Exam 5: Inventories and Cost of Goods Sold

Exam 1: Accounting As a Form of Communication487 Questions

Exam 2: Financial Statements and the Annual Report259 Questions

Exam 3: Processing Accounting Information219 Questions

Exam 4: Income Measurement and Accrual Accounting240 Questions

Exam 5: Inventories and Cost of Goods Sold262 Questions

Exam 6: Cash and Internal Control224 Questions

Exam 7: Receivables and Investments231 Questions

Exam 8: Operating Assets: Property, Plant, and Equipment, and Intangibles253 Questions

Exam 9: Current Liabilities, Contingencies, and the Time Value of Money206 Questions

Exam 10: Long-Term Liabilities204 Questions

Exam 11: Stockholders Equity244 Questions

Exam 12: The Statement of Cash Flows234 Questions

Exam 13: Financial Statement Analysis255 Questions

Exam 14: International-Financial-Reporting-Standards58 Questions

Select questions type

The lower the inventory turnover ratio, the less time inventory resides in storage.

(True/False)

4.9/5  (38)

(38)

Which method might allow a company to make significant inventory purchases at year end for the purpose of manipulating income?

(Multiple Choice)

4.7/5  (43)

(43)

Which method of inventory costing is not acceptable for financial accounting purposes?

(Multiple Choice)

4.7/5  (43)

(43)

For what reason might retailers like Target select an accounting period that ends on or near the end of January?

(Multiple Choice)

4.8/5  (34)

(34)

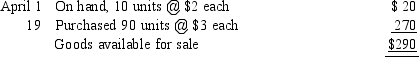

Refer to the data for Learning Tree, Inc.

If the LIFO method is used, what is the amount assigned to cost of goods sold for the 2,500 units sold on May 10?

(Essay)

4.9/5  (34)

(34)

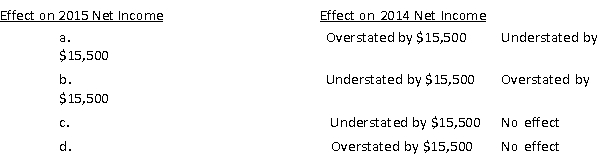

If a company understates its ending inventory balance for 2015 by $15,500, what are the effects on its net income for 2015 and 2014?

(Short Answer)

4.9/5  (38)

(38)

Refer to the information about Cooking Corner.

How much would Cooking Corner pay its supplier if Cooking Corner paid for one-half of the goods acquired within the discount period, and the other half after the expiration of the discount period?

(Essay)

4.8/5  (31)

(31)

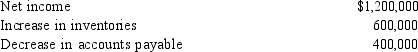

The following information is reported in the operating activities section of Gateway's statement of cash flows for 2014:  Which one of the following conclusions can be assumed from the information provided?

Which one of the following conclusions can be assumed from the information provided?

(Multiple Choice)

4.7/5  (38)

(38)

Refer to the data for Share, Inc.

If the moving average method is used, how much is ending inventory on May 30?

(Essay)

4.8/5  (40)

(40)

Match the costs that might be included as part of the cost of inventory to the listed accounting treatment.

-Freight costs incurred by the buyer to ship goods to its place of business

(Multiple Choice)

4.8/5  (37)

(37)

The inventory turnover ratio is defined as cost of goods sold divided by average inventory.

(True/False)

4.8/5  (39)

(39)

Identify which inventory costing method LIFO or FIFO achieves the effect listed in the following items:

-Prices are rising; profits are higher with this method

(Multiple Choice)

4.8/5  (41)

(41)

Which of these is not an acceptable inventory costing method under IFRS?

(Multiple Choice)

4.7/5  (36)

(36)

Identify which inventory costing method LIFO or FIFO achieves the effect listed in the following items:

-Prices are rising; cost of goods sold is lower with this method

(Multiple Choice)

4.8/5  (34)

(34)

Quan uses a periodic inventory system. At the end of April, Quan had 20 units on hand.  If Quan, Inc. uses FIFO inventory costing, how much is cost of goods sold for April?

If Quan, Inc. uses FIFO inventory costing, how much is cost of goods sold for April?

(Multiple Choice)

4.8/5  (33)

(33)

Match the inventory-related accounts to costs that may be included in inventories for retailers and manufacturers.

-Cost of completed, but unsold items.

(Multiple Choice)

4.8/5  (35)

(35)

The cost of Garmin Corp.'s inventory at the end of the year was $85,000; however, due to obsolescence, the cost to replace the inventory was only $65,000. Identify the effects of this transaction on the accounting equation and income statement accounts at the end of the year.

(Essay)

5.0/5  (41)

(41)

Blenham, Inc. sells merchandise on credit. If a customer pays its balance due within the discount period, what is the effect of the payment on Blenham's accounting equation?

(Multiple Choice)

4.8/5  (43)

(43)

If ending inventory is overstated, then net income is overstated as well.

(True/False)

4.8/5  (45)

(45)

Showing 21 - 40 of 262

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)