Exam 4: Managing Money

Exam 1: Thinking Critically195 Questions

Exam 2: Approaches to Problem Solving149 Questions

Exam 3: Numbers in the Real World290 Questions

Exam 4: Managing Money262 Questions

Exam 5: Statistical Reasoning230 Questions

Exam 6: Putting Statistics to Work258 Questions

Exam 7: Probability: Living With the Odds261 Questions

Exam 8: Exponential Astonishment103 Questions

Exam 9: Modeling Our World85 Questions

Exam 10: Modeling With Geometry127 Questions

Exam 11: Mathematics and the Arts62 Questions

Select questions type

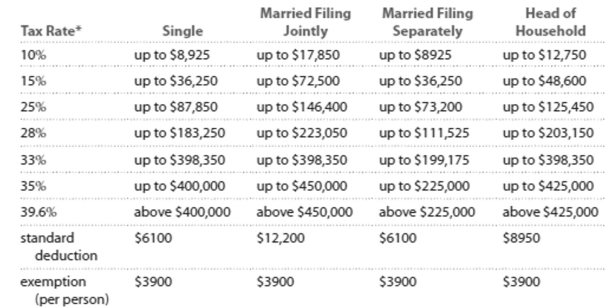

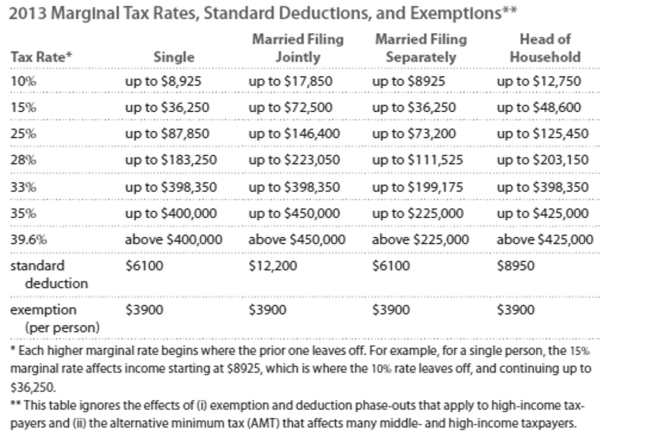

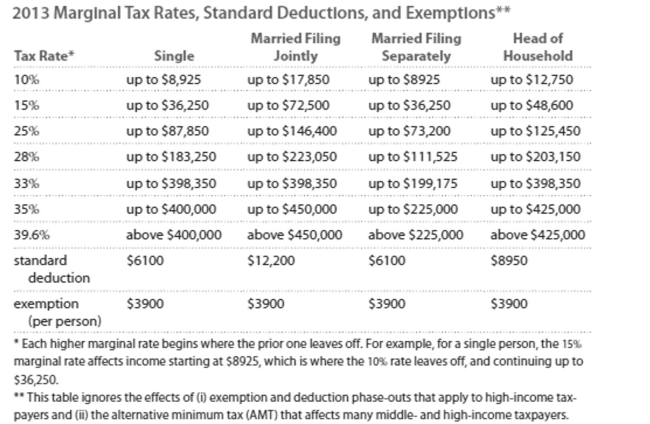

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductions, and Exemptlons**

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle- and high-income taxpayers.

-Mark earned $40,208 from wages as a mechanic and made $1539 in interest. Calculate his FICA tax.

- Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle- and high-income taxpayers.

-Mark earned $40,208 from wages as a mechanic and made $1539 in interest. Calculate his FICA tax.

(Multiple Choice)

4.9/5  (42)

(42)

Provide an appropriate response.

-A(n)________ deduction is the addition of all individual deductions to which you are entitled.

(Multiple Choice)

4.9/5  (30)

(30)

Solve the problem. Refer to the table if necessary.  -You are single and have a taxable income of $56,767. You make monthly contributions of $455 to a tax-deferred savings plan. Calculate the effect on annual take-home pay of the tax-deferred

Contribution.

-You are single and have a taxable income of $56,767. You make monthly contributions of $455 to a tax-deferred savings plan. Calculate the effect on annual take-home pay of the tax-deferred

Contribution.

(Multiple Choice)

4.9/5  (43)

(43)

Write the word or phrase that best completes each statement or answers the question.Decide whether the statement makes sense. Explain your reasoning.

-Apartments in a new building can either be bought or rented. Gale calculated that it

would be cheaper for her to buy. Gale's brother did the same calculations for himself for

the same apartment and found that it would be cheaper to rent.

(Essay)

4.9/5  (46)

(46)

Provide an appropriate response.

-A ______ represents money that is borrowed (or taken from savings)during a single year.

(Multiple Choice)

4.9/5  (43)

(43)

Calculate the amount of interest you'll have at the end of the indicated period.

-You invest $33,200 in an account that pays simple interest of 3% for 1 year(s).

(Multiple Choice)

4.7/5  (42)

(42)

Calculate the balance under the given assumptions.

-Find the savings plan balance after 3 months with an APR of 4% and monthly payments of $155.

(Multiple Choice)

4.9/5  (35)

(35)

Provide an appropriate response.

-Short-term capital gains are profits on items sold within 12 months of their purchase.

(True/False)

4.9/5  (36)

(36)

Solve the problem.

-Suppose you start saving today for a $5000 down payment that you plan to make on a condo in 2 years. Assume that you make no deposits into the account after your initial deposit. The account

Has annual compounding and an APR of 5%. How much would you need to deposit now to reach

Your $5000 goal in 2 years?

(Multiple Choice)

4.7/5  (48)

(48)

You need a loan of $100,000 to buy a condo. Calculate your monthly payments and total closing costs for each choice.

-Choice -year fixed rate at with closing costs of and no points Choice 2: 20-year fixed rate at with closing costs of and 4 points

(Multiple Choice)

4.7/5  (38)

(38)

Solve.

-Calculate the monthly payment for a student loan of $42,434 at a fixed APR of 7% for 10 years.

(Multiple Choice)

4.9/5  (39)

(39)

Write the word or phrase that best completes each statement or answers the question.Decide whether the statement makes sense. Explain your reasoning.

-My mortgage payment is $1400 per month so I will have a tax deduction of

(Essay)

4.8/5  (36)

(36)

Solve the problem. Refer to the table if necessary.  -Matt is single and earned wages of $32,338. He received $421 in interest from a savings account. He contributed $588 to a tax-deferred retirement plan. He had $579 in itemized deductions from

Charitable contributions. Calculate his taxable income.

-Matt is single and earned wages of $32,338. He received $421 in interest from a savings account. He contributed $588 to a tax-deferred retirement plan. He had $579 in itemized deductions from

Charitable contributions. Calculate his taxable income.

(Multiple Choice)

4.9/5  (37)

(37)

Solve the problem.

-Anna deposits $2500 in a savings account that compounds interest annually at an APR of 6% . Dave deposits $2600 in a savings account that compounds interest daily at an APR of 5.6%. After

10 years, who has more in their savings account and how much more do they have?

(Multiple Choice)

4.9/5  (37)

(37)

Provide an appropriate response.

-The ________ in financial formulas is the balance upon which interest is paid.

(Multiple Choice)

4.8/5  (32)

(32)

Write the word or phrase that best completes each statement or answers the question.Decide whether the statement makes sense. Explain your reasoning.

-Gabe said "For years there has been no money in the Social Security trust fund, just a bunch

of IOUs". Kim said "That's impossible, if that were true, how come the government has

been able to pay out Social Security benefits all these years?" Who is making more sense?

(Essay)

4.8/5  (37)

(37)

Showing 61 - 80 of 262

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)