Exam 3: The Adjusting Process

Exam 1: Introduction to Accounting and Business243 Questions

Exam 2: Analyzing Transactions234 Questions

Exam 3: The Adjusting Process225 Questions

Exam 4: The Accounting Cycle211 Questions

Exam 5: Accounting for Retail Businesses273 Questions

Exam 6: Inventories236 Questions

Exam 7: Internal Control and Cash197 Questions

Exam 8: Receivables210 Questions

Exam 9: Long-Term Assets: Fixed and Intangible243 Questions

Exam 10: Liabilities: Current, Installment Notes, and Contingencies199 Questions

Exam 11: Liabilities: Bonds Payable172 Questions

Exam 12: Corporations: Organization, Stock Transactions, and Dividends221 Questions

Exam 13: Statement of Cash Flows193 Questions

Exam 14: Financial Statement Analysis206 Questions

Exam 15: Introduction to Managerial Accounting244 Questions

Exam 16: Job Order Costing212 Questions

Exam 17: Process Cost Systems196 Questions

Exam 18: Activity-Based Costing109 Questions

Exam 19: Support Department and Joint Cost Allocation172 Questions

Exam 20: Cost-Volume-Profit Analysis247 Questions

Exam 21: Variable Costing for Management Analysis136 Questions

Exam 22: Budgeting197 Questions

Exam 23: Evaluating Variances From Standard Costs172 Questions

Exam 24: Evaluating Decentralized Operations210 Questions

Exam 25: Differential Analysis and Product Pricing157 Questions

Exam 26: Capital Investment Analysis191 Questions

Exam 27: Lean Manufacturing and Activity Analysis134 Questions

Exam 28: The Balanced Scorecard and Corporate Social Responsibility170 Questions

Exam 29: Investments137 Questions

Select questions type

For the year ending December 31, Orion, Inc. mistakenly omitted adjusting entries for $1,500 of supplies that were used, (2) unearned revenue of $4,200 that was earned, and (3) insurance of $5,000 that expired. For the year ending December 31, what is the effect of these errors on revenues, expenses, and net income?

(Multiple Choice)

5.0/5  (33)

(33)

Match the type of account (a - e) with the business transactions that follow.

-Paid for a 6-month magazine subscription.

A)Prepaid expense

B)Accrued expense

C)Unearned revenue

D)Accrued revenue

E)None of these

(Short Answer)

4.9/5  (38)

(38)

Accrued salaries of $600 owed to employees for December 29, 30, and 31 are not taken into consideration in preparing the financial statements for the year ended December 31. Indicate which items will be erroneously stated, because of the error, on (a) the income statement for the year and (b) the balance sheet as of December 31. Also indicate whether the items in error will be overstated or understated.

(Essay)

4.9/5  (43)

(43)

Identify the effect (a - h) that omitting each of the following items would have on the balance sheet.a.Assets and stockholders' equity overstated

b.Assets and stockholders' equity understated

c.Assets overstated and stockholders' equity understated

d.Assets understated and stockholders' equity overstated

e.Liabilities and stockholders' equity overstated

f.Liabilities and stockholders' equity understated

g.Liabilities overstated and stockholders' equity understated

h.Liabilities understated and stockholders' equity overstated

-No adjustment was made for supplies used up during the month.

(Short Answer)

4.7/5  (36)

(36)

For the year ending December 31, Beard Clinical Supplies Co. mistakenly omitted adjusting entries for (1) $9,800 of unearned revenue that was earned, (2) earned revenue that was not billed of $10,200, and (3) accrued wages of $7,000. Indicate the combined effect of the errors on (a) revenues, (b) expenses, and (c) net income.

(Essay)

4.8/5  (36)

(36)

Even though GAAP requires the accrual basis of accounting, some businesses prefer using the cash basis of accounting.

(True/False)

4.9/5  (42)

(42)

The matching principle requires expenses be recorded in the same period that the related revenue is recorded.

(True/False)

4.7/5  (35)

(35)

The cash basis of accounting records revenues and expenses when the cash is exchanged while the accrual basis of accounting

(Multiple Choice)

4.8/5  (37)

(37)

The adjusting entry to record the depreciation of a building for the fiscal period is

(Multiple Choice)

4.8/5  (31)

(31)

Match the type of account (a - e) with the business transactions that follow.

-Received payment covering a 6-month magazine subscription.

A)Prepaid expense

B)Accrued expense

C)Unearned revenue

D)Accrued revenue

E)None of these

(Short Answer)

4.8/5  (40)

(40)

A company pays an employee $3,000 for a five-day work week, Monday-Friday. The adjusting entry on December 31, which is a Wednesday, is a debit to Wages Expense, $1,800, and a credit to Wages Payable, $1,800.

(True/False)

4.7/5  (36)

(36)

Which of the following is considered to be unearned revenue?

(Multiple Choice)

4.8/5  (36)

(36)

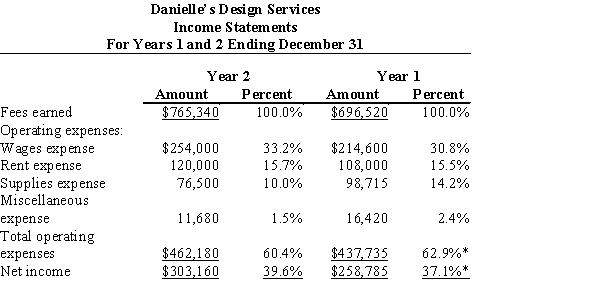

A vertical analysis of two income statements for Danielle's Design Services is shown below:  *Differences due to rounding Which of the following analyses reflect the data given?

*Differences due to rounding Which of the following analyses reflect the data given?

(Multiple Choice)

4.8/5  (44)

(44)

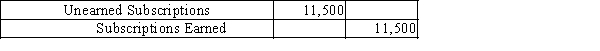

How will the following adjusting journal entry affect the accounting equation?

(Multiple Choice)

4.9/5  (41)

(41)

The difference between the balance of a fixed asset account and the balance of its related accumulated depreciation account is termed the book value of the asset.

(True/False)

4.7/5  (38)

(38)

A contra asset account for Land will normally appear on the balance sheet.

(True/False)

4.9/5  (36)

(36)

Showing 81 - 100 of 225

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)