Exam 10: Liabilities: Current, Installment Notes, and Contingencies

Exam 1: Introduction to Accounting and Business243 Questions

Exam 2: Analyzing Transactions234 Questions

Exam 3: The Adjusting Process225 Questions

Exam 4: The Accounting Cycle211 Questions

Exam 5: Accounting for Retail Businesses273 Questions

Exam 6: Inventories236 Questions

Exam 7: Internal Control and Cash197 Questions

Exam 8: Receivables210 Questions

Exam 9: Long-Term Assets: Fixed and Intangible243 Questions

Exam 10: Liabilities: Current, Installment Notes, and Contingencies199 Questions

Exam 11: Liabilities: Bonds Payable172 Questions

Exam 12: Corporations: Organization, Stock Transactions, and Dividends221 Questions

Exam 13: Statement of Cash Flows193 Questions

Exam 14: Financial Statement Analysis206 Questions

Exam 15: Introduction to Managerial Accounting244 Questions

Exam 16: Job Order Costing212 Questions

Exam 17: Process Cost Systems196 Questions

Exam 18: Activity-Based Costing109 Questions

Exam 19: Support Department and Joint Cost Allocation172 Questions

Exam 20: Cost-Volume-Profit Analysis247 Questions

Exam 21: Variable Costing for Management Analysis136 Questions

Exam 22: Budgeting197 Questions

Exam 23: Evaluating Variances From Standard Costs172 Questions

Exam 24: Evaluating Decentralized Operations210 Questions

Exam 25: Differential Analysis and Product Pricing157 Questions

Exam 26: Capital Investment Analysis191 Questions

Exam 27: Lean Manufacturing and Activity Analysis134 Questions

Exam 28: The Balanced Scorecard and Corporate Social Responsibility170 Questions

Exam 29: Investments137 Questions

Select questions type

The interest portion of an installment note payment is computed by multiplying the interest rate by the carrying amount of the note at the end of the period.

(True/False)

4.9/5  (43)

(43)

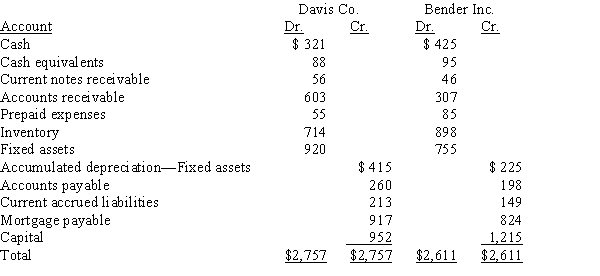

Use the following information and calculate the quick ratio for Davis Company and for Bender Inc.(a)Calculate the quick ratio for each company. Round ratios to two decimal places.(b)Comment on which one is more able to meet current liabilities.

(Essay)

4.8/5  (30)

(30)

On June 8, Smith Technologies issued a $75,000, 6%, 140-day note payable to Johnson Company. What is the due date of the note?

(Multiple Choice)

4.8/5  (36)

(36)

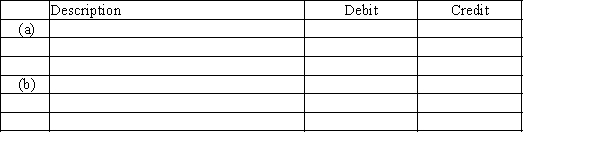

On January 1, Yeargan Company obtained a $125,000, 7-year 5% installment note from Farmers Bank. The note requires annual payments of $21,602, with the first payment occurring on the last day of the fiscal year. The first payment consists of $6,250 interest and principal repayment of $15,352.

Journalize the following entries:

(a) Issued the installment note for cash on January 1.(b) Paid the first annual payment on the note.

(Essay)

4.8/5  (34)

(34)

Which of the following are included in the employer's payroll taxes?

(Multiple Choice)

4.8/5  (37)

(37)

Vacation pay payable is reported on the balance sheet as a(n)

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following would most likely be classified as a current liability?

(Multiple Choice)

4.8/5  (39)

(39)

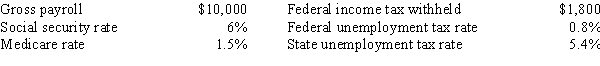

The following totals for the month of April were taken from the payroll register of Magnum Company. Use this information to answer the questions that follow.  -An employee receives an hourly rate of $15, with time and a half for all hours worked in excess of 40 during the week. Payroll data for the first week of the calendar year are as follows: hours worked, 46; federal income tax withheld, $110; Social security tax rate, 6%; and Medicare tax rate, 1.5%; state unemployment tax, 5.4% on the first $7,000; federal unemployment tax, 0.8% on the first $7,000. What is the net amount to be paid to the employee? If required, round your answers to the nearest cent.

