Exam 1: Introduction to Accounting and Business

Exam 1: Introduction to Accounting and Business243 Questions

Exam 2: Analyzing Transactions234 Questions

Exam 3: The Adjusting Process225 Questions

Exam 4: The Accounting Cycle211 Questions

Exam 5: Accounting for Retail Businesses273 Questions

Exam 6: Inventories236 Questions

Exam 7: Internal Control and Cash197 Questions

Exam 8: Receivables210 Questions

Exam 9: Long-Term Assets: Fixed and Intangible243 Questions

Exam 10: Liabilities: Current, Installment Notes, and Contingencies199 Questions

Exam 11: Liabilities: Bonds Payable172 Questions

Exam 12: Corporations: Organization, Stock Transactions, and Dividends221 Questions

Exam 13: Statement of Cash Flows193 Questions

Exam 14: Financial Statement Analysis206 Questions

Exam 15: Introduction to Managerial Accounting244 Questions

Exam 16: Job Order Costing212 Questions

Exam 17: Process Cost Systems196 Questions

Exam 18: Activity-Based Costing109 Questions

Exam 19: Support Department and Joint Cost Allocation172 Questions

Exam 20: Cost-Volume-Profit Analysis247 Questions

Exam 21: Variable Costing for Management Analysis136 Questions

Exam 22: Budgeting197 Questions

Exam 23: Evaluating Variances From Standard Costs172 Questions

Exam 24: Evaluating Decentralized Operations210 Questions

Exam 25: Differential Analysis and Product Pricing157 Questions

Exam 26: Capital Investment Analysis191 Questions

Exam 27: Lean Manufacturing and Activity Analysis134 Questions

Exam 28: The Balanced Scorecard and Corporate Social Responsibility170 Questions

Exam 29: Investments137 Questions

Select questions type

Bob Johnson is the sole owner of Johnson's Carpet Cleaning Service. Bob purchased a personal automobile for $10,000 cash plus he took out a loan for $20,000 in his name. Describe how this transaction is related to the business entity assumption.

(Essay)

4.9/5  (27)

(27)

Which of the following asset accounts is increased when a receivable is collected?

(Multiple Choice)

4.8/5  (40)

(40)

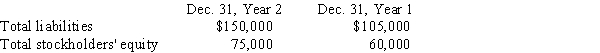

The following data were taken from Miller Company's balance sheet:  (a) Compute the ratio of liabilities to stockholders' equity. Round your answer to one decimal place.(b) Has the creditors' risk increased or decreased from December 31, Year 1, to December 31, Year 2?

(a) Compute the ratio of liabilities to stockholders' equity. Round your answer to one decimal place.(b) Has the creditors' risk increased or decreased from December 31, Year 1, to December 31, Year 2?

(Essay)

4.8/5  (26)

(26)

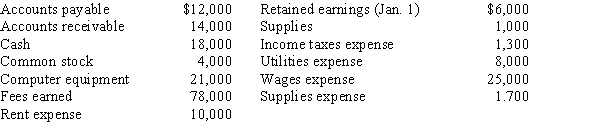

The account balances of Awesome Travel Services at December 31 are listed below. There were no additional investments or dividends by Awesome Travel Services during the year.  Prepare an income statement, a statement of stockholders' equity, and a balance sheet as of December 31.

Prepare an income statement, a statement of stockholders' equity, and a balance sheet as of December 31.

(Essay)

4.9/5  (46)

(46)

At the end of its accounting period, December 31, of Year 1, Hsu's Financial Services has assets of $575,000 and stockholders' equity of $335,000. Using the accounting equation and considering each case independently, determine the following amounts.

(a) Hsu's liabilities as of December 31, of Year 1.(b) Hsu's liabilities as of December 31, of Year 2, assuming that assets increased by $56,000 and

shareholders' equity decreased by $32,000.(c) Net income or net loss during Year 2, assuming that as of December 31, Year 2, assets were $592,000,

liabilities were $450,000, and there were no additional investments or dividends.

(Essay)

4.8/5  (32)

(32)

Cash investments made by the owner in the business are reported on the statement of cash flows in the

(Multiple Choice)

4.9/5  (26)

(26)

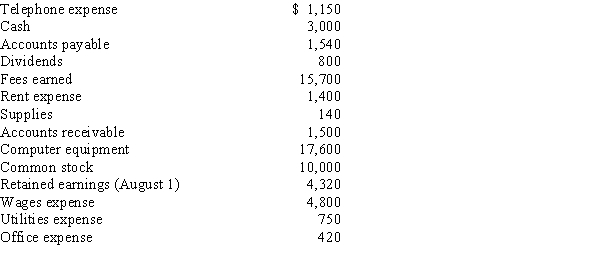

Using the following accounts and their amounts, prepare in good format an income statement for Bright Futures Company for the month ended August 31.

(Essay)

4.7/5  (32)

(32)

Goods purchased on account for future use in the business, such as supplies, are called

(Multiple Choice)

4.9/5  (38)

(38)

Match the following business types with each business listed below. Each may be used more than once.

-A health club and spa

A)Service business

B)Manufacturing business

C)Retail business

(Short Answer)

4.8/5  (37)

(37)

Paying an account payable increases liabilities and decreases assets.

(True/False)

4.8/5  (27)

(27)

How does paying a liability in cash affect the accounting equation?

(Multiple Choice)

4.8/5  (28)

(28)

For accounting purposes, the business entity should be considered separate from its owners if the entity is

(Multiple Choice)

4.9/5  (33)

(33)

An income statement is a summary of the revenues and expenses of a business as of a specific date.

(True/False)

4.8/5  (34)

(34)

Match each transaction with its effect on the accounting equation. Each letter may be used more than once.

-Paid wages

A)Increase assets, increase liabilities

B)Increase liabilities, decrease stockholders' equity

C)Increase assets, increase stockholders' equity

D)No effect

E)Decrease assets, decrease liabilities

F)Decrease assets, decrease stockholders' equity

(Short Answer)

4.8/5  (21)

(21)

If a shareholder wanted to know how money flowed into and out of the company, which financial statement would the shareholder use?

(Multiple Choice)

4.7/5  (37)

(37)

Match each transaction with its effect on the accounting equation. Each letter may be used more than once.

-Received cash for providing services to customers

A)Increase assets, increase liabilities

B)Increase liabilities, decrease stockholders' equity

C)Increase assets, increase stockholders' equity

D)No effect

E)Decrease assets, decrease liabilities

F)Decrease assets, decrease stockholders' equity

(Short Answer)

4.9/5  (31)

(31)

At December 31 of the current year, Martin Consultants has assets of $430,000 and liabilities of $205,000. Using the accounting equation and considering each case independently, determine the following:

(a) stockholders' equity, as of December 31.(b) stockholders' equity, as of December 31 of the next year, assuming that assets increased by $12,000

and liabilities increased by $15,000.(c) stockholders' equity, as of December 31 of the next year, assuming that assets decreased by $8,000

and liabilities increased by $14,000.

(Essay)

4.9/5  (33)

(33)

How does receiving a bill to be paid next month for services received affect the accounting equation?

(Multiple Choice)

4.8/5  (29)

(29)

Showing 181 - 200 of 243

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)