Exam 7: Inventory

Exam 1: Overview of Corporate Financial Reporting101 Questions

Exam 2: Analyzing Transaction and Their Effect on Financial Statement74 Questions

Exam 3: Double-Entry Accounting and the Accounting Cycle84 Questions

Exam 4: Revenue Recognition and the Statement of Income78 Questions

Exam 5: The Statement of Cash Flows112 Questions

Exam 6: Cash and Accounts130 Questions

Exam 7: Inventory96 Questions

Exam 8: Long-Term Assets95 Questions

Exam 9: Current Liabilities65 Questions

Exam 10: Long-Term Liabilities100 Questions

Exam 12: Financial Statement Analysis120 Questions

Select questions type

Which of the following is NOT an inventory account in a manufacturing company?

(Multiple Choice)

4.8/5  (24)

(24)

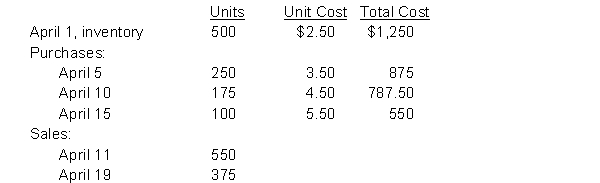

Jolly Gyms Inc. uses a periodic inventory system and had the following activity for a single inventory item:  Instructions

Determine the ending inventory and cost of goods sold using:

a) FIFO

b) Weighted-average (round unit cost to nearest cent)

Instructions

Determine the ending inventory and cost of goods sold using:

a) FIFO

b) Weighted-average (round unit cost to nearest cent)

(Short Answer)

4.9/5  (40)

(40)

Just-in-time inventory systems are designed to reduce the cost of inventory storage and increase the amount of cash on hand.

(True/False)

4.9/5  (35)

(35)

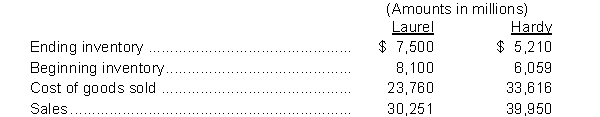

The following information is available from recent financial statements of Laurel Incorporated and Hardy Enterprises:  Instructions

a) Calculate the inventory turnover and days in inventory for both companies.

b) What conclusions concerning the management of inventory can be drawn from these data?

Instructions

a) Calculate the inventory turnover and days in inventory for both companies.

b) What conclusions concerning the management of inventory can be drawn from these data?

(Short Answer)

4.8/5  (43)

(43)

The cost-to-sales ratio is a method used to estimate inventory instead of performing a physical count.

(True/False)

4.9/5  (36)

(36)

Compare and contrast a perpetual and a periodic inventory system. What factors should a company take into consideration when deciding which system to use?

(Essay)

4.7/5  (39)

(39)

Under the FIFO inventory formula, the cost of ending inventory and cost of goods sold will be the same under both the perpetual and periodic inventory systems.

(True/False)

5.0/5  (35)

(35)

A small local convenience store is opening in your neighborhood. Inventory is limited and keeping initial start-up costs low is a priority. What type of inventory system would you recommend?

(Multiple Choice)

4.7/5  (36)

(36)

The longer the inventory remains unsold, the higher the risk of

(Multiple Choice)

4.9/5  (45)

(45)

Propack Inc. purchases goods from a supplier FOB destination. This means that

(Multiple Choice)

4.8/5  (33)

(33)

In 2020 Borger Industries had beginning inventory of $106,000, purchases of $1,126,500, ending inventory of $116,000, accounts payable of $49,605, and sales of $2,147,250. Inventory turnover for 2017 was closest to

(Multiple Choice)

4.9/5  (38)

(38)

Effective inventory management would have one person place the order for new inventory, a second person check it against the purchase order when it arrives, and a third person record the receipt of inventory in the accounting records. The purpose of this system is

(Multiple Choice)

4.8/5  (38)

(38)

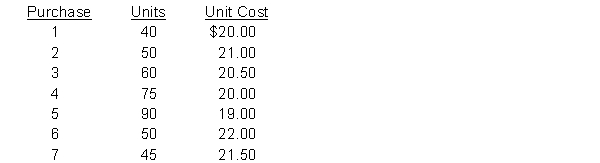

McLaughlin Inc. began business in the current month. The bookkeeper received a report from an outside firm specializing in physical inventory counts that the ending inventory was $1,426.60. However, according to the bookkeeper's records, the inventory at month end was $1,517.50. The bookkeeper has rechecked his records several times and still comes up with the same amount. He believes that the difference between the two amounts must be due to inventory shrinkage. The company had no inventory at the beginning of the month and 70 units on hand per a physical inventory count at the end of the month. The company uses the periodic method. Listed below are the company's purchases for the month:  Instructions

Write an explanation for the bookkeeper on how the difference in amounts could occur. (Hint: use different cost formulas to calculate the ending inventory). Provide numerical support.

Instructions

Write an explanation for the bookkeeper on how the difference in amounts could occur. (Hint: use different cost formulas to calculate the ending inventory). Provide numerical support.

(Essay)

4.8/5  (32)

(32)

Showing 81 - 96 of 96

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)