Exam 6: Reporting and Analyzing Inventory

Exam 1: Introduction to Financial Statements218 Questions

Exam 2: A Further Look at Financial Statements238 Questions

Exam 3: The Accounting Information System275 Questions

Exam 4: Accrual Accounting Concepts310 Questions

Exam 5: Merchandising Operations and the Multiple-Step Income Statement261 Questions

Exam 6: Reporting and Analyzing Inventory250 Questions

Exam 7: Fraud, Internal Control, and Cash245 Questions

Exam 8: Reporting and Analyzing Receivables262 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets276 Questions

Exam 10: Reporting and Analyzing Liabilities294 Questions

Exam 11: Reporting and Analyzing Stockholders Equity263 Questions

Exam 12: Statement of Cash Flows216 Questions

Exam 13: Financial Analysis: The Big Picture271 Questions

Exam 14: Time Value of Money295 Questions

Select questions type

The following information is available for Wallace Company for 2014. Wallace uses the LIFO inventory method.  Instructions

(a) Calculate the inventory turnover and days in inventory for Wallace Company based on LIFO.

(b) Calculate the inventory turnover and days in inventory after adjusting for the LIFO reserve.

Instructions

(a) Calculate the inventory turnover and days in inventory for Wallace Company based on LIFO.

(b) Calculate the inventory turnover and days in inventory after adjusting for the LIFO reserve.

(Essay)

4.9/5  (38)

(38)

Johnson Company has a high inventory turnover that has increased over the last year. All of the following statements are true regarding this situation except Johnson County:

(Multiple Choice)

4.9/5  (48)

(48)

When a perpetual inventory system is used, which of the following is a purpose of taking a physical inventory?

(Multiple Choice)

4.8/5  (40)

(40)

Given equal circumstances, which inventory method would probably be the most time consuming?

(Multiple Choice)

4.9/5  (32)

(32)

The following information was available for Bowyer Company at December 31, 2014: beginning inventory $90,000; ending inventory $70,000; cost of goods sold $880,000; and sales $1,200,000. Bowyer's inventory turnover in 2014 was

(Multiple Choice)

4.7/5  (34)

(34)

A company just starting in business purchased three merchandise inventory items at the following prices. First purchase $80; Second purchase $95; Third purchase $85. If the company sold two units for a total of $290 and used FIFO costing, the gross profit for the period would be

(Multiple Choice)

4.8/5  (43)

(43)

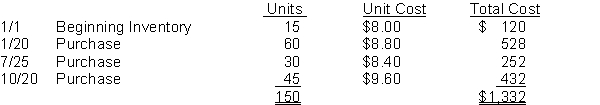

Faster Company uses the periodic inventory method and had the following inventory information available:  A physical count of inventory on December 31 revealed that there were 55 units on hand.

Instructions

Answer the following independent questions and show computations supporting your answers.

1. Assume that the company uses the FIFO method. The value of the ending inventory at December 31 is $__________.

2. Assume that the company uses the Average Cost method. The value of the ending inventory on December 31 is $__________.

3. Assume that the company uses the LIFO method. The value of the ending inventory on December 31 is $__________.

4. Assume that the company uses the FIFO method. The value of the cost of goods sold at December 31 is $__________.

A physical count of inventory on December 31 revealed that there were 55 units on hand.

Instructions

Answer the following independent questions and show computations supporting your answers.

1. Assume that the company uses the FIFO method. The value of the ending inventory at December 31 is $__________.

2. Assume that the company uses the Average Cost method. The value of the ending inventory on December 31 is $__________.

3. Assume that the company uses the LIFO method. The value of the ending inventory on December 31 is $__________.

4. Assume that the company uses the FIFO method. The value of the cost of goods sold at December 31 is $__________.

(Short Answer)

4.8/5  (35)

(35)

A company may use more than one inventory cost flow method at the same time.

(True/False)

4.7/5  (30)

(30)

Showing 241 - 250 of 250

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)