Exam 9: Long-Term Assets: Fixed and Intangible

Exam 1: Introduction to Accounting and Business243 Questions

Exam 2: Analyzing Transactions234 Questions

Exam 3: The Adjusting Process225 Questions

Exam 4: The Accounting Cycle211 Questions

Exam 5: Accounting for Retail Businesses273 Questions

Exam 6: Inventories236 Questions

Exam 7: Internal Control and Cash197 Questions

Exam 8: Receivables210 Questions

Exam 9: Long-Term Assets: Fixed and Intangible243 Questions

Exam 10: Liabilities: Current, Installment Notes, and Contingencies199 Questions

Exam 11: Liabilities: Bonds Payable172 Questions

Exam 12: Corporations: Organization, Stock Transactions, and Dividends221 Questions

Exam 13: Statement of Cash Flows193 Questions

Exam 14: Financial Statement Analysis206 Questions

Exam 15: Introduction to Managerial Accounting244 Questions

Exam 16: Job Order Costing212 Questions

Exam 17: Process Cost Systems196 Questions

Exam 18: Activity-Based Costing109 Questions

Exam 19: Support Department and Joint Cost Allocation172 Questions

Exam 20: Cost-Volume-Profit Analysis247 Questions

Exam 21: Variable Costing for Management Analysis136 Questions

Exam 22: Budgeting197 Questions

Exam 23: Evaluating Variances From Standard Costs172 Questions

Exam 24: Evaluating Decentralized Operations210 Questions

Exam 25: Differential Analysis and Product Pricing157 Questions

Exam 26: Capital Investment Analysis191 Questions

Exam 27: Lean Manufacturing and Activity Analysis134 Questions

Exam 28: The Balanced Scorecard and Corporate Social Responsibility170 Questions

Exam 29: Investments137 Questions

Select questions type

The depreciation method that does not use residual value in calculating the first year's depreciation expense is

(Multiple Choice)

4.9/5  (33)

(33)

A machine costing $185,000 with a 5-year life and $20,000 residual value was purchased January 2. Compute depreciation for each of the five years, using the double-declining-balance method.

(Essay)

4.8/5  (34)

(34)

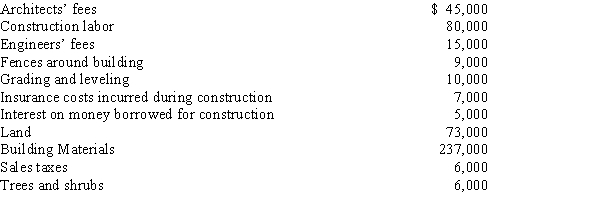

Eagle Country Club has acquired a lot to construct a clubhouse. Eagle had the following costs related to the construction:  Determine the cost of the club house to be reported on the balance sheet.

Determine the cost of the club house to be reported on the balance sheet.

(Essay)

4.8/5  (35)

(35)

Intangible assets differ from property, plant, and equipment assets in that they lack physical substance.

(True/False)

4.9/5  (36)

(36)

Classify each of the following costs associated with long-lived assets as one of the following:

-Supplies (materials) used to test new equipment

A)Land improvements

B)Buildings

C)Land

D)Machinery and equipment

(Short Answer)

4.9/5  (29)

(29)

Match each account name to the financial statement section (a-i) in which it would appear.

-Loss on Disposal of Asset

A)Current Assets

B)Fixed Assets

C)Intangible Assets

D)Current Liability

E)Long-Term Liability

F)Owners' Equity

G)Revenues

H)Operating Expenses

I)Other Income/Expense

(Short Answer)

4.8/5  (38)

(38)

What would be the cost basis of a new machine with a purchase price of $109,000, with transportation costs of $12,000, installation costs of $5,000, and special acquisition fees of $6,000?

(Essay)

4.8/5  (37)

(37)

The calculation for annual depreciation using the double-declining balance method is

(Multiple Choice)

4.9/5  (36)

(36)

The journal entry for recording payment for the short-term lease of a fixed asset would

(Multiple Choice)

4.9/5  (39)

(39)

On December 31, Strike Company traded in one of its batting cages for another one that has a cost of $500,000. Strike receives a trade-in allowance of $11,000. The old equipment had an initial cost of $215,000 and has accumulated depreciation of $185,000. Depreciation has been recorded up to the end of the year. The difference will be paid in cash. What is the amount of the gain or loss on this transaction?

(Multiple Choice)

4.8/5  (31)

(31)

On July 1, Harding Construction purchases a bulldozer for $228,000. The equipment has an 8-year life with a residual value of $16,000. Harding uses straight-line depreciation.(a) Calculate the depreciation expense and provide the journal entry for the first year ending December 31.(b) Calculate the third year's depreciation expense and provide the journal entry for the third year ending

December 31.(c) Calculate the last year's depreciation expense and provide the journal entry for the last year.

(Essay)

5.0/5  (30)

(30)

The cost of replacing an engine in a truck is an example of ordinary maintenance.

(True/False)

4.8/5  (34)

(34)

On December 31, Bowman Company estimated that goodwill of $80,000 was impaired. On June 1, a patent with an estimated useful economic life of 10 years was acquired for $252,000.

Required:

(a) Journalize the adjusting entry on December 31 for the impaired goodwill.(b) Journalize the adjusting entry on December 31 for the amortization of the patent rights.

(Essay)

4.9/5  (33)

(33)

A number of major structural repairs completed at the beginning of the current fiscal year at a cost of $1,000,000 are expected to extend the life of a building 10 years beyond the original estimate. The original cost of the building was $6,552,000, and it has been depreciated by the straight-line method for 25 years. Estimated residual value is negligible and has been ignored. The related accumulated depreciation account after the depreciation adjustment at the end of the preceding fiscal year is $4,550,000.(a)What has the amount of annual depreciation been in past years?

(b)What was the original life estimate of the building?

(c)To what account should the $1,000,000 be debited?

(d)What is the book value of the building after the extraordinary repairs have been made?

(e)What is the expected remaining life of the building after the extraordinary repairs have been made?

(f)What is the amount of straight-line depreciation for the current year, assuming that the repairs were completed at the very beginning of the current year? Round to the nearest dollar.

(Essay)

4.7/5  (38)

(38)

Losses on the discarding of fixed assets are reported in the income statement.

(True/False)

4.9/5  (34)

(34)

The method used to calculate the depletion of a natural resource is the straight-line method.

(True/False)

4.8/5  (24)

(24)

Factors contributing to a decline in the usefulness of a fixed asset may be divided into the following two categories

(Multiple Choice)

4.8/5  (38)

(38)

Though a piece of equipment is still being used, the equipment should be removed from the accounts if it has been fully depreciated.

(True/False)

4.9/5  (31)

(31)

Champion Company purchased and installed carpet in its new general offices on March 31 for a total cost of $18,000. The carpet is estimated to have a 15-year useful life and no residual value.

(a)Prepare the journal entries necessary for recording the purchase of the new carpet.(b)Record the December 31 adjusting entry for the partial-year depreciation expense for the carpet assuming that Champion Company uses the straight-line method.

(Essay)

4.9/5  (33)

(33)

Showing 201 - 220 of 243

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)