Exam 8: Reporting and Analyzing Receivables

Exam 1: The Purpose and Use of Financial Statements90 Questions

Exam 2: A Further Look at Financial Statements130 Questions

Exam 3: The Accounting Information System96 Questions

Exam 4: Accrual Accounting Concepts87 Questions

Exam 5: Merchandising Operations93 Questions

Exam 6: Reporting and Analyzing Inventory98 Questions

Exam 7: Internal Control and Cash95 Questions

Exam 8: Reporting and Analyzing Receivables70 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets139 Questions

Exam 10: Reporting and Analyzing Liabilities98 Questions

Exam 12: Reporting and Analyzing Investments130 Questions

Exam 13: Statement of Cash Flows75 Questions

Exam 14: Performance Measurement66 Questions

Select questions type

Calculate the maturity value associated with each of the following notes receivable, assuming interest is due at maturity. (Round your answers to the nearest cent.)

a. A $10,000, 7%, 3-month note dated April 20.

b. A $5,000, 5.5%, 4-month note dated March 5.

c. An $8,000, 3%, 1-month note dated September 10.

Free

(Essay)

5.0/5  (30)

(30)

Correct Answer:

(a) Maturity value: $10,175 $10,000 + ($10,000 * 7% * 3/12) = $10,000 + $175 = $10,175.00 (b) Maturity value: $5,091.67 $5,000 + ($5,000 * 5.5% * 4/12) = $5,000 + $91.67 = $5,091.67 (c) Maturity value: $8,020 $8,000 + ($8,000 *3% * 1/12) = $8,000 + $20 = $8,020.00

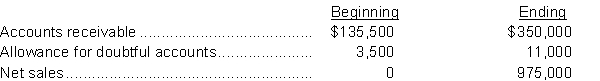

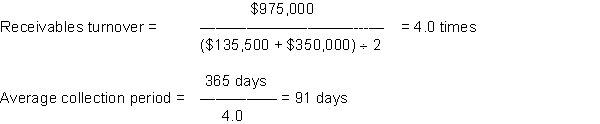

The following data are presented for Ratalan Ltd. for 2018:  InstructionsCalculate the receivables turnover and the average collection period for accounts receivable in days.

InstructionsCalculate the receivables turnover and the average collection period for accounts receivable in days.

Free

(Essay)

4.7/5  (45)

(45)

Correct Answer:

Which of the following statements is false?

Free

(Multiple Choice)

4.8/5  (41)

(41)

Correct Answer:

B

When an account becomes uncollectible and must be written off

(Multiple Choice)

4.7/5  (41)

(41)

Under the allowance method for uncollectible accounts, Bad Debts Expense is recorded

(Multiple Choice)

4.7/5  (31)

(31)

The receivable that is usually evidenced by a formal instrument of credit is a(n)

(Multiple Choice)

4.9/5  (38)

(38)

Other receivables include nontrade receivables such as loans to company officers.

(True/False)

4.9/5  (26)

(26)

The Allowance for Doubtful Accounts is a liability account and has a normal credit balance.

(True/False)

4.7/5  (29)

(29)

Uncollectible accounts must be estimated because it is not possible to know which accounts will not be collected.

(True/False)

5.0/5  (46)

(46)

Under the allowance method for uncollectible accounts, writing off an uncollectible account

(Multiple Choice)

4.9/5  (42)

(42)

The net amount expected to be received in cash from receivables is termed the

(Multiple Choice)

4.8/5  (35)

(35)

To find the balance due from an individual customer, the accountant would refer to the

(Multiple Choice)

4.8/5  (29)

(29)

An aging of accounts receivable schedule is based on the premise that the longer the period an account remains unpaid, the greater the probability that it will eventually be collected.

(True/False)

4.7/5  (37)

(37)

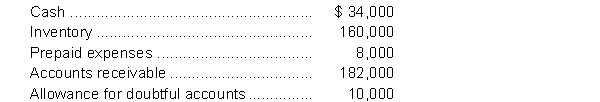

The general ledger of Grangehill Corporation at December 31, 2018 shows the following balances, all of which are normal:  Management estimates the carrying amount of accounts receivable should be $158,000.Instructions

a. Prepare the adjusting entry for bad debts for 2018.

b. Show how the current assets would be presented on the statement of financial position at December 31, 2018.

Management estimates the carrying amount of accounts receivable should be $158,000.Instructions

a. Prepare the adjusting entry for bad debts for 2018.

b. Show how the current assets would be presented on the statement of financial position at December 31, 2018.

(Essay)

4.9/5  (41)

(41)

The collection of an account that had been previously written off under the allowance method for uncollectible accounts

(Multiple Choice)

4.9/5  (38)

(38)

Showing 1 - 20 of 70

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)