Exam 10: Reporting and Analyzing Liabilities

Exam 1: The Purpose and Use of Financial Statements90 Questions

Exam 2: A Further Look at Financial Statements130 Questions

Exam 3: The Accounting Information System96 Questions

Exam 4: Accrual Accounting Concepts87 Questions

Exam 5: Merchandising Operations93 Questions

Exam 6: Reporting and Analyzing Inventory98 Questions

Exam 7: Internal Control and Cash95 Questions

Exam 8: Reporting and Analyzing Receivables70 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets139 Questions

Exam 10: Reporting and Analyzing Liabilities98 Questions

Exam 12: Reporting and Analyzing Investments130 Questions

Exam 13: Statement of Cash Flows75 Questions

Exam 14: Performance Measurement66 Questions

Select questions type

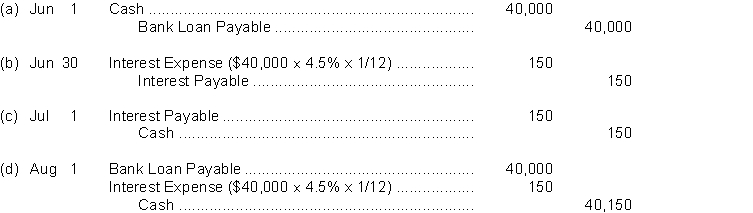

On June 1, Babar Corporation borrows $40,000 from the bank by signing a 2-month, 4.5%, bank loan. Interest is due at the beginning of each month, commencing July 1.InstructionsPrepare the entries listed associated with the bank loan on the books of Babar Corporation.

a. Prepare the entry on June 1 when the loan was received.

b. Prepare any adjusting entries necessary on June 30 in order to prepare the monthly financial statements. Assume no other interest accrual entries have been made.

c. Prepare the entry to record the payment of the interest on July 1.

d. Prepare the entry to record repayment of the loan at maturity on August 1.

Free

(Essay)

4.9/5  (36)

(36)

Correct Answer:

The face value of a bond is the amount of principal and interest due at the maturity date.

Free

(True/False)

4.8/5  (46)

(46)

Correct Answer:

False

On March 2, Conroy and Conrad Inc. obtained a loan for $120,000 for 5 years at 7%. Payments are $2,000. What type of loan is this considered to be?

(Multiple Choice)

4.9/5  (30)

(30)

All transactions between bondholders and other investors must be recorded by the issuing corporation.

(True/False)

4.8/5  (31)

(31)

Harmonized Sales Tax (HST) collected by a retailer are expenses

(Multiple Choice)

4.9/5  (34)

(34)

Interest rates on notes and loans are usually stated as a(n)

(Multiple Choice)

4.9/5  (37)

(37)

McMichael Exhibits Inc. received its annual property tax bill for $26,200 in January. It was paid when due on March 31. McMichael Exhibits year end is Dec 31. The Dec 31 balances should be

(Multiple Choice)

4.8/5  (42)

(42)

$8 million, 6%, 10-year bonds are issued at less than face value. Interest will be paid semi-annually. When calculating the market price of the bond, the present value of

(Multiple Choice)

4.9/5  (32)

(32)

The effective-interest method is required for companies reporting under IFRS, but optional for companies using ASPE if other methods do not result in material differences.

(True/False)

4.8/5  (35)

(35)

A five-year, 4%, $80,000 note payable is issued on January 1. Terms include fixed annual principal payments of $16,000, plus interest on the outstanding balance. The entry to record the first instalment payment will include a

(Multiple Choice)

4.7/5  (39)

(39)

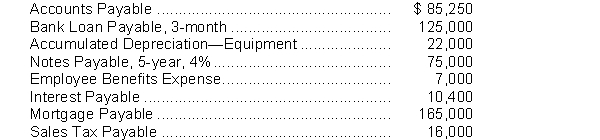

National Supplies Corporation has the following selected accounts at December 31, 2018 after posting adjusting entries:  Instructions

a. Prepare the current liability section of National Supplies' statement of financial position, assuming $24,000 of the mortgage is payable next year.

b. Comment on National Supplies' liquidity, assuming total current assets are $225,000.

Instructions

a. Prepare the current liability section of National Supplies' statement of financial position, assuming $24,000 of the mortgage is payable next year.

b. Comment on National Supplies' liquidity, assuming total current assets are $225,000.

(Essay)

4.8/5  (42)

(42)

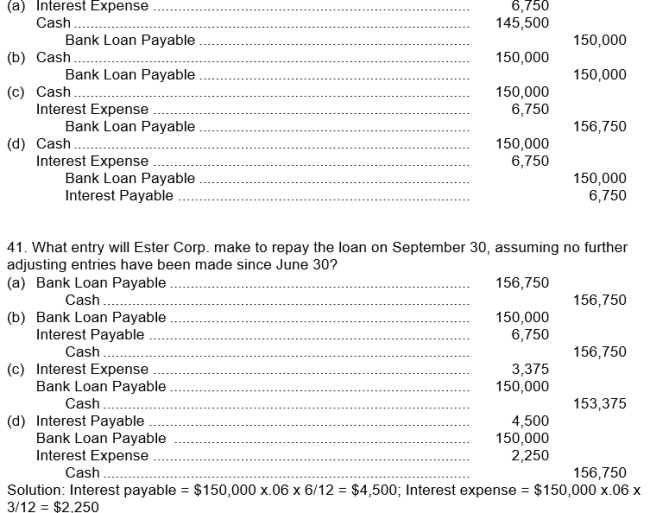

Use the following information for questions.

On January 1 of this year, Gertoni Lenders agrees to lend Ester Corp. $150,000. Ester Corp. signs a $150,000, 6%, 9-month loan. Interest is due at maturity.

-The entry made by Ester Corp. on January 1 to record the receipt of the loan is

(Short Answer)

4.7/5  (42)

(42)

Use the following information for questions.

On October 1, 2018, Mekhi's Golf Service Limited borrows $80,000 from Rigor Bank by signing a 3-month, $80,000, 4% bank loan. Interest is due the first of each month.

-What adjusting entry is required at December 31, 2018?

(Multiple Choice)

4.8/5  (39)

(39)

The classification of a liability as current or non-current is important because it may affect the evaluation of a company's liquidity.

(True/False)

4.9/5  (36)

(36)

Provisions are liabilities of uncertain timing or amount, along with some uncertainty as to whether the liability will have to be paid.

(True/False)

4.9/5  (28)

(28)

Showing 1 - 20 of 98

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)