Exam 5: Inventories and Cost of Goods Sold

Exam 1: Accounting As a Form of Communication487 Questions

Exam 2: Financial Statements and the Annual Report259 Questions

Exam 3: Processing Accounting Information219 Questions

Exam 4: Income Measurement and Accrual Accounting240 Questions

Exam 5: Inventories and Cost of Goods Sold262 Questions

Exam 6: Cash and Internal Control224 Questions

Exam 7: Receivables and Investments231 Questions

Exam 8: Operating Assets: Property, Plant, and Equipment, and Intangibles253 Questions

Exam 9: Current Liabilities, Contingencies, and the Time Value of Money206 Questions

Exam 10: Long-Term Liabilities204 Questions

Exam 11: Stockholders Equity244 Questions

Exam 12: The Statement of Cash Flows234 Questions

Exam 13: Financial Statement Analysis255 Questions

Exam 14: International-Financial-Reporting-Standards58 Questions

Select questions type

Refer to the data for Learning Tree, Inc.

If the moving average method is used, what is the amount assigned to cost of goods sold for the 2,500 units sold on May 10?

(Essay)

4.7/5  (37)

(37)

Park, Inc. purchased merchandise from Jay Zee Music Company on June 5, 2015. The goods were shipped the same day. The merchandise's selling price was $15,000. The credit terms were 1/10, n/30. The shipping terms were FOB shipping point. Park received the merchandise on June 10, 2015. Park paid the amount due on June 13, 2015. If Park uses the periodic inventory system, the effect of recording the payment on June 13, 2015, will include

(Multiple Choice)

5.0/5  (39)

(39)

Floors, Inc. offers terms of 2/10, n/30 to credit customers. Tile Magic Corp. purchased 100 tile cutters with a list price of $20 each on August 5, 2015, on account. Tile Magic Corp. paid the invoice on August 31, 2015. How much sales discount will Floors recognize?

(Multiple Choice)

4.9/5  (38)

(38)

A LIFO reserve represents the amount by which cost of goods sold on a FIFO basis exceeds the cost of goods sold on a LIFO basis for the current year.

(True/False)

4.9/5  (39)

(39)

Whether LIFO costing is applied at the time each sale is made or only at the end of the period, both the periodic and perpetual systems will yield the same ending inventory under LIFO.

(True/False)

4.9/5  (45)

(45)

Caruso, Inc. has an inventory turnover rate of 8 times. If its cost of goods sold is $150,000, then

(Multiple Choice)

4.9/5  (36)

(36)

The lower of cost or market LCM rule violates the historical cost principle.

(True/False)

4.8/5  (31)

(31)

The ratio of a company's cost of goods sold to its average inventory is called its

________________________________________.

(Short Answer)

4.8/5  (34)

(34)

When the market value of inventory items has declined below its cost, which method would be the most appropriate in complying with GAAP?

(Multiple Choice)

4.9/5  (36)

(36)

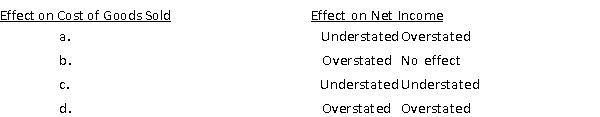

If a company overstates its ending inventory for the current year, what are the effects on cost of goods sold and net income for the current year?

(Short Answer)

4.9/5  (37)

(37)

For the buyer, a is an amount deducted by customers for payment within the discount period.

(Short Answer)

4.9/5  (33)

(33)

During the current period, Audix Corp. sold products to customers for a total of $76,000. Due to defective products, customers were given $2,800 in refunds for products that were returned and another $3,500 in reductions to their account balances. Discounts in the amount of $5,500 were given for early payment of account balances.

REQUIRED:

Prepare the Net Sales section of Audix's income statement.

(Essay)

4.8/5  (33)

(33)

Bower Corp.'s cost of sales has remained steady over the last two years. During this same time period, however, its inventory has increased considerably. What does this information tell you about the company's inventory turnover? Explain your answer.

(Essay)

4.9/5  (39)

(39)

The gross profit ratio is computed by dividing net sales by gross profit.

(True/False)

4.8/5  (36)

(36)

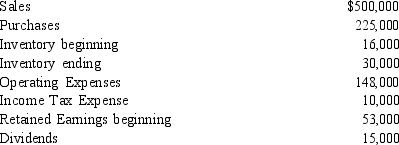

Givens Corp.

Givens Corp. is a merchandising company that uses the periodic inventory system. Selected account balances are listed below:

-Refer to information for Givens Corp. Calculate the cost of goods sold for Givens Corp.

-Refer to information for Givens Corp. Calculate the cost of goods sold for Givens Corp.

(Multiple Choice)

4.8/5  (29)

(29)

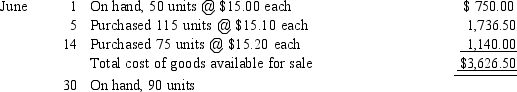

Eversoll Inc. uses the periodic inventory system.  If Eversoll uses the FIFO inventory method, the amount assigned to the June 30 inventory would be

If Eversoll uses the FIFO inventory method, the amount assigned to the June 30 inventory would be

(Multiple Choice)

4.8/5  (38)

(38)

The gross profit ratio is calculated as gross profit divided by net income.

(True/False)

4.8/5  (36)

(36)

Showing 41 - 60 of 262

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)