Exam 9: Long-Term Assets: Fixed and Intangible

Exam 1: Introduction to Accounting and Business243 Questions

Exam 2: Analyzing Transactions234 Questions

Exam 3: The Adjusting Process225 Questions

Exam 4: The Accounting Cycle211 Questions

Exam 5: Accounting for Retail Businesses273 Questions

Exam 6: Inventories236 Questions

Exam 7: Internal Control and Cash197 Questions

Exam 8: Receivables210 Questions

Exam 9: Long-Term Assets: Fixed and Intangible243 Questions

Exam 10: Liabilities: Current, Installment Notes, and Contingencies199 Questions

Exam 11: Liabilities: Bonds Payable172 Questions

Exam 12: Corporations: Organization, Stock Transactions, and Dividends221 Questions

Exam 13: Statement of Cash Flows193 Questions

Exam 14: Financial Statement Analysis206 Questions

Exam 15: Introduction to Managerial Accounting244 Questions

Exam 16: Job Order Costing212 Questions

Exam 17: Process Cost Systems196 Questions

Exam 18: Activity-Based Costing109 Questions

Exam 19: Support Department and Joint Cost Allocation172 Questions

Exam 20: Cost-Volume-Profit Analysis247 Questions

Exam 21: Variable Costing for Management Analysis136 Questions

Exam 22: Budgeting197 Questions

Exam 23: Evaluating Variances From Standard Costs172 Questions

Exam 24: Evaluating Decentralized Operations210 Questions

Exam 25: Differential Analysis and Product Pricing157 Questions

Exam 26: Capital Investment Analysis191 Questions

Exam 27: Lean Manufacturing and Activity Analysis134 Questions

Exam 28: The Balanced Scorecard and Corporate Social Responsibility170 Questions

Exam 29: Investments137 Questions

Select questions type

Expenditures for research and development are generally recorded as

(Multiple Choice)

4.8/5  (33)

(33)

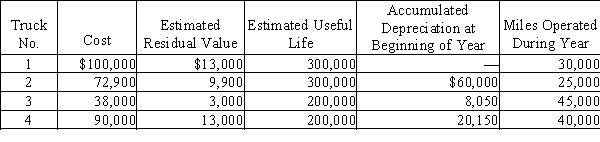

Prior to adjustment at the end of the year, the balance in Trucks is $300,900 and the balance in Accumulated Depreciation-Trucks is $88,200. Details of the subsidiary ledger are as follows:  Required:

(a)Based on the units-of-output method, determine the depreciation rates per mile and the amount to be credited to the accumulated depreciation section of each of the subsidiary accounts for the miles operated during the current year.(b)Journalize the entry to record depreciation for the year.

Required:

(a)Based on the units-of-output method, determine the depreciation rates per mile and the amount to be credited to the accumulated depreciation section of each of the subsidiary accounts for the miles operated during the current year.(b)Journalize the entry to record depreciation for the year.

(Essay)

4.7/5  (33)

(33)

Classify each of the following costs associated with long-lived assets as one of the following:

-Modifying a building purchased for new business location

A)Land improvements

B)Buildings

C)Land

D)Machinery and equipment

(Short Answer)

5.0/5  (31)

(31)

When a property, plant, and equipment asset is sold for cash, any gain or loss on the asset sold should be recorded.

(True/False)

4.8/5  (30)

(30)

When exchanging equipment, if the trade-in allowance is greater than the book value a loss results.

(True/False)

4.7/5  (36)

(36)

Functional depreciation occurs when a fixed asset is no longer able to provide services at the level for which it was intended.

(True/False)

5.0/5  (25)

(25)

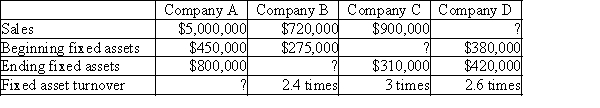

Fill in the missing numbers using the formula for fixed asset turnover:

(Essay)

4.9/5  (36)

(36)

Copy equipment was acquired at the beginning of the year at a cost of $72,000 that has an estimated residual value of $9,000 and an estimated useful life of 5 years. It is estimated that the machine will output an estimated 1,000,000 copies. This year, 315,000 copies were made. What is the units-of-output depreciation for the year?

(Multiple Choice)

4.9/5  (33)

(33)

An asset was purchased for $58,000 and originally estimated to have a useful life of 10 years with a residual value of $3,000. After two years of straight-line depreciation, it was determined that the remaining useful life of the asset was only 2 years with a residual value of $2,000. What will be the annual depreciation for the asset?

(Multiple Choice)

4.9/5  (37)

(37)

Computer equipment was acquired at the beginning of the year at a cost of $57,000 that has an estimated residual value of $9,000 and an estimated useful life of 5 years. Determine the second-year depreciation using the straight-line method.

(Multiple Choice)

5.0/5  (36)

(36)

Match the intangible assets described with their proper classification (a-d).

-A new kitchen gadget that can be produced by only one company

A)Patent

B)Copyright

C)Trademark

D)Goodwill

(Short Answer)

4.8/5  (36)

(36)

When a company sells machinery at a price equal to its book value, this transaction would be recorded with an entry that would include the following:

(Multiple Choice)

4.8/5  (34)

(34)

A copy machine acquired on May 1 with a cost of $2,545 has an estimated useful life of 3 years. Assuming that it will have a residual value of $445, determine the depreciation for the first and second year by the straight-line method. Round your answers to the nearest whole dollar.

(Essay)

4.9/5  (30)

(30)

Equipment was acquired at the beginning of the year at a cost of $75,000. The equipment was depreciated using the straight-line method based upon an estimated useful life of 6 years and an estimated residual value of $7,500.(a)What was the depreciation expense for the first year?

(b)Assuming the equipment was sold at the end of the second year for $59,000, determine the gain or loss on sale of the equipment.(c)Journalize the entry to record the sale.

(Essay)

4.8/5  (32)

(32)

A machine with a cost of $75,000 has an estimated residual value of $5,000 and an estimated life of 4 years or 18,000 hours. What is the amount of depreciation for the second full year, using the double-declining-balance method?

(Multiple Choice)

4.9/5  (37)

(37)

Falcon Company acquired an adjacent lot to construct a new warehouse, paying $40,000 and giving a short-term note for $410,000. Legal fees paid were $13,275, delinquent taxes assessed were $14,500, and fees paid to remove an old building from the land were $15,800. Materials salvaged from the demolition of the building were sold for $6,800. A contractor was paid $890,000 to construct the new warehouse. Determine the cost of the land to be reported on the balance sheet and show your work.

(Essay)

4.8/5  (34)

(34)

Xtra Company purchased a business from Argus for $96,000 above the fair value of its net assets. Argus had developed the goodwill over 12 years. How much would Xtra amortize the goodwill for its first year?

(Multiple Choice)

4.8/5  (31)

(31)

Which intangible assets are amortized over their useful life?

(Multiple Choice)

4.8/5  (30)

(30)

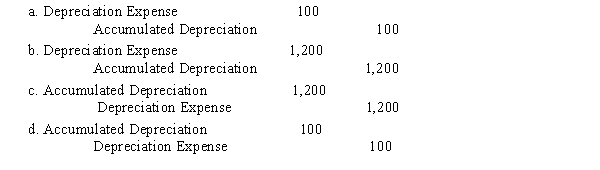

If a fixed asset, such as a computer, were purchased on January 1 for $3,750 with an estimated life of 3 years and a salvage or residual value of $150, the journal entry for monthly expense under straight-line depreciation is

(Short Answer)

4.9/5  (34)

(34)

Showing 141 - 160 of 243

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)