40)

(40)

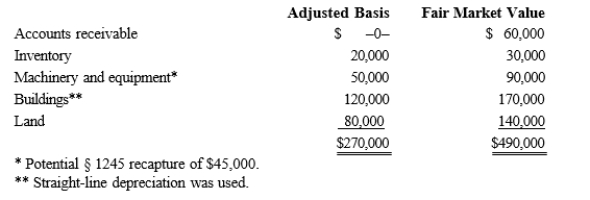

Kristine owns all of the stock of a C corporation which owns the following assets.  Her adjusted basis for her stock is $270,000. Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Her adjusted basis for her stock is $270,000. Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

(Multiple Choice)

4.8/5  (33)

(33)

List some techniques that can be used to avoid and/or reduce double taxation for a C corporation.

(Essay)

4.7/5  (40)

(40)

Blue, Inc., records taxable income before salary payments of $700,000 to its president who has a marginal rate of

32%.

a. Calculate the tax liability to Blue if the president's salary is $400,000 and if it is $100,000.

b. What tax benefit is there of paying the higher salary to the president?

c. What negative tax result may occur associated with the payment of the higher salary?

(Essay)

4.7/5  (38)

(38)

Ralph wants to purchase either the stock or the assets of Red, Inc., a C corporation. Under what circumstances would Ralph prefer to purchase:

a. The stock from the shareholders?

b. The assets from the corporation?

(Essay)

4.9/5  (43)

(43)

Ashley holds a 65% interest in a business entity. Her basis for ownership interest is $300,000. The net income of the business for the tax year is $100,000 and the entity liabilities have increased by $60,000. Determine the effect of the earnings and the liabilities on Ashley's basis for her ownership interest if the business is:

a. A C corporation.

b. An S corporation.

c. A partnership.

(Essay)

4.8/5  (33)

(33)

Lee owns all the stock of Vireo, Inc., a C corporation for which he has an adjusted basis of $150,000. The assets of

Vireo are recorded as follows. Adjusted Basis FMV Cash \ 35,000 \ 35,000 Accounts receivable 20,000 20,000 Inventory 22,000 25,000 Building 28,000 30,000 Land 40,000 90,000 Lee sells his stock to Katrina for $300,000. Determine the tax consequences to:

a. Lee.

b. Katrina.

c. Vireo

(Essay)

4.8/5  (37)

(37)

Match the following statements.

-Sale of corporate stock by the C corporation shareholders.

(Multiple Choice)

4.9/5  (41)

(41)

John wants to buy a business whose assets have appreciated in value. If the business is operated as a C corporation, it does not matter to John whether he purchases the assets or the stock.

(True/False)

4.8/5  (31)

(31)

Kirk is establishing a business in year 1 that could have potential environmental liability problems. Therefore, he is trying to decide between the C corporation form and the S corporation form. He projects that the business will generate losses of approximately $100,000 each year for the first three years and then will generate profits of at least $200,000 each year thereafter. All profits will be reinvested in the growth of the business. Kirk projects he will be in the 35% bracket for all tax years. Advise Kirk on which tax form he should select.

(Essay)

4.8/5  (40)

(40)

Showing 21 - 40 of 113

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)