Exam 3: The Adjusting Process

Exam 1: Introduction to Accounting and Business243 Questions

Exam 2: Analyzing Transactions234 Questions

Exam 3: The Adjusting Process225 Questions

Exam 4: The Accounting Cycle211 Questions

Exam 5: Accounting for Retail Businesses273 Questions

Exam 6: Inventories236 Questions

Exam 7: Internal Control and Cash197 Questions

Exam 8: Receivables210 Questions

Exam 9: Long-Term Assets: Fixed and Intangible243 Questions

Exam 10: Liabilities: Current, Installment Notes, and Contingencies199 Questions

Exam 11: Liabilities: Bonds Payable172 Questions

Exam 12: Corporations: Organization, Stock Transactions, and Dividends221 Questions

Exam 13: Statement of Cash Flows193 Questions

Exam 14: Financial Statement Analysis206 Questions

Exam 15: Introduction to Managerial Accounting244 Questions

Exam 16: Job Order Costing212 Questions

Exam 17: Process Cost Systems196 Questions

Exam 18: Activity-Based Costing109 Questions

Exam 19: Support Department and Joint Cost Allocation172 Questions

Exam 20: Cost-Volume-Profit Analysis247 Questions

Exam 21: Variable Costing for Management Analysis136 Questions

Exam 22: Budgeting197 Questions

Exam 23: Evaluating Variances From Standard Costs172 Questions

Exam 24: Evaluating Decentralized Operations210 Questions

Exam 25: Differential Analysis and Product Pricing157 Questions

Exam 26: Capital Investment Analysis191 Questions

Exam 27: Lean Manufacturing and Activity Analysis134 Questions

Exam 28: The Balanced Scorecard and Corporate Social Responsibility170 Questions

Exam 29: Investments137 Questions

Select questions type

Generally accepted accounting principles require accrual-basis accounting.

(True/False)

4.9/5  (33)

(33)

Prepaid advertising, representing payment for the next quarter, would be reported on the balance sheet as a(n)

(Multiple Choice)

4.7/5  (37)

(37)

What is the correct debit and credit to record the adjusting entry for $800 of fees earned but not yet billed or paid?

(Multiple Choice)

4.8/5  (28)

(28)

Classify the following items as: (1) prepaid expense, (2) unearned revenue, (3) accrued expense, or (4) accrued revenue.

a) fees received but not yet earned

b) fees earned but not yet received

c) paid premium on a one-year insurance policy

d) property tax owed to be paid beginning of next year

(Essay)

4.9/5  (36)

(36)

A company depreciates its equipment $500 a year. The adjusting entry on December 31 is a debit to Depreciation Expense, $500, and a credit to Equipment, $500.

(True/False)

4.8/5  (42)

(42)

The balance in the office supplies account on January 1 was $7,000, supplies purchased during January were $3,000, and the supplies on hand at January 31 were $2,000. The amount to be used for the appropriate adjusting entry is

(Multiple Choice)

5.0/5  (33)

(33)

The adjustment for accrued fees was debited to Accounts Payable instead of Accounts Receivable. This error will be detected when the adjusted trial balance is prepared.

(True/False)

4.8/5  (37)

(37)

A business pays biweekly salaries of $20,000 every other Friday for a ten-day period ending on that day. The last payday of December is Friday, December 27. Assume the next pay period begins on Monday, December 30, and the proper adjusting entry is journalized at the end of the fiscal period (December 31). The entry for the payment of the payroll on Friday, January 10, includes a

(Multiple Choice)

4.9/5  (43)

(43)

Match the type of account (a - e) with the business transactions that follow.

-Annual depreciation on equipment, recorded on a monthly basis.

A)Prepaid expense

B)Accrued expense

C)Unearned revenue

D)Accrued revenue

E)None of these

(Short Answer)

4.8/5  (42)

(42)

Prepare the December 31 adjusting entries for the following transactions. Omit explanations.1. Fees accrued but not billed, $6,300

2. The Supplies account balance on December 31, $4,750; Supplies on hand, $960

3. Wages accrued but not paid, $2,700

4. Depreciation of office equipment, $1,650

5. Rent expired during year, $10,800

(Essay)

4.9/5  (46)

(46)

The type of account and normal balance of Unearned Fees is

(Multiple Choice)

5.0/5  (46)

(46)

If there is a balance in the unearned subscriptions account after adjusting entries are made, it represents a(n)

(Multiple Choice)

4.9/5  (36)

(36)

The balance in the accumulated depreciation account is the sum of the depreciation expense recorded in past periods.

(True/False)

4.8/5  (29)

(29)

Indicate with a Yes or No whether or not each of the following accounts would, under normal circumstances, require an adjusting entry.1. Cash

2. Prepaid Expenses

3. Depreciation Expense

4. Accounts Payable

5. Accumulated Depreciation

6. Equipment

(Essay)

4.9/5  (38)

(38)

The unexpired insurance at the end of the fiscal period represents

(Multiple Choice)

4.8/5  (40)

(40)

Which of the accounting steps in the accounting process below would be completed last?

(Multiple Choice)

4.8/5  (39)

(39)

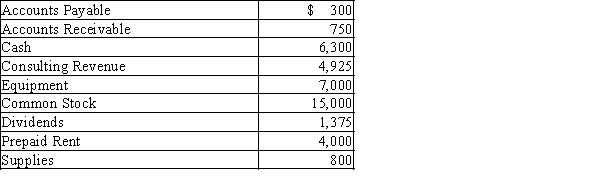

Jordon James started JJJ Consulting on January 1. The following are the account balances at the end of the first month of business, before adjusting entries were recorded:  Adjustment data:

Supplies on hand at the end of the month, $200

Unbilled consulting revenue, $700

Rent expense for the month, $1,000

Depreciation on equipment, $90

(a) Prepare the required adjusting entries, adding accounts as needed.(b) Prepare an adjusted trial balance for JJJ Consulting as of January 31.

Adjustment data:

Supplies on hand at the end of the month, $200

Unbilled consulting revenue, $700

Rent expense for the month, $1,000

Depreciation on equipment, $90

(a) Prepare the required adjusting entries, adding accounts as needed.(b) Prepare an adjusted trial balance for JJJ Consulting as of January 31.

(Essay)

4.9/5  (38)

(38)

Showing 101 - 120 of 225

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)