Exam 10: Liabilities: Current, Installment Notes, and Contingencies

Exam 1: Introduction to Accounting and Business243 Questions

Exam 2: Analyzing Transactions234 Questions

Exam 3: The Adjusting Process225 Questions

Exam 4: The Accounting Cycle211 Questions

Exam 5: Accounting for Retail Businesses273 Questions

Exam 6: Inventories236 Questions

Exam 7: Internal Control and Cash197 Questions

Exam 8: Receivables210 Questions

Exam 9: Long-Term Assets: Fixed and Intangible243 Questions

Exam 10: Liabilities: Current, Installment Notes, and Contingencies199 Questions

Exam 11: Liabilities: Bonds Payable172 Questions

Exam 12: Corporations: Organization, Stock Transactions, and Dividends221 Questions

Exam 13: Statement of Cash Flows193 Questions

Exam 14: Financial Statement Analysis206 Questions

Exam 15: Introduction to Managerial Accounting244 Questions

Exam 16: Job Order Costing212 Questions

Exam 17: Process Cost Systems196 Questions

Exam 18: Activity-Based Costing109 Questions

Exam 19: Support Department and Joint Cost Allocation172 Questions

Exam 20: Cost-Volume-Profit Analysis247 Questions

Exam 21: Variable Costing for Management Analysis136 Questions

Exam 22: Budgeting197 Questions

Exam 23: Evaluating Variances From Standard Costs172 Questions

Exam 24: Evaluating Decentralized Operations210 Questions

Exam 25: Differential Analysis and Product Pricing157 Questions

Exam 26: Capital Investment Analysis191 Questions

Exam 27: Lean Manufacturing and Activity Analysis134 Questions

Exam 28: The Balanced Scorecard and Corporate Social Responsibility170 Questions

Exam 29: Investments137 Questions

Select questions type

A pension plan that promises employees a fixed annual pension benefit, based on years of service and compensation, is called a(n)

(Multiple Choice)

4.9/5  (30)

(30)

Martinez Co. borrowed $50,000 on March 1 of the current year by signing a 60-day, 9%, interest-bearing note. Assuming a 360-day year, when the note is paid on April 30, the entry to record the payment should include a

(Multiple Choice)

4.9/5  (42)

(42)

During the first year of operations, employees earned vacation pay of $35,000. The vacations will be taken during the second year. The vacation pay expense should be recorded in the second year as the vacations are taken by the employees.

(True/False)

4.8/5  (50)

(50)

Match the following terms or phrases in (a-g) with the explanations in 1-8. Terms or phrases may be used more than once.

-Measures the "instant" debt-paying ability of a company

A)Current ratio

B)Working capital

C)Quick assets

D)Quick ratio

E)Record an accrual and disclose in the notes to the financial statements

F)Disclose only in notes to financial statements

G)No disclosure needed in notes to financial statements

(Short Answer)

4.8/5  (39)

(39)

The journal entry to record the cost of warranty repairs that were incurred during the current period, but related to sales made in prior years, includes a debit to Warranty Expense.

(True/False)

4.8/5  (26)

(26)

Which of the following taxes would be deducted in determining an employee's net pay?

(Multiple Choice)

4.7/5  (37)

(37)

According to a summary of the payroll of Sinclair Company, $545,000 was subject to the 6.0% social security tax and the 1.5% Medicare tax. Also, $10,000 was subject to state and federal unemployment taxes.(a)Calculate the employer's payroll taxes using the following rates: state unemployment tax, 5.4%; federal unemployment tax, 0.8%.(b)Journalize the entry to record the accrual of the employer's payroll taxes.

(Essay)

4.7/5  (44)

(44)

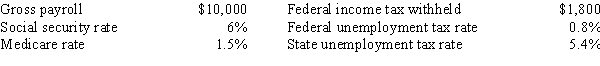

Assuming no employees are subject to ceilings for their earnings, Harris Company has the following information for the pay period of January 15-31. Use this information to answer the questions that follow.  -An aid in internal control over payrolls that indicates employee attendance is

-An aid in internal control over payrolls that indicates employee attendance is

(Multiple Choice)

4.9/5  (41)

(41)

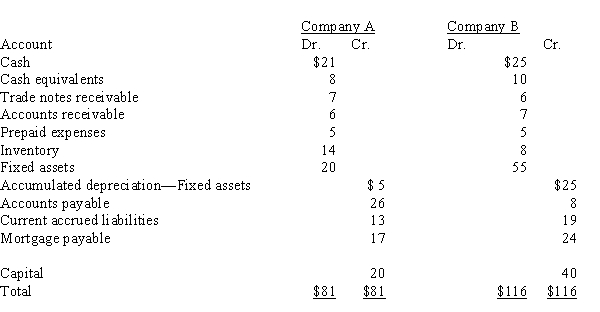

For Company A and Company B:

(a)Calculate the quick ratio for each company. Round ratios to two decimal places.(b)Comment on which one is more able to meet current liabilities.

(Essay)

4.8/5  (35)

(35)

Federal unemployment compensation taxes that are collected by the federal government are not paid directly to the unemployed but are allocated among the states for use in state programs.

(True/False)

4.7/5  (28)

(28)

Taxes deducted from an employee's earnings to finance social security and Medicare benefits are called FICA taxes.

(True/False)

4.8/5  (42)

(42)

Match each payroll item that follows to the one item (a-f) that best describes its characteristics.

-FICA - Medicare

A)Amount is limited, withheld from employee only

B)Amount is limited, withheld from employee and matched by employer

C)Amount is limited, paid by employer only

D)Amount is not limited, withheld from employee only

E)Amount is not limited, withheld from employee and matched by employer

F)Amount is not limited, paid by employer only

(Short Answer)

4.8/5  (25)

(25)

On July 8, Jones Inc. issued an $80,000, 6%, 120-day note payable to Miller Company. Assume that the fiscal year of Jones ends July 31. Using a 360-day year, what is the amount of interest expense recognized by Jones in the current fiscal year? When required, round your answer to the nearest dollar.

(Multiple Choice)

4.8/5  (34)

(34)

On October 1, Ramos Co. signed a $90,000, 60-day discounted note at the bank. The discount rate was 6%, and the note was paid on November 30. (Assume a 360-day year is used for interest calculations.)(a)Journalize the entries for October 1 and November 30.(b)Assume that Ramos Co. signed a 6% interest-bearing note. Journalize the entries for October 1 and November 30.

(Essay)

4.7/5  (41)

(41)

Interest expense is reported in the operating expense section of the income statement.

(True/False)

4.9/5  (38)

(38)

An interest-bearing note is a loan in which the lender deducts interest from the amount loaned before the money is advanced to the borrower.

(True/False)

4.8/5  (39)

(39)

All long-term liabilities eventually become current liabilities.

(True/False)

4.8/5  (37)

(37)

An employee's take-home pay is equal to gross pay less all voluntary deductions.

(True/False)

4.7/5  (31)

(31)

Showing 81 - 100 of 199

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)