-An employee receives an hourly rate of $15, with time and a half for all hours worked in excess of 40 during the week. Payroll data for the first week of the calendar year are as follows: hours worked, 46; federal income tax withheld, $110; Social security tax rate, 6%; and Medicare tax rate, 1.5%; state unemployment tax, 5.4% on the first $7,000; federal unemployment tax, 0.8% on the first $7,000. What is the net amount to be paid to the employee? If required, round your answers to the nearest cent.

(Multiple Choice)

4.8/5  (28)

(28)

Which is not a determinate in calculating federal income taxes withheld from an individual's pay?

(Multiple Choice)

4.7/5  (34)

(34)

A borrower has two alternatives for a loan: (a) issue a $480,000, 60-day, 8% note or (2) issue a $480,000, 60-day note that the creditor discounts at 8%. (Assume a 360-day year is used for interest calculations.)(a)Calculate the amount of the interest expense for each option.(b)Determine the proceeds received by the borrower in each situation.

(Essay)

4.8/5  (39)

(39)

On January 1, Gemstone Company obtained a $165,000, 10-year, 7% installment note from Guarantee Bank. The note requires annual payments of $23,492, with the first payment occurring on the last day of the fiscal year. The first payment consists of interest of $11,550 and principal repayment of $11,942. The journal entry to record the issuance of the installment note for cash on January 1 would include a

(Multiple Choice)

4.8/5  (31)

(31)

Assuming no employees are subject to ceilings for their earnings, Harris Company has the following information for the pay period of January 15-31. Use this information to answer the questions that follow.  -Salaries Payable would be recorded in the amount of

-Salaries Payable would be recorded in the amount of

(Multiple Choice)

4.9/5  (39)

(39)

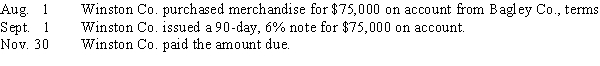

Journalize the following entries on the books of Winston Co. for August 1, September 1, and November 30. (Assume a 360-day year is used for interest calculations.)

(Essay)

4.8/5  (37)

(37)

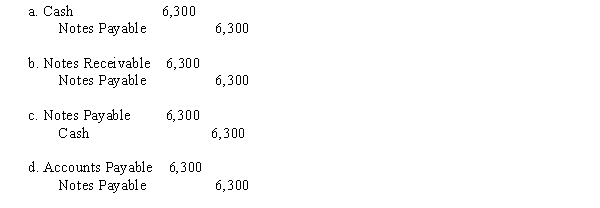

The journal entry to record the conversion of a $6,300 accounts payable to a note payable would be

(Short Answer)

4.8/5  (30)

(30)

Match the following terms or phrases in (a-g) with the explanations in 1-8. Terms or phrases may be used more than once.

-Cash + Temporary investments + Accounts receivable

A)Current ratio

B)Working capital

C)Quick assets

D)Quick ratio

E)Record an accrual and disclose in the notes to the financial statements

F)Disclose only in notes to financial statements

G)No disclosure needed in notes to financial statements

(Short Answer)

4.8/5  (26)

(26)

The journal entry a company uses to record partially funded pension rights for its salaried employees at the end of the year is

(Multiple Choice)

4.9/5  (42)

(42)

Several months ago, Maximilien Company experienced a spill of radioactive materials into the Missouri River from one of its plants. As a result, the Environmental Protection Agency (EPA) fined the company $1,750,000. The company contested the fine. In addition, an employee is seeking $975,000 damages related to the spill. Finally, a homeowner has sued the company for $580,000. Although the homeowner lives 15 miles downstream from the plant, he believes that the spill has reduced his home's resale value by $580,000.Maximilien's legal counsel believes the following will happen in relationship to these incidents:

(a)It is probable that the EPA fine will stand.(b)An out-of-court settlement for $650,000 has recently been reached with the employee, with the final papers to be signed next week.(c)Counsel believes that the homeowner's case is weak and will be decided in favor of Maximilien Company.(d)Other litigation related to the spill is possible, but the damage amounts are uncertain.(1)Based on this information, prepare the journal entries for the contingent liabilities associated with the spill. Use the account "Environmental Awards and Fines" to recognize the expense for the period.

(2)Prepare any note disclosure related to the spill.

(Essay)

4.7/5  (40)

(40)

A business issued a 120-day, 6% note for $10,000 to a creditor on account. The company uses a 360-day year for interest calculations. Journalize the entries to record (a) the issuance of the note and (b) the payment of the note at maturity, including interest.

(Essay)

4.8/5  (40)

(40)

Showing 121 - 140 of 199

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)